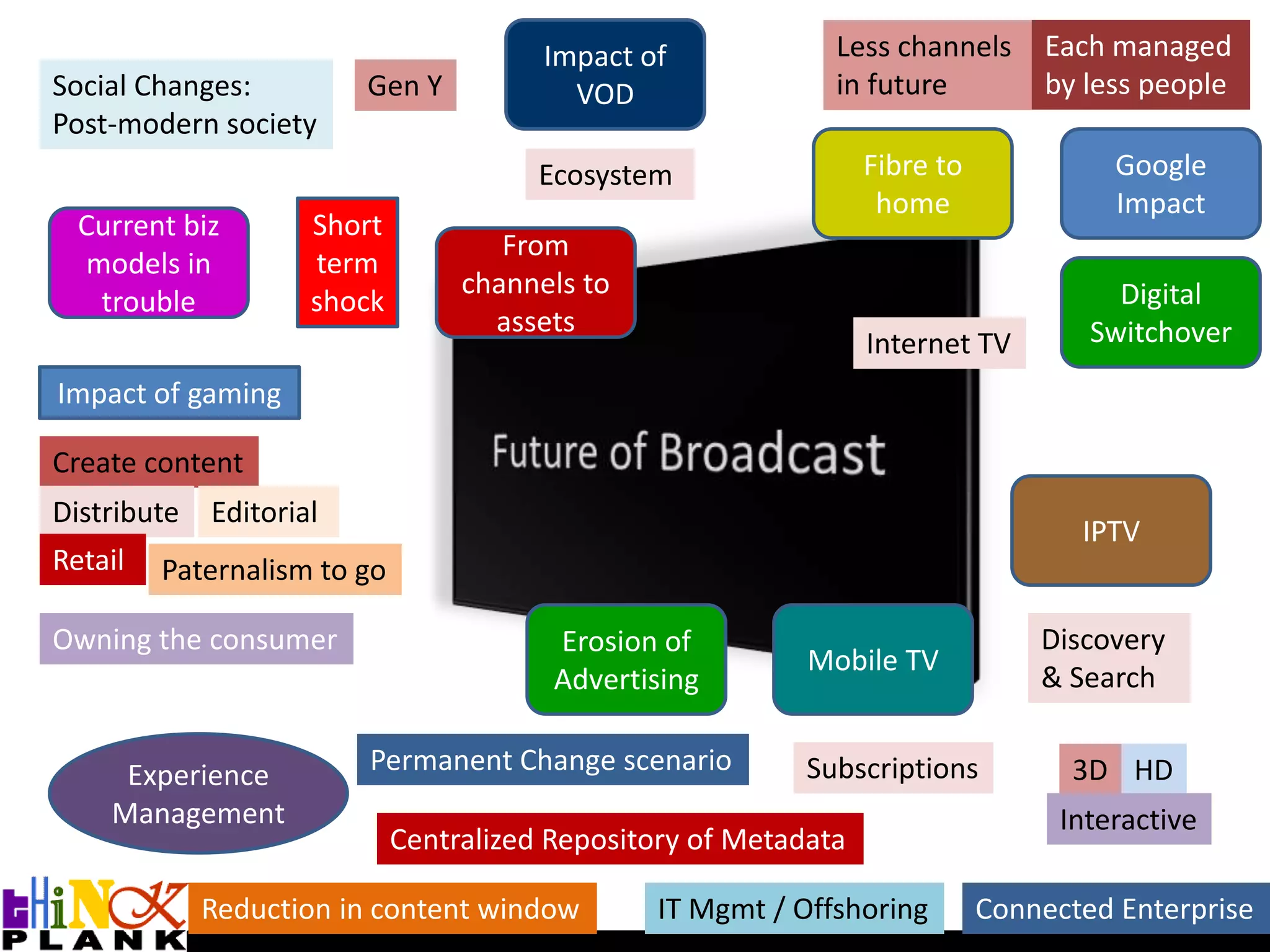

