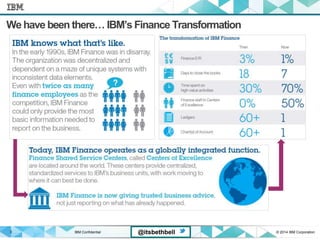

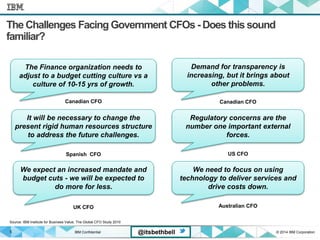

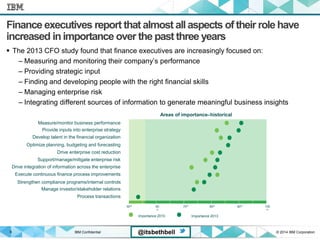

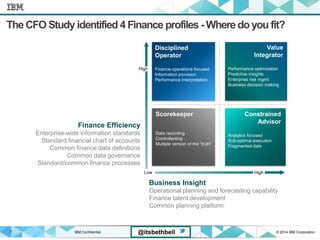

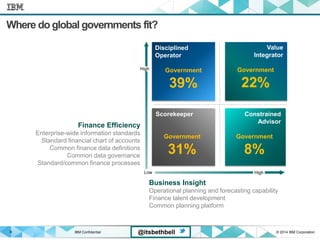

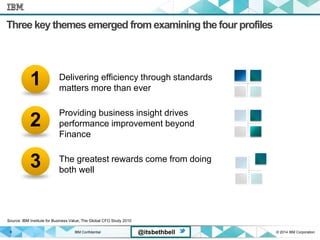

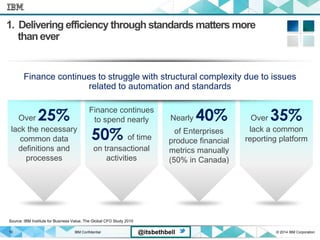

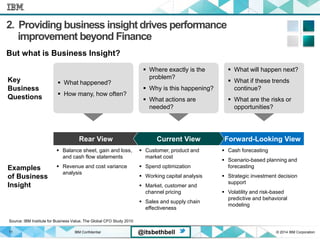

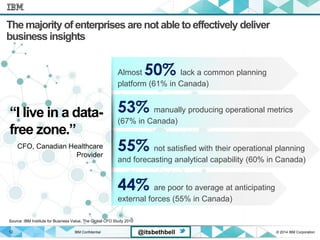

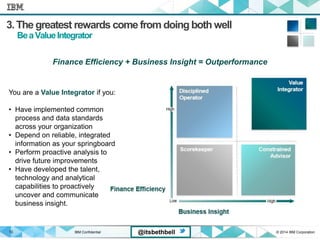

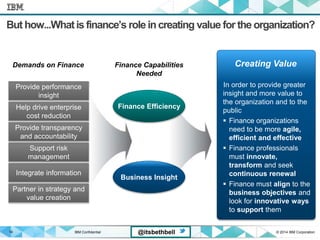

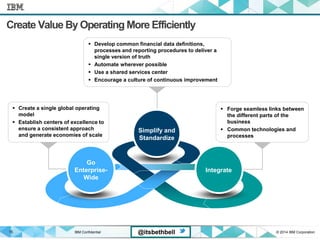

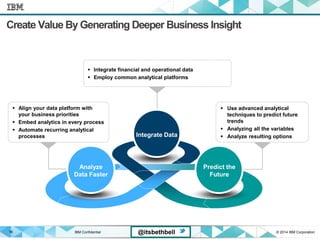

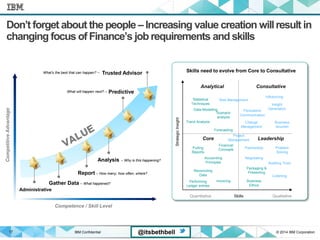

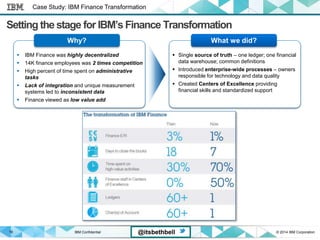

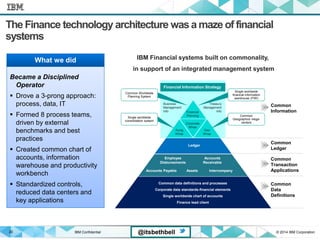

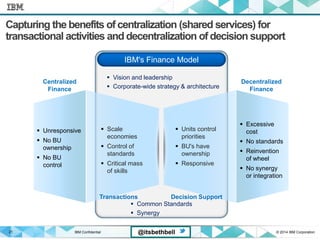

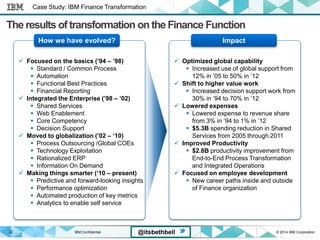

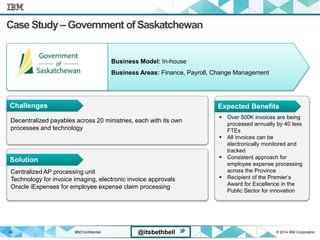

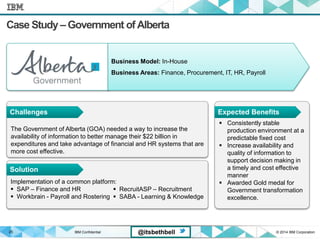

