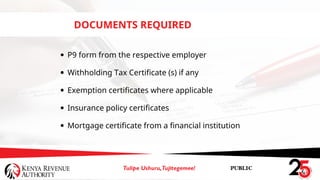

The document outlines the requirements and penalties associated with filing individual tax returns, emphasizing that all individuals with Personal Identification Numbers (PINs) must submit returns by a specified due date. It details necessary documents for compliance, highlights penalties for late filings, and introduces technological enhancements by the Kenya Revenue Authority (KRA) to streamline the process. Additionally, it specifies that both individuals and entities are subject to these tax obligations, with defined penalties for late submissions and payments.