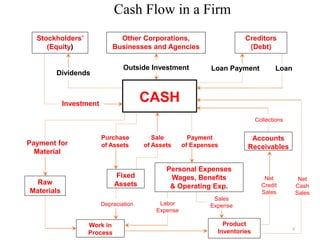

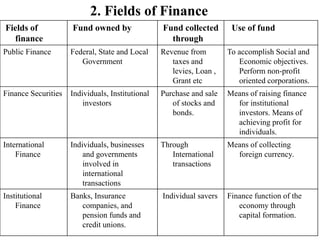

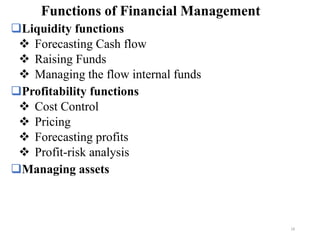

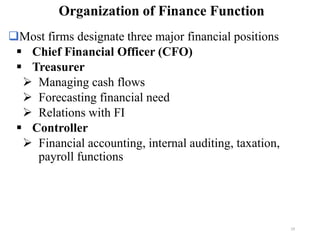

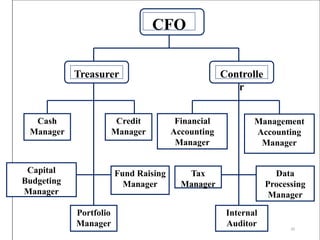

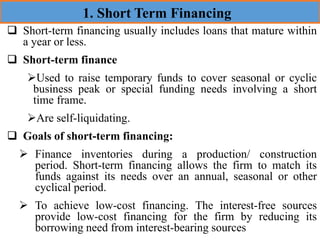

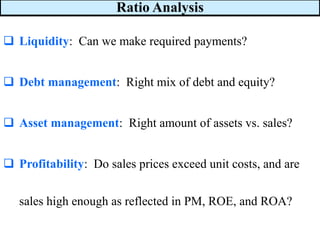

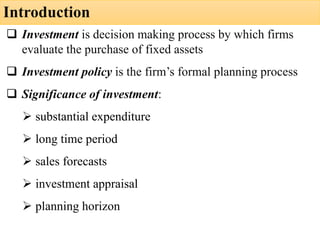

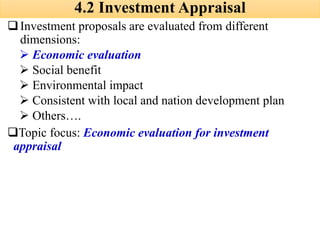

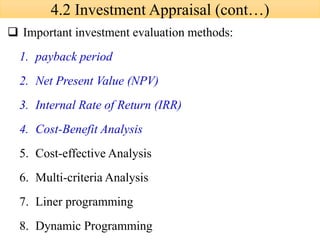

Financial management involves planning, acquiring, and managing funds to maximize the value of a firm. It includes forecasting, major investment decisions, coordination, control, and risk management. The key financial questions that must be addressed are what capital investments to make, how to raise funds to pay for investments, and how to handle daily financial activities like collections and payments. Financial management also deals with issues like evaluating new investment proposals, increasing stock value, determining working capital needs, and raising short- and long-term capital.