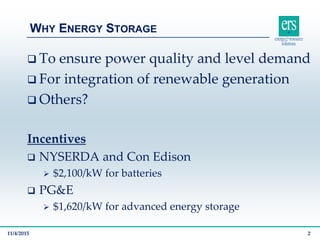

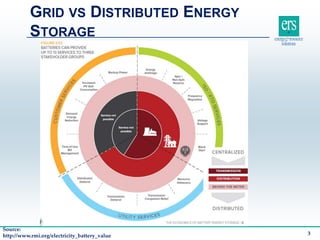

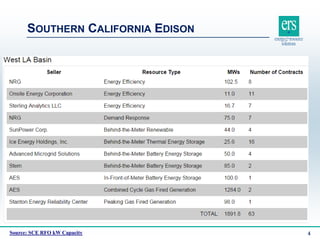

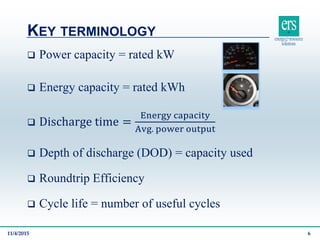

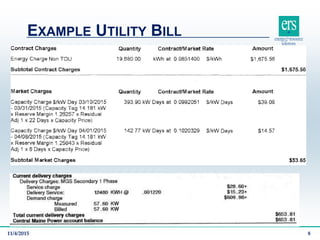

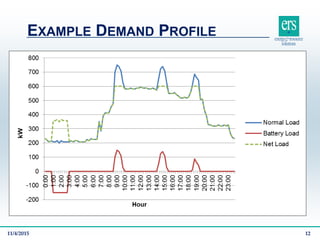

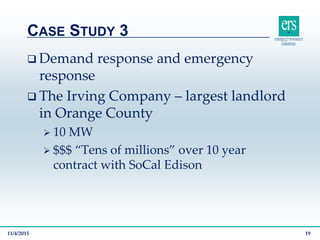

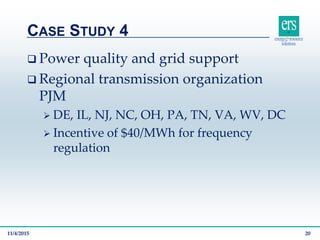

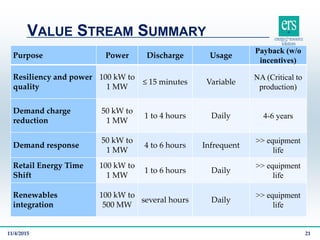

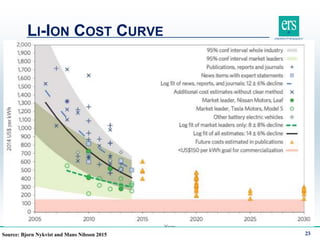

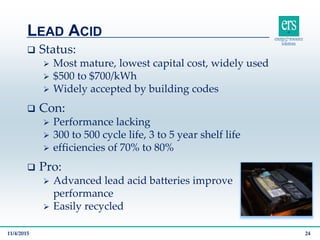

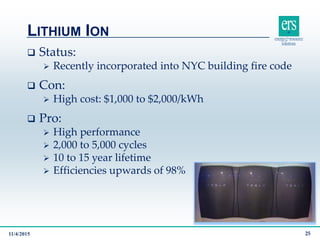

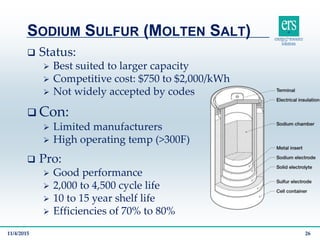

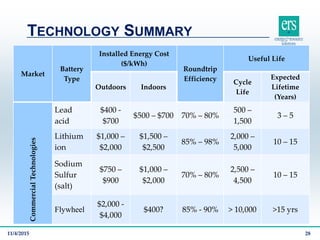

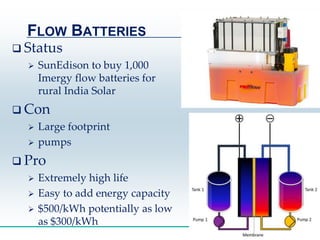

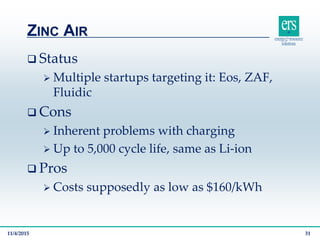

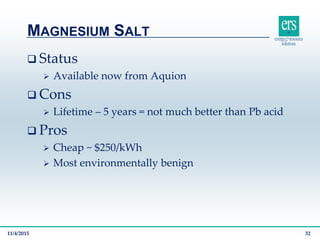

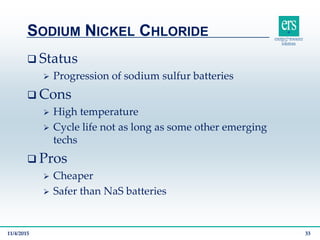

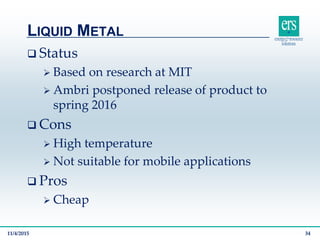

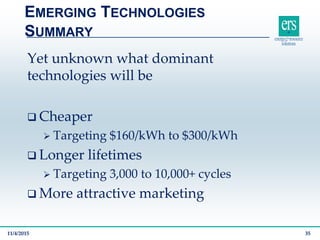

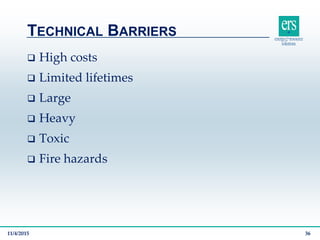

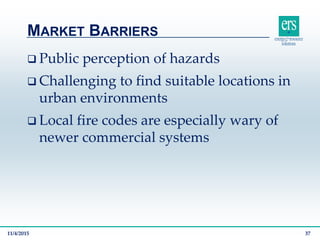

The document discusses the benefits and technologies related to facility-scale battery storage, emphasizing its role in power quality, demand charge reduction, demand response, and renewable generation integration. It covers various battery types, their costs, efficiencies, and market challenges facing energy storage systems. Additionally, it highlights case studies showcasing successful implementations and the evolving landscape of energy storage technologies.