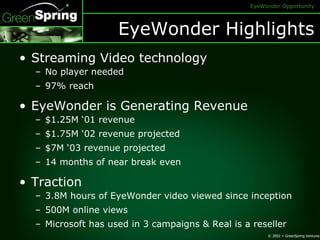

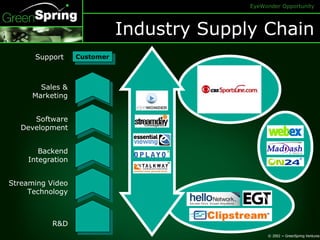

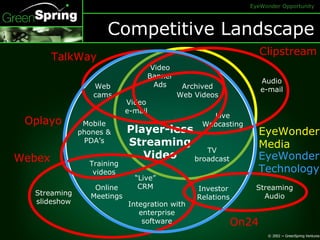

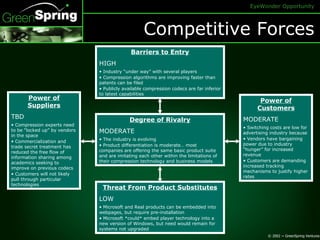

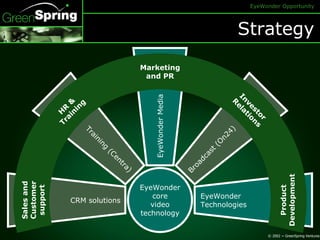

EyeWonder is a streaming video technology company that has seen increasing revenue over recent years. It had $1.25M in revenue in 2001, $1.75M in 2002, and projects $7M in 2003. EyeWonder's technology allows video to be streamed without requiring a separate video player, giving it a high reach of 97%. Major companies like Microsoft have used EyeWonder's technology in their marketing campaigns. EyeWonder differentiates itself from competitors by focusing on its core video streaming technology and through marketing, product development, and sales/customer support strategies.