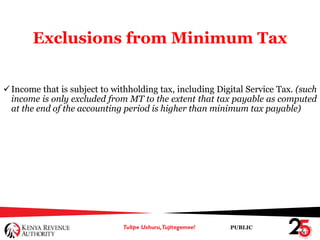

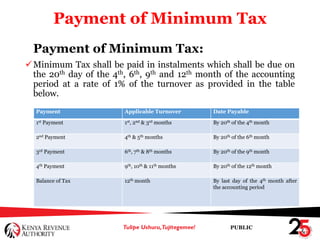

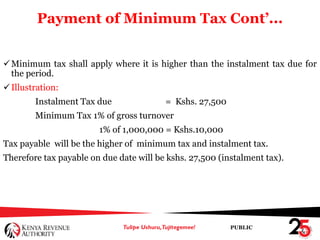

The Finance Act 2020 introduced a minimum tax of 1% on gross turnover aimed at expanding the tax base and ensuring fairness, effective from January 1, 2021. Exemptions include certain income types, and taxpayers must pay minimum tax in installments with specific due dates based on turnover. Taxpayers must declare their turnover monthly and file annual returns while handling losses under specific provisions of the Income Tax Act.