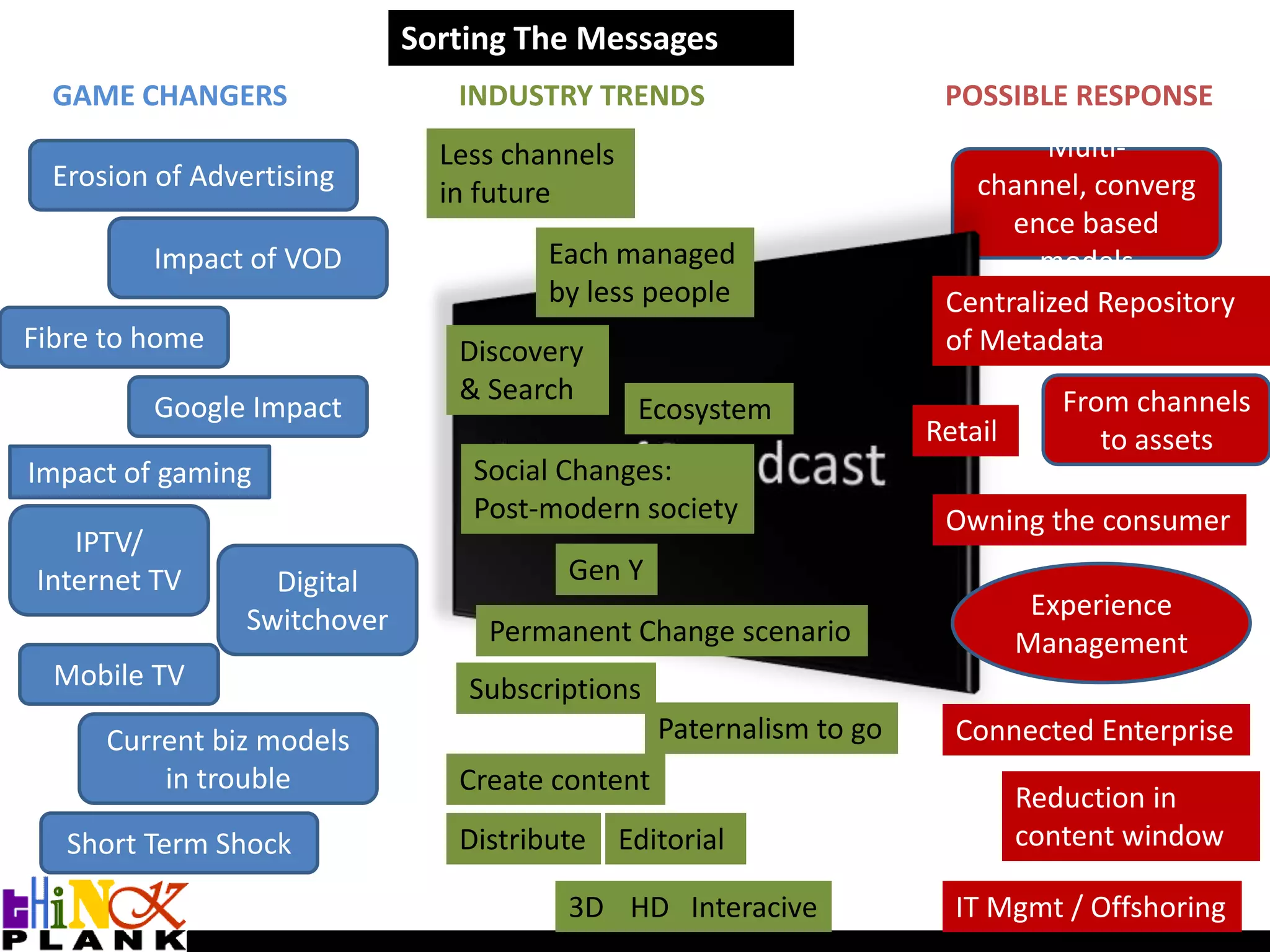

