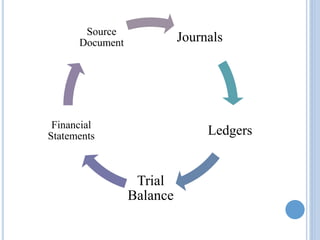

Financial statements are formal reports that provide financial information about a business. They include an income statement, balance sheet, and statement of cash flows. Financial statements are produced through the accounting process and reveal a business's financial results, position, and cash flows. They are important for management, creditors, bankers, investors, and the government to make decisions.