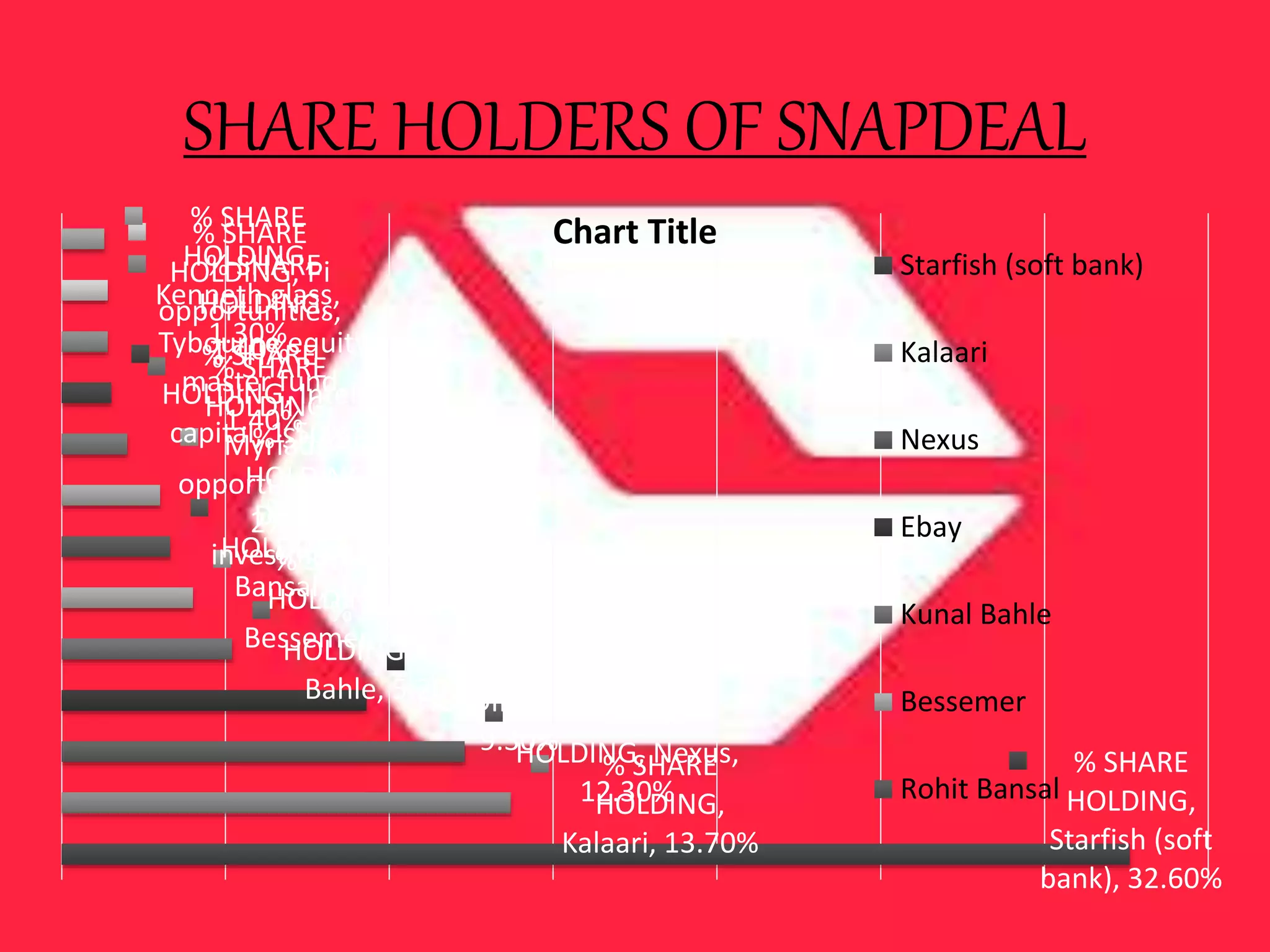

Snapdeal is an Indian e-commerce company headquartered in New Delhi. It was founded in 2010 and has over 3 lakh sellers and offers over 30 million products. Snapdeal's mission is to create life-changing experiences for small businesses in India and its vision is to create India's most powerful digital commerce ecosystem. Snapdeal has received over $2 billion in funding over 7 rounds from investors like SoftBank and Foxconn. Currently, Snapdeal is India's largest online marketplace with over 25 million registered users across 6000 cities.