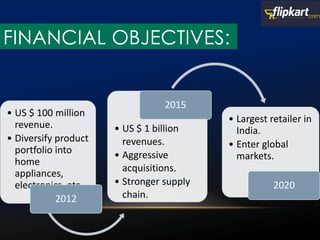

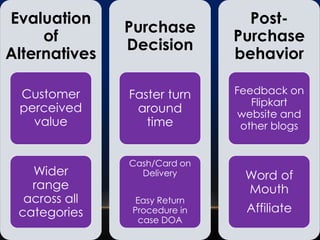

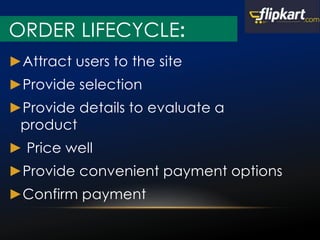

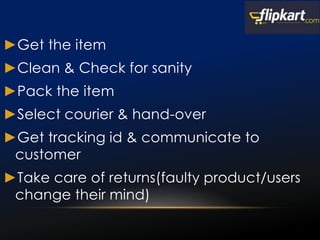

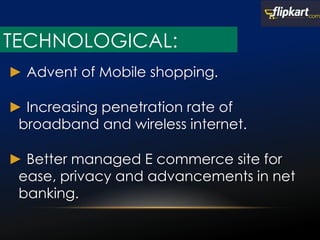

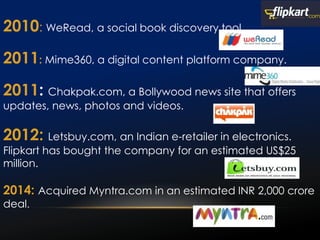

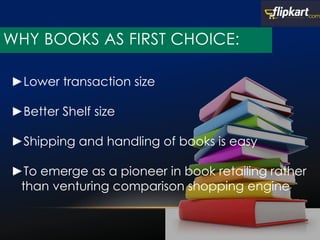

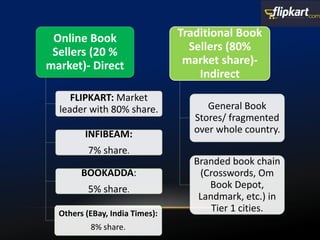

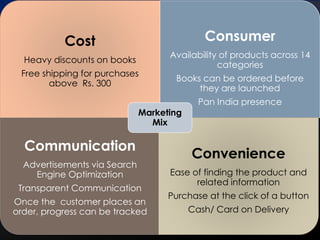

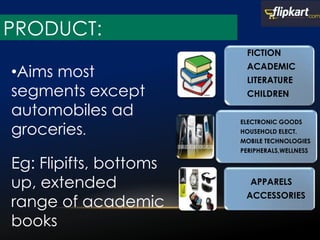

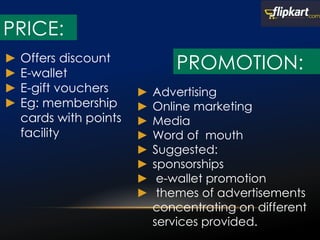

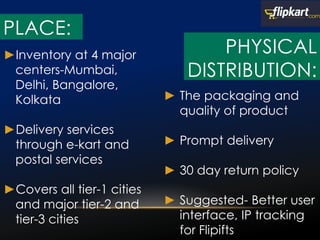

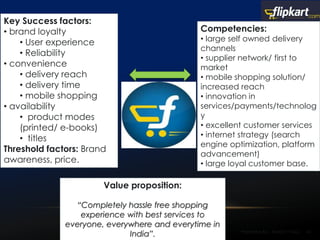

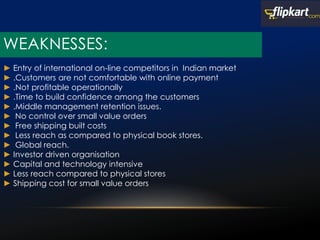

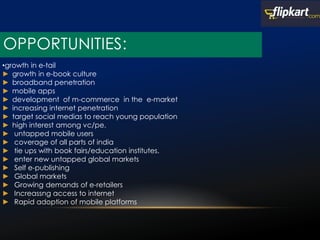

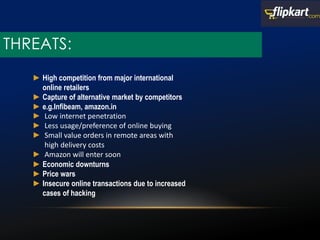

Flipkart, founded in 2007 by IIT graduates Binny and Sachin Bansal in Bangalore, is India's largest e-commerce company, primarily known for its extensive collection of books. The company aims to achieve $10 billion in sales by 2014 and plans to diversify its product offerings while enhancing the online shopping experience, including cash-on-delivery and customer-friendly return policies. Despite facing competition from international online retailers, Flipkart has established a strong brand presence, a loyal customer base, and a commitment to innovate in the e-commerce space.