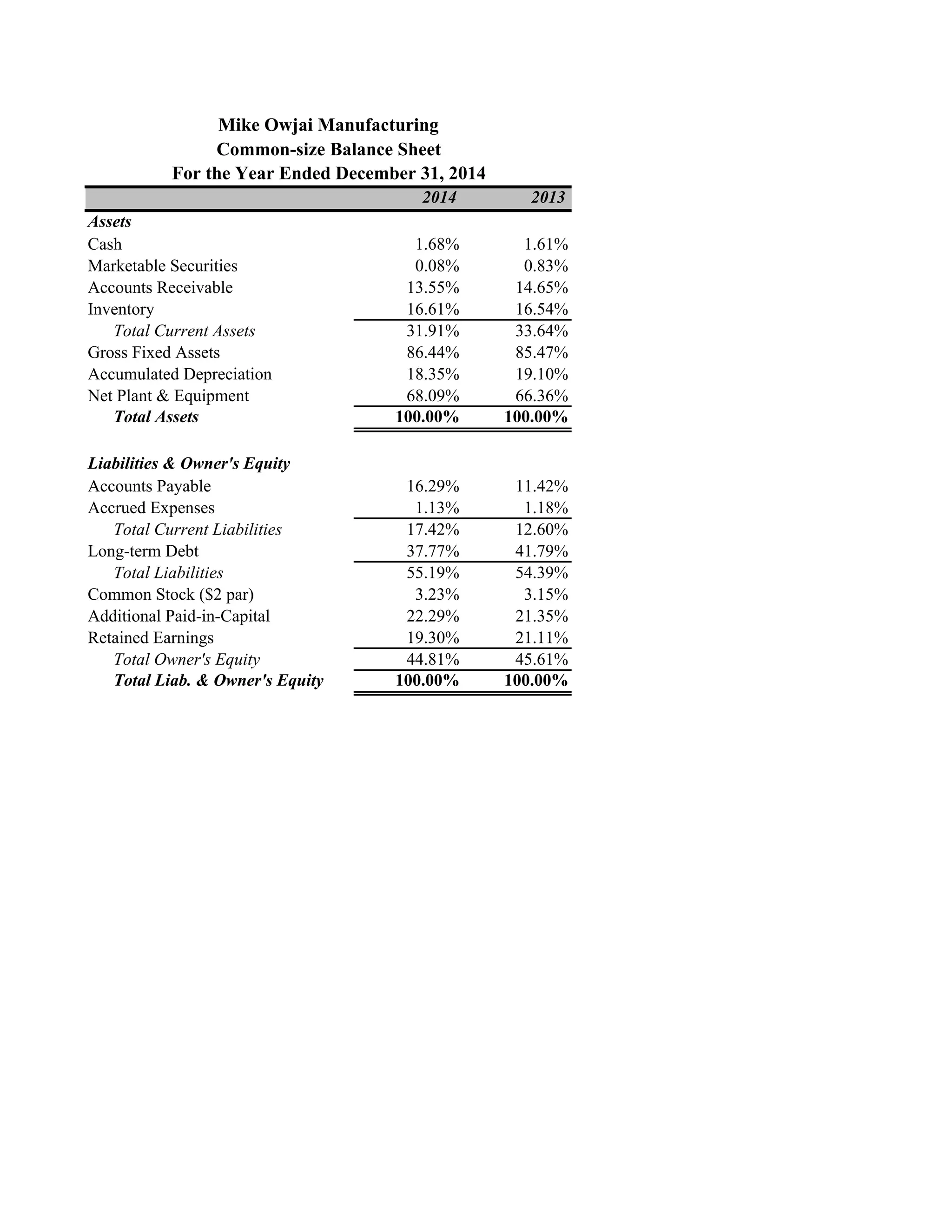

The document presents financial statements and analysis for two companies, Mike Owjai Manufacturing and Winter Park Web Design, for various years. Key figures include sales revenue, cost of goods, gross profit, net income, and balance sheet details, highlighting changes in financial performance over time. Additionally, the document includes cash flow statements which summarize cash flows from operations, investing, and financing activities.