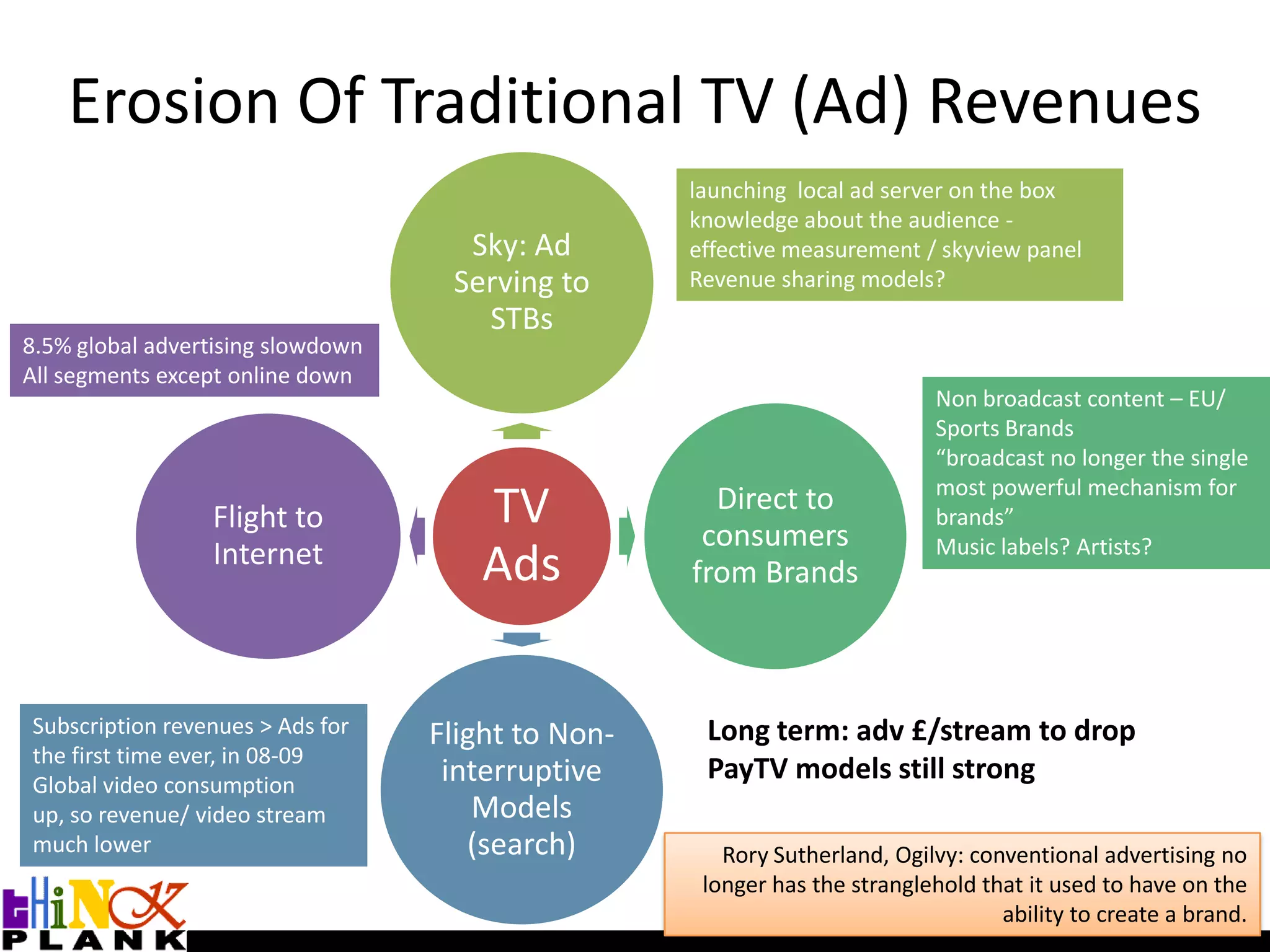

