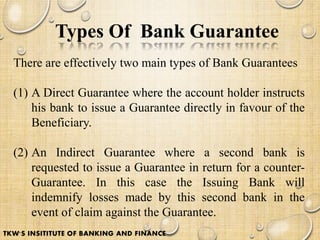

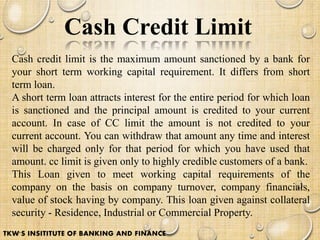

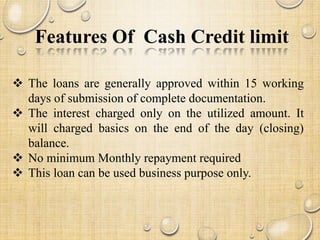

Working capital finance (WCF) refers to a business's capital used in day-to-day operations, calculated as current assets minus current liabilities. It includes various funding types such as cash credit and bill discounting, each having advantages and disadvantages that impact liquidity and credit ratings. Additionally, financial instruments like bank guarantees and letters of credit are essential for managing risks and facilitating international trade.