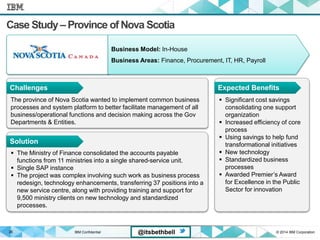

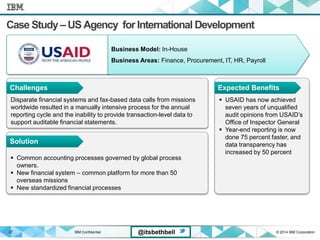

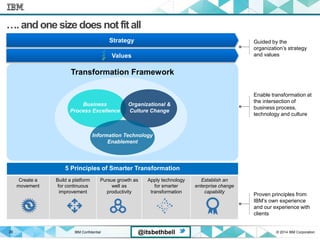

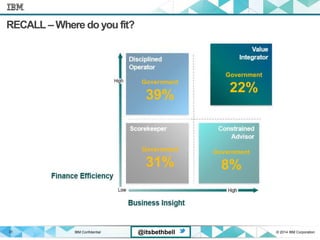

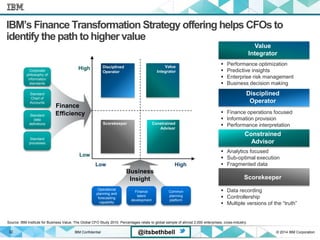

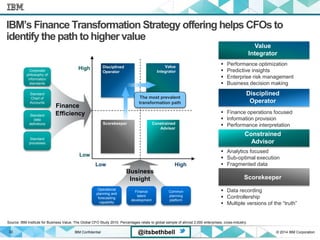

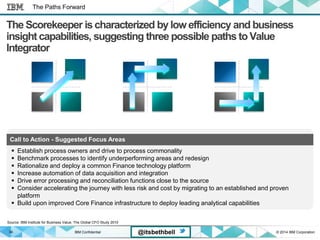

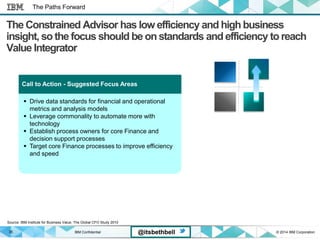

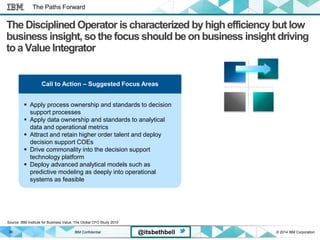

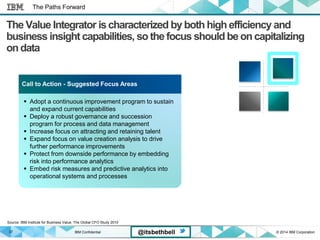

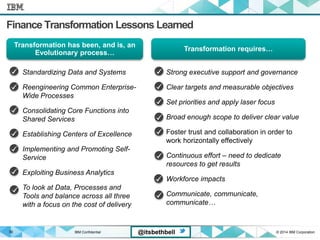

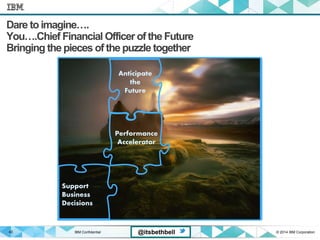

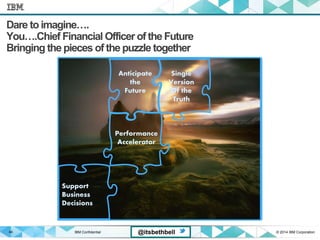

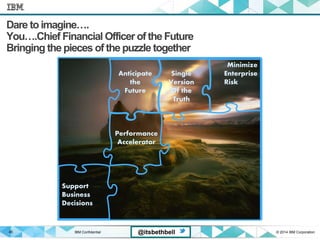

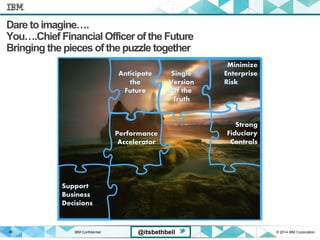

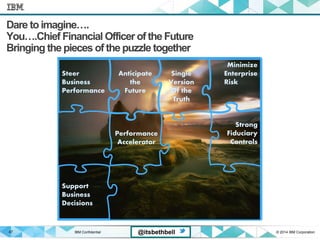

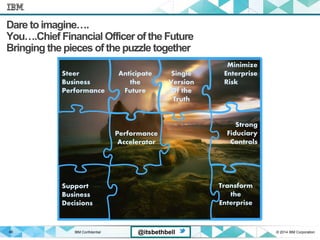

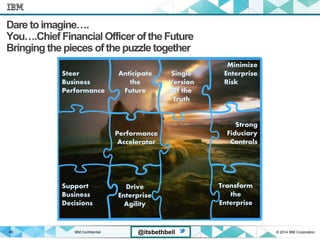

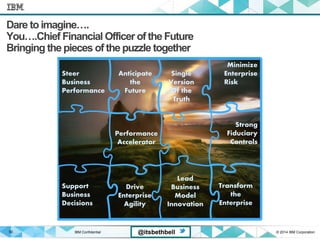

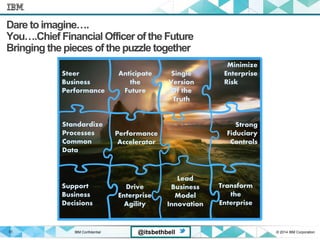

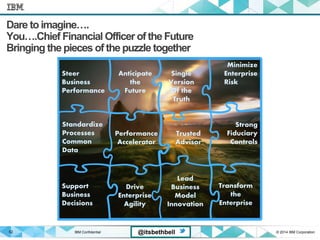

This document discusses challenges facing finance professionals in government and business and the need to transform finance functions to both increase efficiency and provide more strategic business insights. It provides examples of IBM's own finance transformation, where they standardized processes, integrated data and increased analytical capabilities. The document advocates that finance organizations operate more efficiently through standards and integration while also generating deeper business insights through advanced analytics. This allows them to create more value by advising on strategy, managing risks and providing transparency. It also notes the skills finance professionals require are evolving from core accounting to more consultative and analytical roles.