- The document discusses fire insurance policies that businesses take out to cover loss of stock from fire.

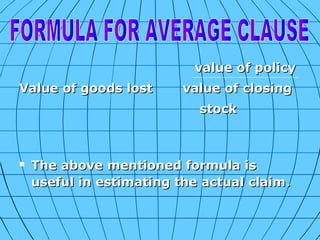

- It provides steps for lodging an insurance claim after a fire, which include calculating gross profit percentage, preparing a memorandum trading account, and deducting any salvaged stock from total stock value.

- An example is given showing how to calculate the claim amount based on stock values and trading details provided before and up to the date of a fire. The memorandum trading account balances the closing stock value which is then used to determine the claim.