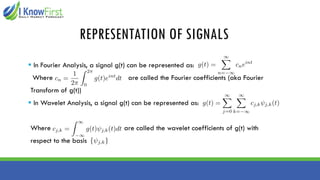

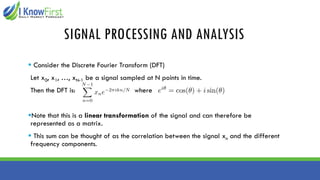

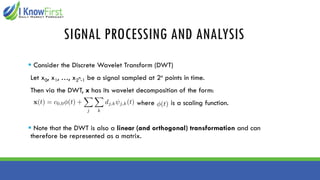

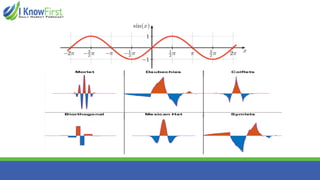

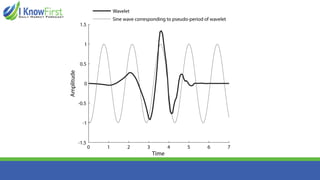

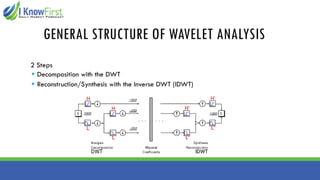

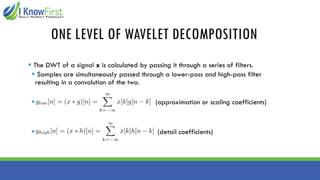

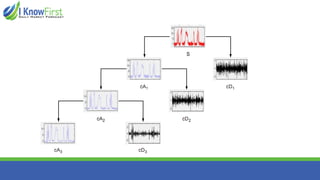

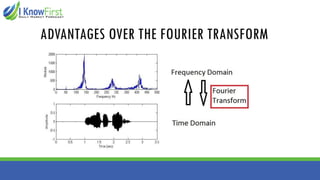

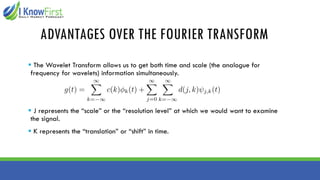

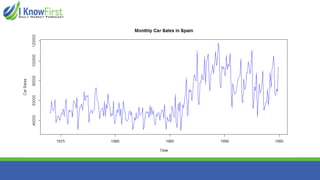

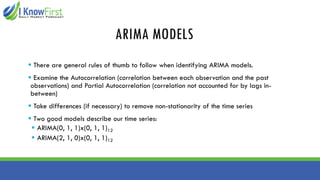

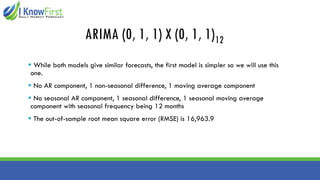

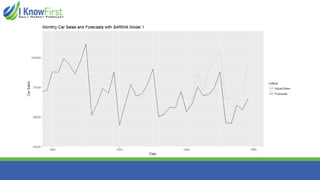

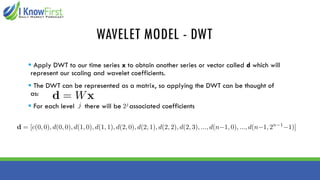

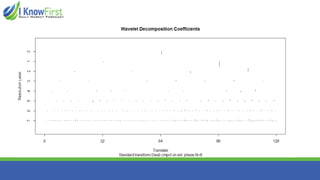

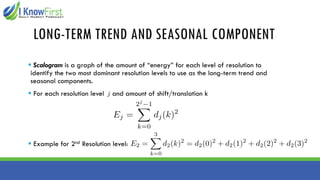

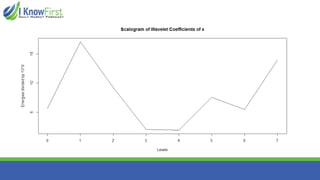

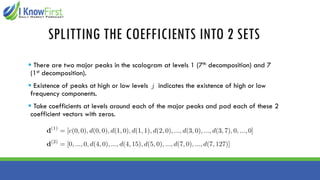

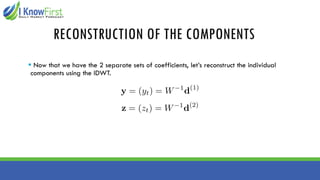

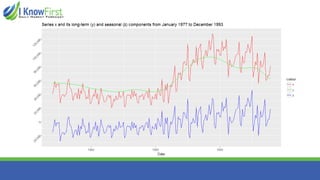

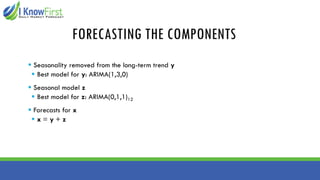

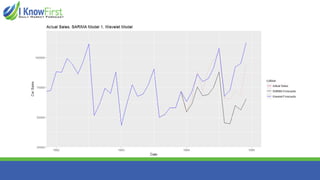

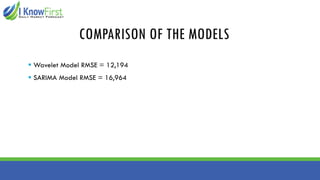

The document discusses wavelet analysis and its applications in various fields, including data compression, signal analysis, and financial markets. It compares wavelet analysis to traditional Fourier analysis, highlighting advantages such as the ability to capture both time and frequency information, particularly for signals with abrupt changes. Additionally, it presents a case study on forecasting car sales in Spain using wavelet analysis combined with ARIMA models, demonstrating improved accuracy in forecasts.