The four main factors that affect the amount of depreciation are:

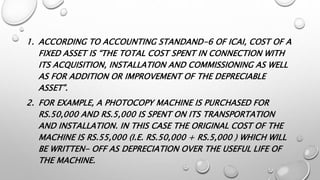

1) The cost of the asset, which includes the purchase price and additional expenditures required to ready the asset for use.

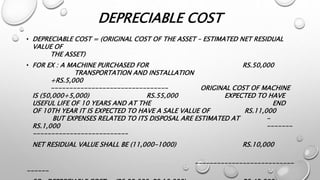

2) The estimated residual value, or expected sale price of the asset at the end of its useful life minus disposal costs.

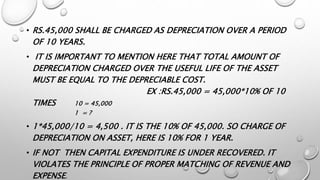

3) The depreciable cost, which is the original cost minus the estimated residual value.

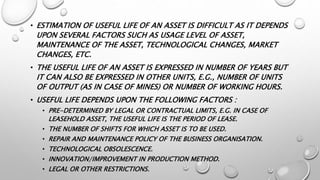

4) The estimated useful life of the asset, which depends on its expected period of use, maintenance, and potential obsolescence.