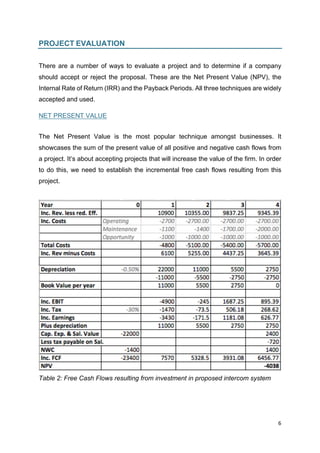

This report evaluates a proposed investment in a new intercom system for Adelaide Manufacturing Company Ltd. The weighted average cost of capital (WACC) of 8.20% was calculated using the company's capital structure and used to evaluate the project. The net present value (NPV) of -$4038 and internal rate of return (IRR) of less than the WACC indicate the project should be rejected. The payback period is also longer than the company's maximum of 4 years. Based on the negative NPV, the recommendation is that the company should not purchase the new intercom system.