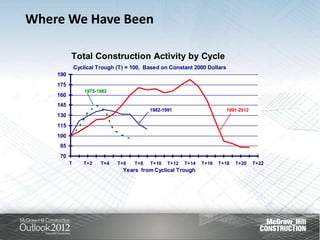

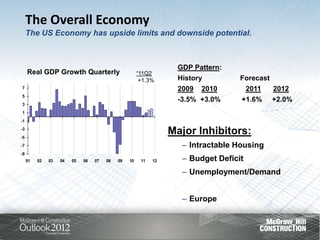

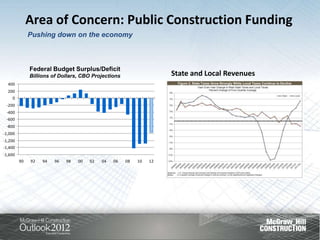

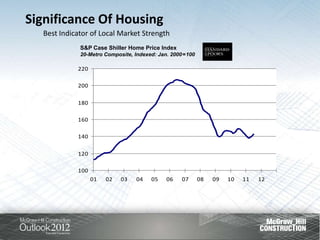

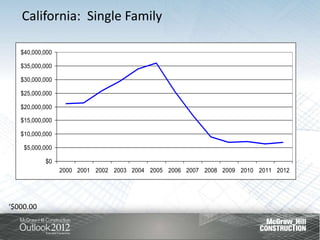

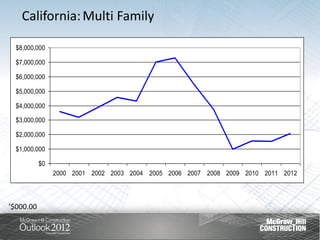

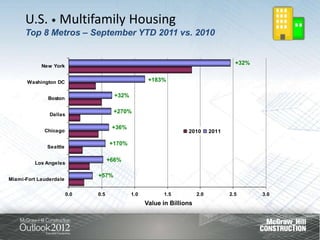

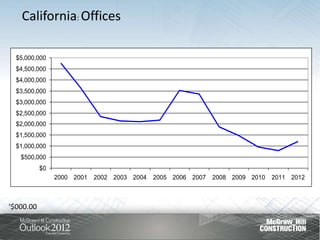

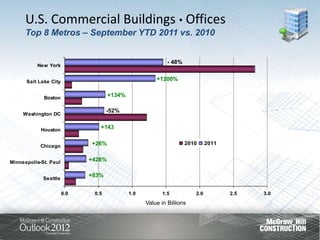

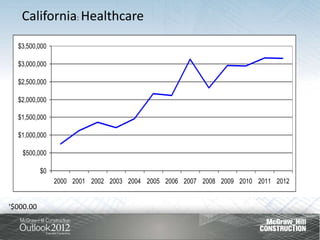

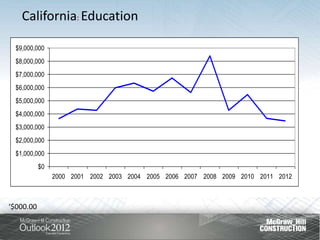

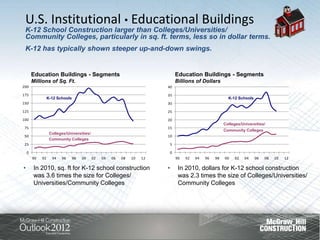

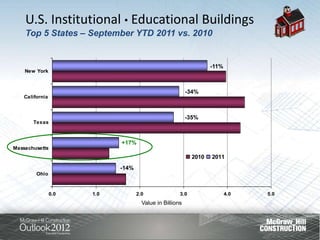

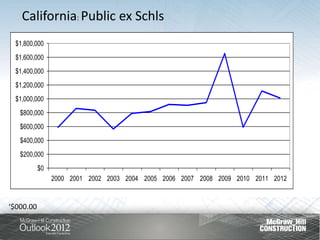

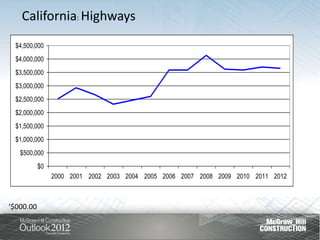

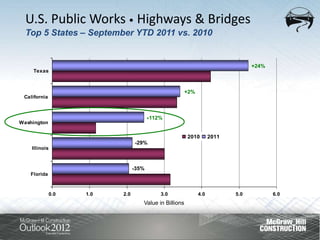

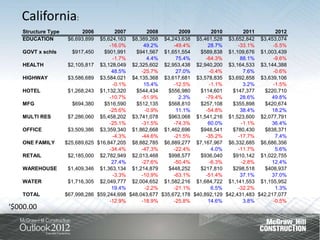

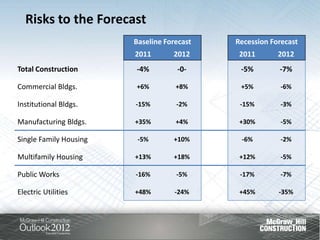

This document provides an overview of construction industry trends in California and the United States from 2000-2012. It shows that total construction activity follows a cyclical pattern, with downturns occurring roughly every 10 years. The most recent downturn was from 2008-2010 due to the housing crash and economic recession. Key factors currently inhibiting growth are the intractable housing market, large budget deficits, high unemployment, and economic issues in Europe. While some sectors like multifamily and healthcare are improving, public funding for projects is decreasing which is pushing down on overall construction activity. The document analyzes construction trends by sector and state, finding a mixed recovery with some areas like Dallas and Seattle multifamily growing significantly while other regions like New York remain