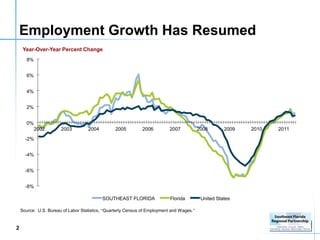

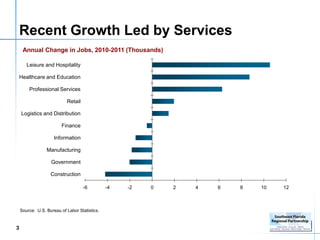

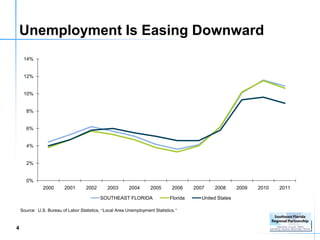

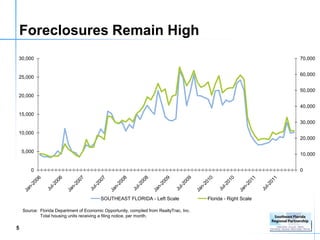

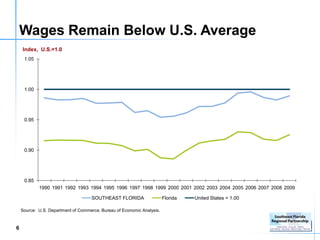

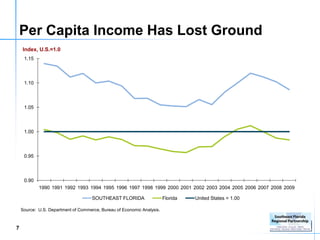

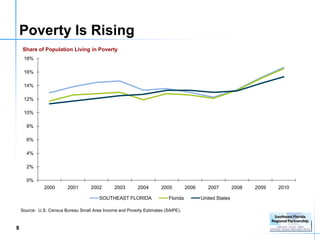

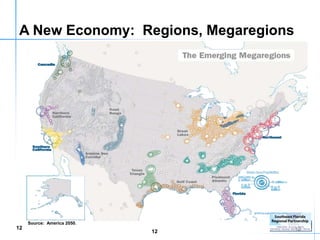

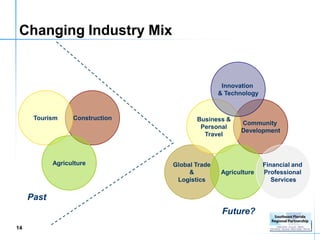

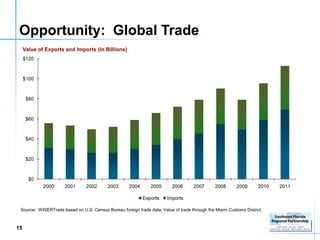

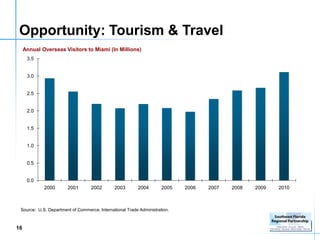

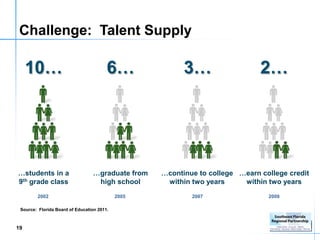

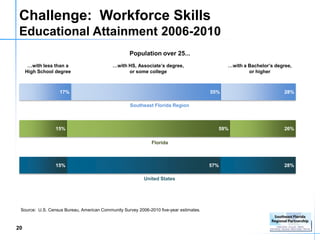

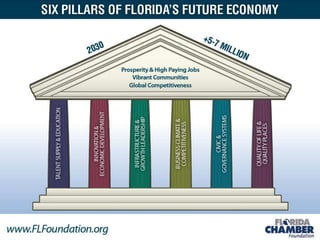

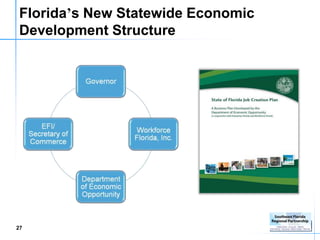

The document focuses on the economic development challenges and opportunities facing Southeast Florida, highlighting trends in employment, unemployment, and foreclosures. It emphasizes the region's need to adapt to a new economy characterized by global competition and innovation while addressing rising poverty and wage disparities. A call to action is made for aligning regional and state plans to develop a comprehensive economic strategy aimed at long-term prosperity.