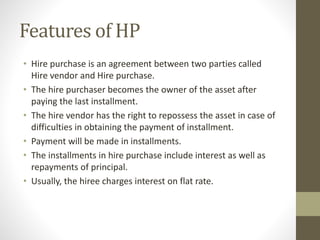

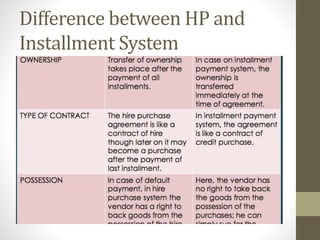

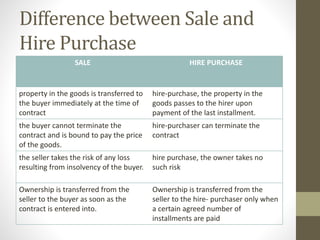

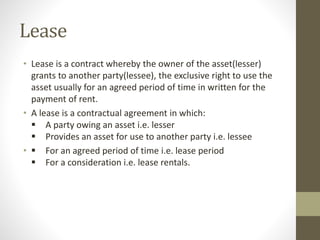

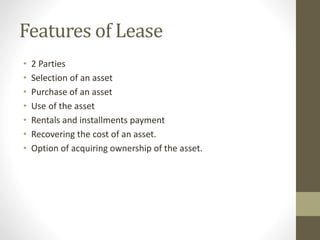

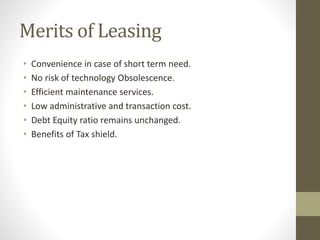

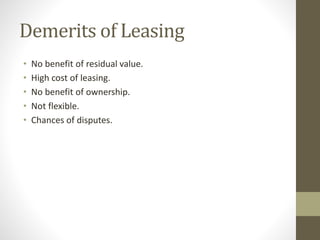

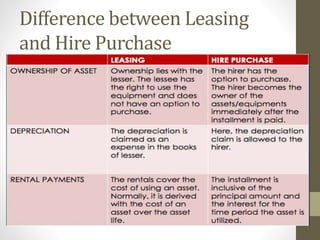

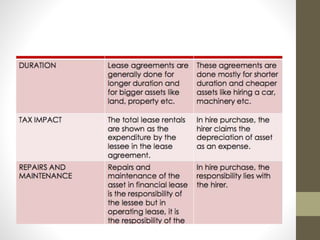

The document provides a detailed overview of hire purchase and lease systems, outlining processes, features, advantages, and disadvantages. It discusses the differences between hire purchase, installment purchasing, and leasing, as well as key definitions and the contents of hire purchase agreements. Additionally, it highlights the implications for both vendors and purchasers regarding ownership transfer and financial responsibilities.