This document discusses various aspects of finance management in Echjay Steel company. It covers the following key points:

1. The finance department manages all financial activities of the company including capital budgeting, profit distribution, sourcing capital, and accounting.

2. The organization structure of the finance department includes a finance manager who oversees assistants, a cash/bank manager, costing assistant, and clerks.

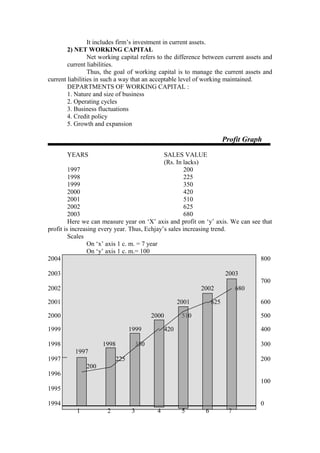

3. The company obtains short-term financing from internal sources like profits and long-term financing from external sources like banks. Capitalization and working capital management are also discussed.