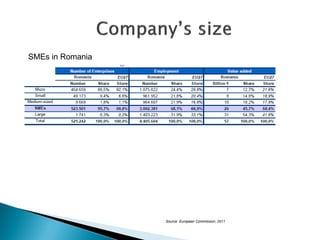

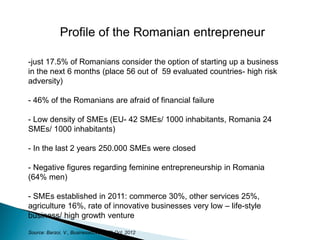

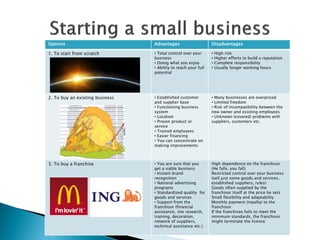

This document discusses different types of companies and methods for raising capital. It differentiates between goods producing and service businesses, and identifies small and medium enterprises (SMEs) as making up over 98% of companies globally and playing a key economic role. The document also examines franchising as a capital raising method, describing it as a contractual relationship where a franchisee operates under a franchisor's brand and guidance in exchange for fees. Lastly, it outlines various options for company financing, including venture capital, business angels, initial public offerings, incubators, and crowdfunding.