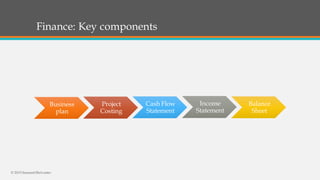

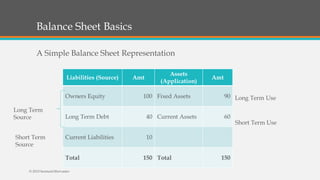

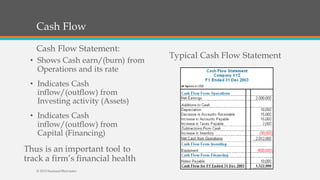

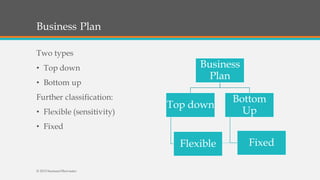

This document provides an overview of finance concepts that are important for companies that have received private equity or venture capital funding. It discusses key financial statements like the balance sheet, income statement, cash flow statement and how to analyze them. It outlines some dos and don'ts for financial management of such companies, like focusing on cash flows and margins. The presentation emphasizes the importance of building accurate business plans and budgets. It also notes that business owners should focus on working capital, investments, returns and compliance requirements when managing finances.