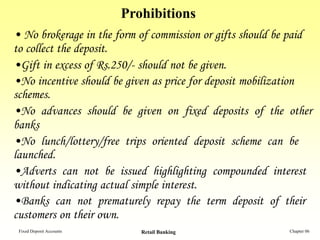

The document provides a comprehensive overview of fixed deposit accounts, including definitions, eligibility, interest rates, and procedures for early withdrawal and renewal. It outlines the tax implications, joint holdings, and policies for deceased depositors, along with prohibitions related to deposit mobilization schemes. Additionally, it explains the conditions under which banks can grant loans against fixed deposits and the process for repayment of deposits.