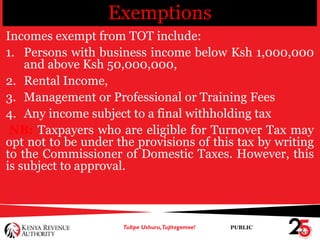

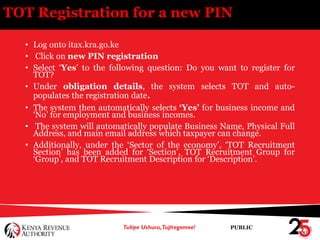

The document summarizes Kenya's turnover tax (TOT). It states that TOT is charged at 1% on gross sales between KES 1-50 million annually. It is due by the 20th of each month and expenses are not deductible. The document provides details on registration, filing returns, payments and penalties for non-compliance.