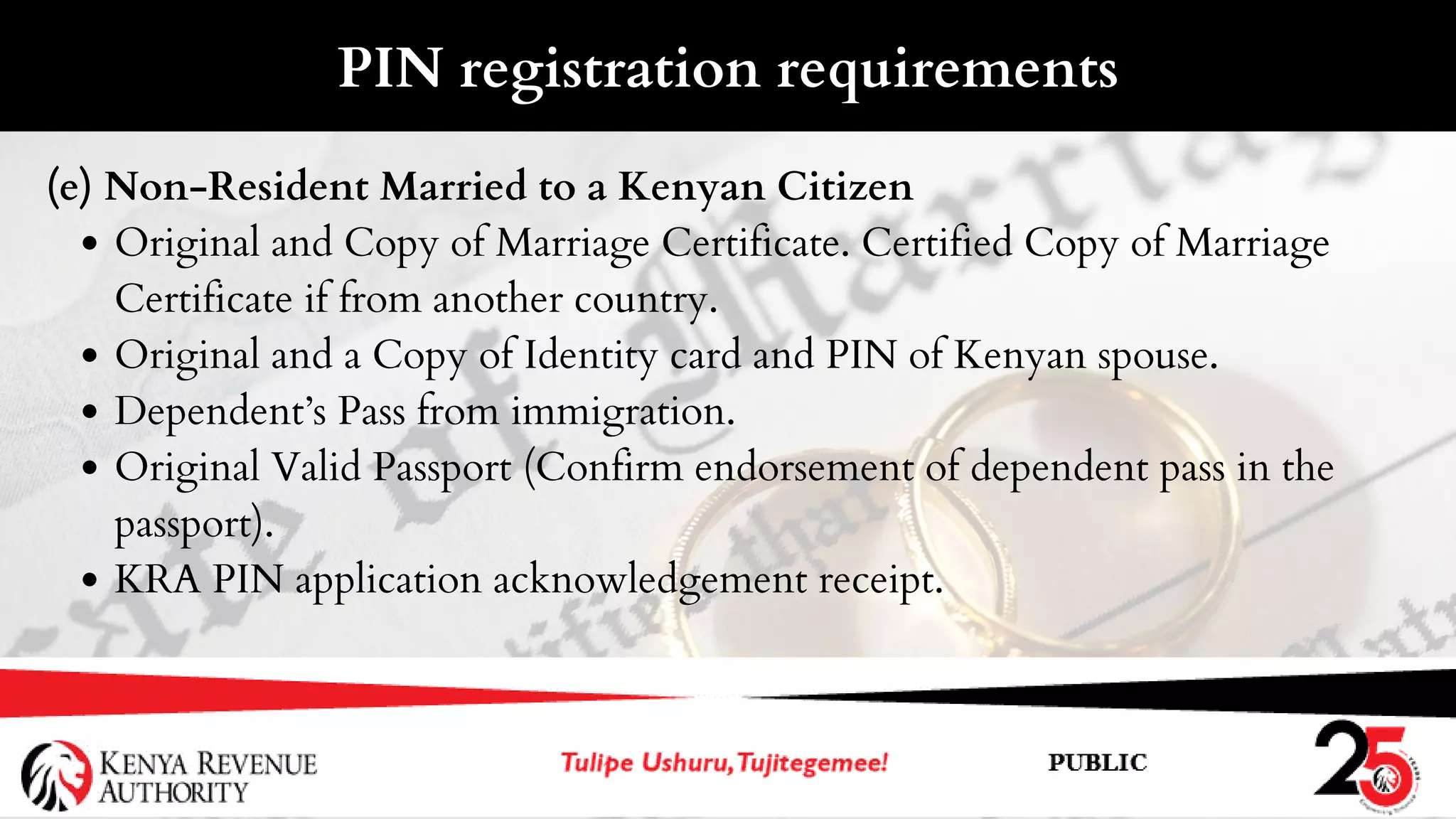

A Personal Identification Number (PIN) is a unique identifier issued to taxpayers (individuals and non-individuals) to transact business with the Kenya Revenue Authority (KRA) and other government agencies. To apply for a PIN, taxpayers can access the online application on the KRA website or through mobile apps. The requirements for PIN registration vary depending on taxpayer type, including documents like passports, marriage certificates, and letters of introduction. A PIN is linked to specific tax obligations that a taxpayer must adhere to, such as due dates for filing and paying taxes.