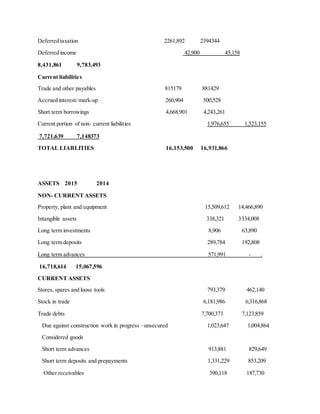

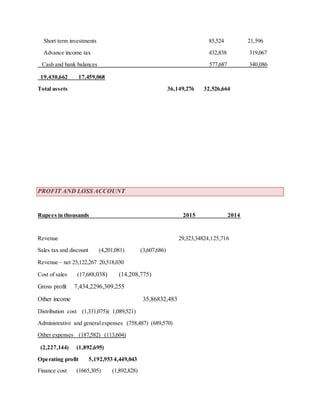

This document contains ratio analyses for the years 2015 and 2014. Ratio analyses are used to evaluate a firm's financial performance in key areas like short-term solvency, debt management, asset management, profitability, and market value. The document provides calculations for liquidity ratios, debt ratios, profitability ratios, and marketability ratios for both years. These ratios indicate the company's ability to meet short-term obligations, use of debt financing, operating efficiency, and stock valuation.