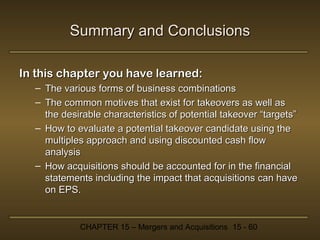

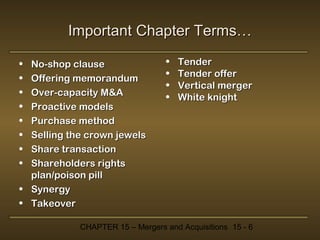

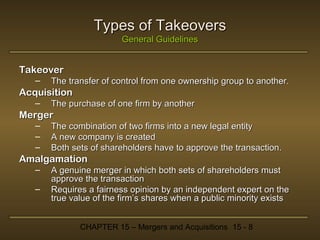

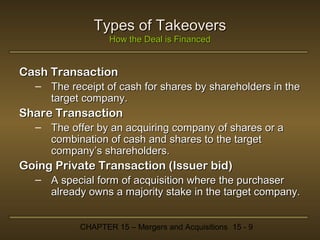

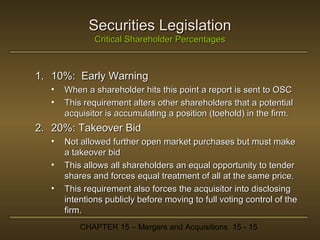

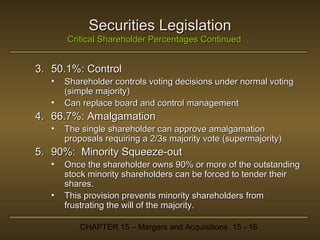

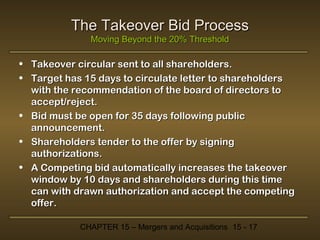

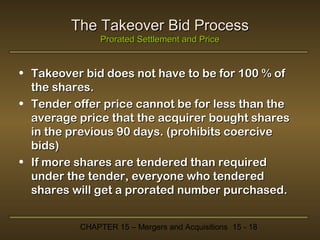

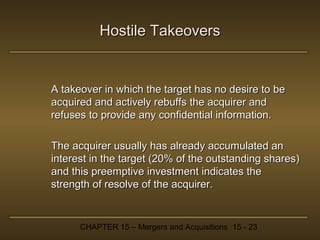

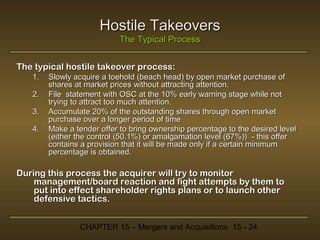

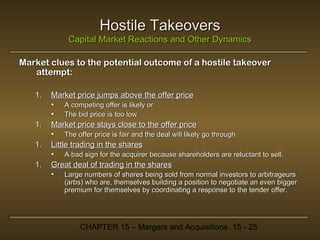

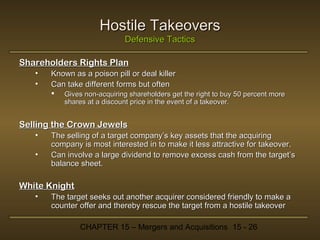

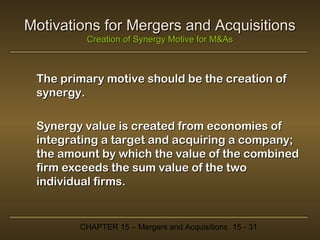

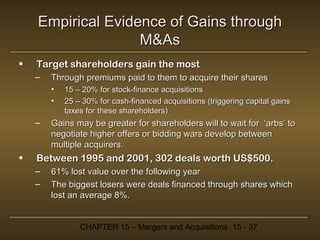

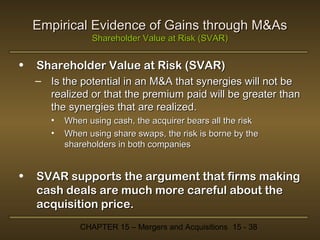

This document provides an overview and agenda for a chapter on mergers and acquisitions. It begins with learning objectives that cover the different types of acquisitions, how friendly and hostile acquisitions proceed, and where acquisition gains may be found. It then defines important terms and covers types of takeovers such as mergers, acquisitions, and amalgamations. It also discusses securities legislation pertaining to takeovers, the processes for friendly and hostile acquisitions, defensive tactics, and motivations for mergers and acquisitions focusing on creating synergy.

![Creation of Synergy Motive for M&As

Synergy is the additional value created (∆V) :

[ 15-1]

∆ V = VA− T -(VA + VT )

Where:

VT = the pre-merger value of the target firm

VA - T = value of the post merger firm

VA = value of the pre-merger acquiring firm

CHAPTER 15 – Mergers and Acquisitions 15 - 32](https://image.slidesharecdn.com/chapter15-mergersandacquisitions-140105051714-phpapp01/85/Chapter-15-mergers-and-acquisitions-32-320.jpg)

![Discounted Cash Flow Analysis

Free Cash Flow to Equity

Free cash flow to equity = net income + / − non − cash items (amortization,

[ 15-2]

deferred taxes, etc.) + / − changes in net working capital (not including cash

