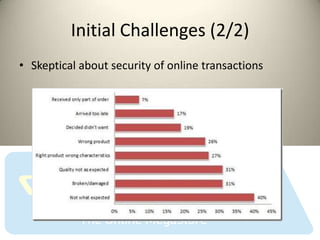

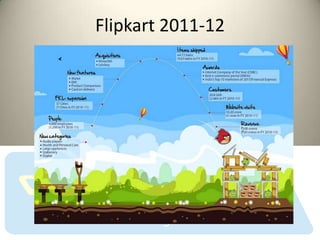

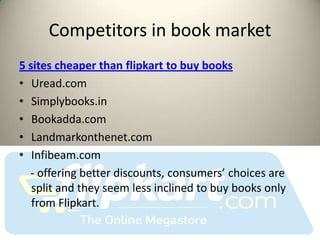

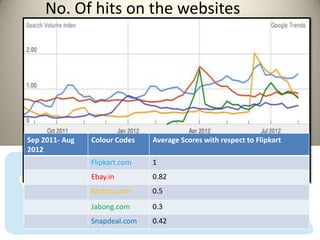

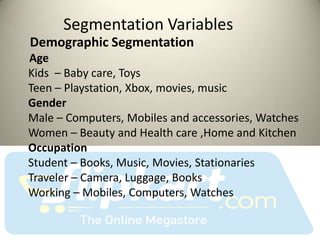

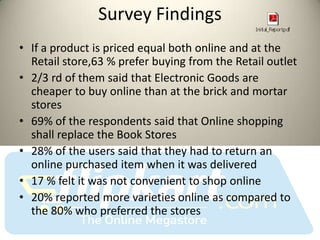

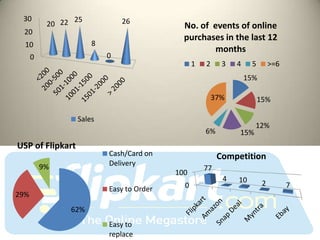

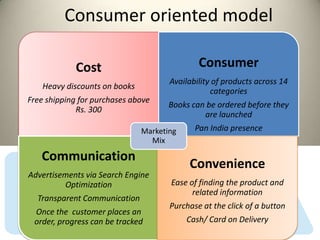

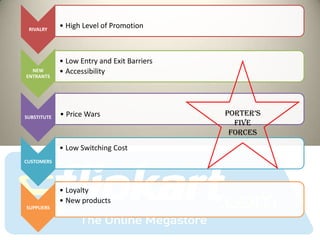

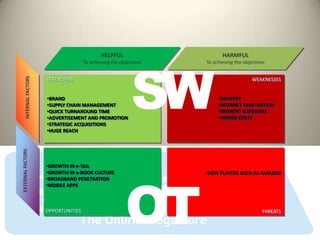

Flipkart is one of the leading e-commerce companies in India founded in 2007. It started by selling books online and has since expanded into multiple product categories. It has raised funding from investors and acquired other companies to grow. Some initial challenges were Indians' skepticism of online shopping due to past experiences. Flipkart built trust through policies like cash on delivery, returns, and its own delivery system. The company has grown significantly in terms of revenue, employees, and suppliers. It faces competition from other online retailers and its strategy is focused on areas like pricing, selection, customer experience and loyalty.