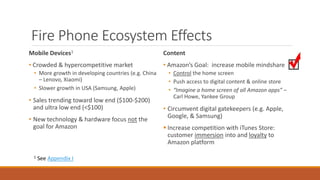

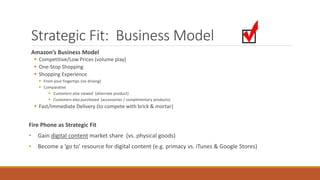

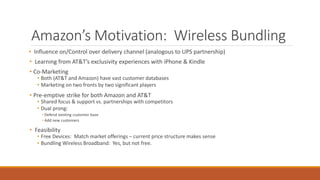

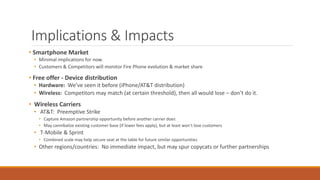

The document discusses the potential strategy of Amazon to bundle free wireless broadband with its Fire Phone as a means to enhance its mobile ecosystem and increase customer loyalty. Amazon aims to control the home screen and promote its digital content platform, but the feasibility and implications of such bundling are debated. Long-term profitability concerns suggest that offering devices for free could lead to harmful reductions in profits amid competitive market dynamics.

![Conclusions

“We shouldn’t underestimate their [Amazon’s] ability to stand out from a crowded

market” Carl Howe, Yankee Group

• Amazon needs phone as driver for digital content (e.g. home screen control)

• AT&T as preemptive strike: don’t let Verizon or T-Mobile/Sprint partner

• Wireless bundling should not be free

• Short term gains minimal

• Long term profit reductions harmful for all

For those that do buy the Fire Phone, it will undoubtedly create a "halo effect" on

the rest of Amazon's businesses; the big unknown is just how far it will stretch.](https://image.slidesharecdn.com/firephonefreebundledwirelessrovick-140927054723-phpapp01/85/Amazon-Fire-Phone-and-AT-T-free-bundled-wireless-6-320.jpg)