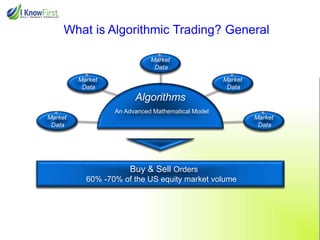

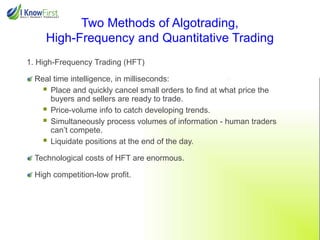

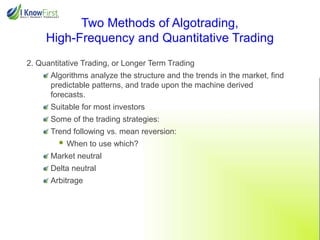

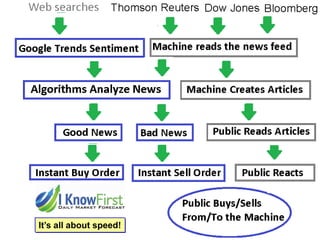

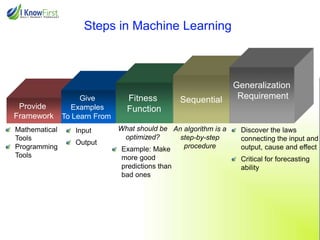

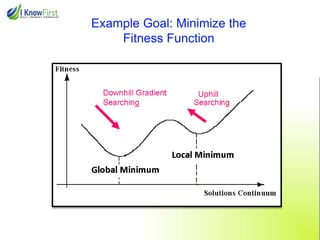

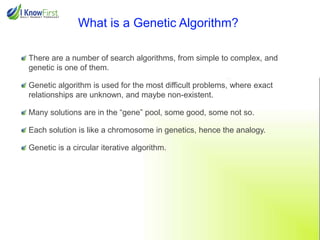

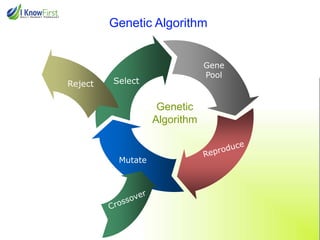

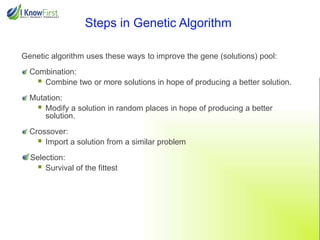

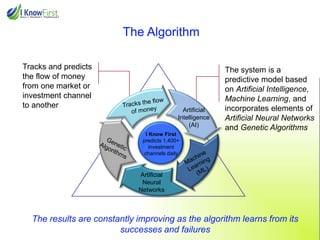

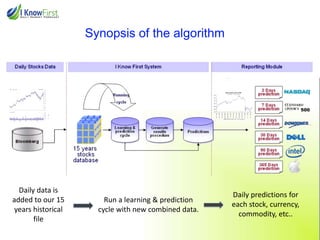

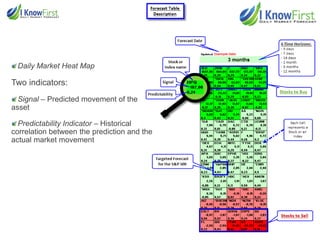

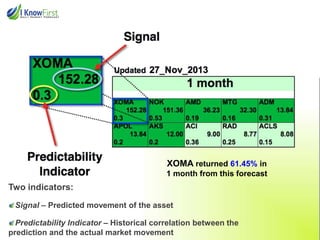

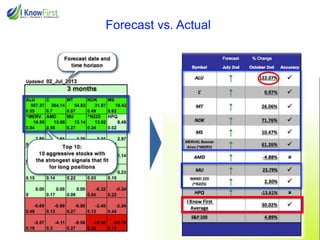

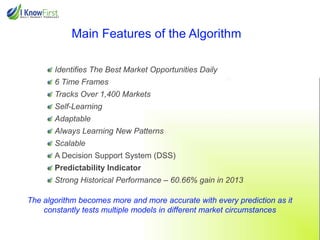

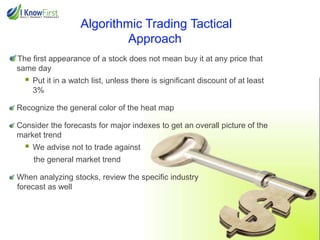

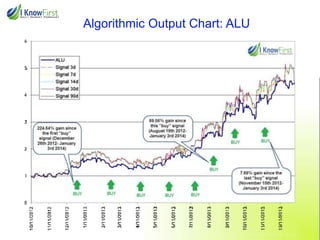

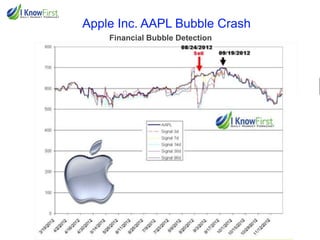

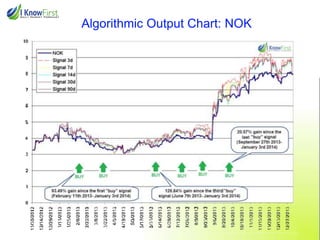

The document discusses algorithmic trading, detailing trends, strategies, and the development of an advanced forecasting algorithm by I Know First, which predicts movements across over 1,400 markets and achieved a 60.66% return in 2013. It contrasts high-frequency trading and quantitative trading methods while highlighting the implications of recent regulatory scrutiny aimed at high-frequency trading practices. Additionally, it emphasizes the importance of machine learning, genetic algorithms, and maintaining competitiveness in a rapidly evolving market landscape.