and marketable securities ) − net capital expenditures

CHAPTER 15 – Mergers and Acquisitions 15 - 47](https://image.slidesharecdn.com/chapter15-mergersandacquisitions-140105051714-phpapp01/85/Chapter-15-mergers-and-acquisitions-47-320.jpg)

![Discounted Cash Flow Analysis

The General DCF Model

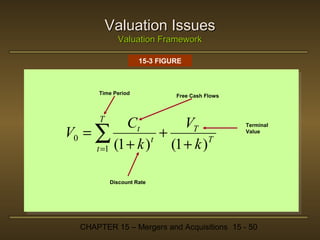

• Equation 15 – 3 is the generalized version of the

DCF model showing how forecast free cash

flows are discounted to the present and then

summed.

[ 15-3]

α

CFα

CFt

CF1

CF2

V0 =

+

+ ... +

=∑

(1 + k )1 (1 + k ) 2

(1 + k )α t =1 (1 + k ) t

CHAPTER 15 – Mergers and Acquisitions 15 - 48](https://image.slidesharecdn.com/chapter15-mergersandacquisitions-140105051714-phpapp01/85/Chapter-15-mergers-and-acquisitions-48-320.jpg)

![Discounted Cash Flow Analysis

The Constant Growth DCF Model

• Equation 15 – 4 is the DCF model for a target firm where

the free cash flows are expected to grow at a constant

rate for the foreseeable future.

[ 15-4]

V0 =

CF1

k−g

• Many target firms are high growth firms and so a multistage model may be more appropriate.

(See Figure 15 -3 on the following slide for the DCF Valuation Framework.)

CHAPTER 15 – Mergers and Acquisitions 15 - 49](https://image.slidesharecdn.com/chapter15-mergersandacquisitions-140105051714-phpapp01/85/Chapter-15-mergers-and-acquisitions-49-320.jpg)

![Discounted Cash Flow Analysis

The Multiple Stage DCF Model

• The multi-stage DCF model can be amended to

include numerous stages of growth in the

forecast period.

• This is exhibited in equation 15 – 5:

T

[ 15-5]

CFt

VT

V0 = ∑

+

t

(1 + k )T

t =1 (1 + k )

CHAPTER 15 – Mergers and Acquisitions 15 - 51](https://image.slidesharecdn.com/chapter15-mergersandacquisitions-140105051714-phpapp01/85/Chapter-15-mergers-and-acquisitions-51-320.jpg)