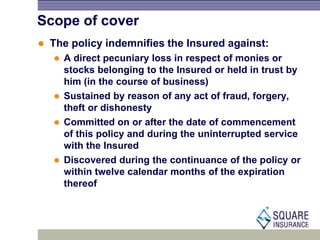

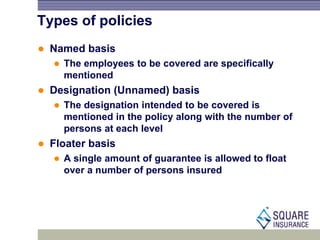

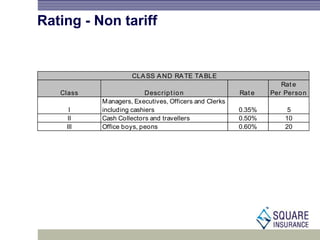

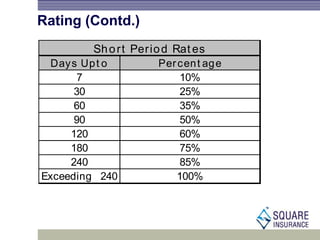

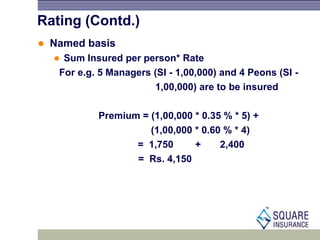

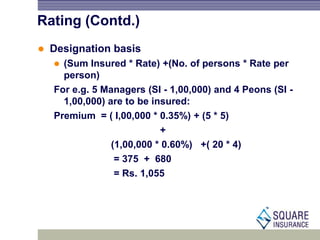

The document outlines the Fidelity Guarantee Insurance Policy, which protects employers against losses due to employee dishonesty during employment. It details the policy's definition, scope of cover, exclusions, terms and conditions, and types of policies available, including named basis, designation basis, and floater basis. Additionally, it provides information on the ratings and premiums based on the type of employees insured.

![Rating (Contd.)

Floater basis (for more than one designation)

(Sum Insured * Weighted average Rate) +(No. of

persons per designation * Rate per person)

For e.g. 5 Managers and 4 Peons are to be insured

with a SI of Rs. 1,00,000 to float over both levels

Weighted average Rate = [(5*0.35) + (4*0.60)] / 9

= 0.461%

Premium = (1,00,000 * 0.461%) + (5 * 5) + (20 * 4)

= Rs. 566](https://image.slidesharecdn.com/fidelityinsurance-190128144945/85/Fidelity-Guarantee-Insurance-14-320.jpg)