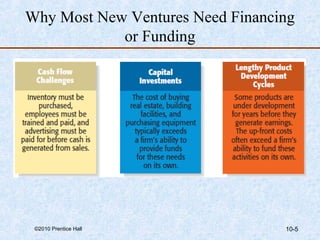

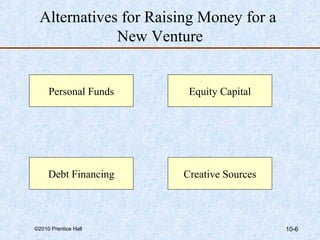

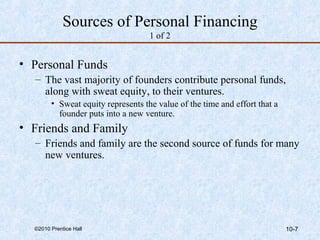

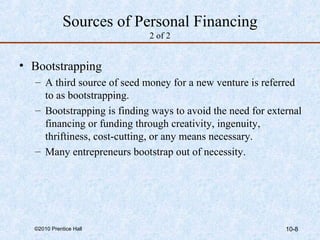

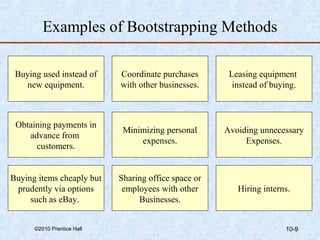

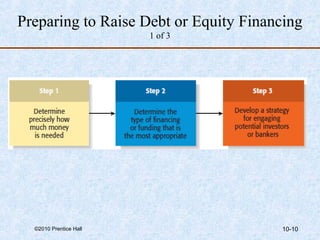

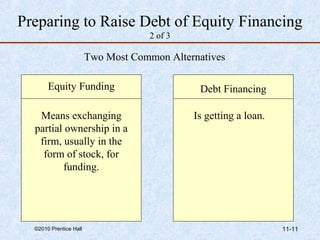

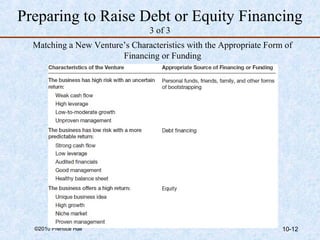

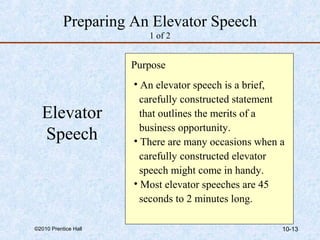

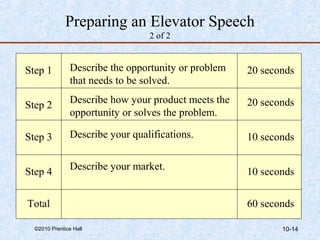

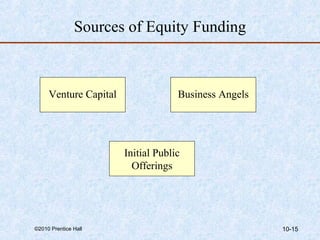

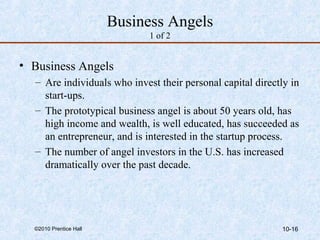

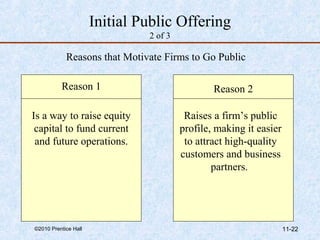

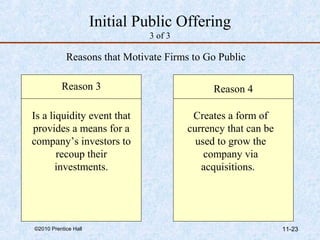

This chapter discusses various methods for obtaining financing or funding for new ventures. It explains that most startups need funding to cover initial operating costs until they become profitable, develop their product, and grow. The chapter outlines personal sources of funding like personal savings, friends and family, and bootstrapping. It also discusses external sources such as debt financing from banks or the SBA, equity funding from business angels and venture capitalists, and public offerings. The key steps for preparing to obtain financing and the differences between debt and equity options are also reviewed.