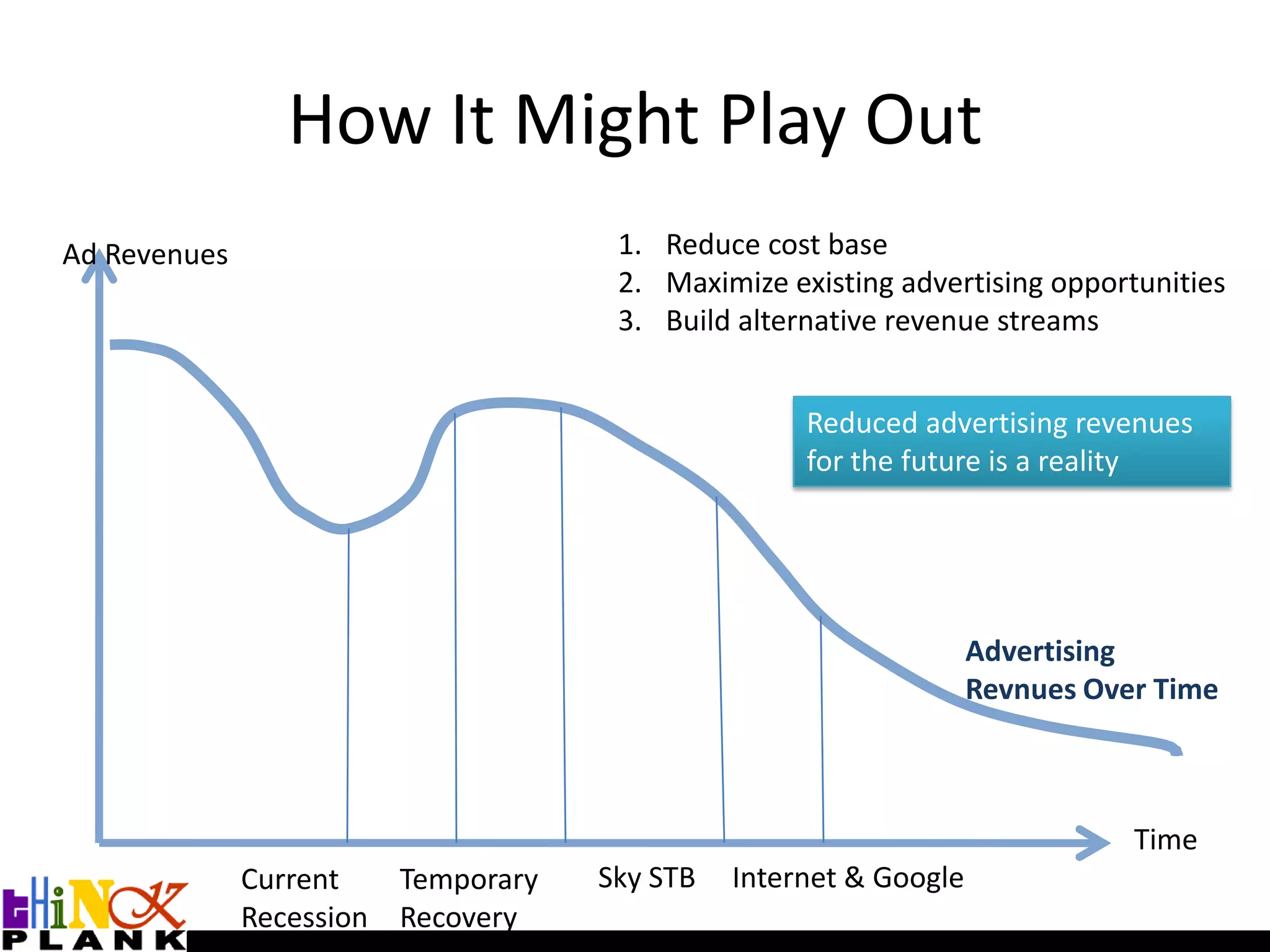

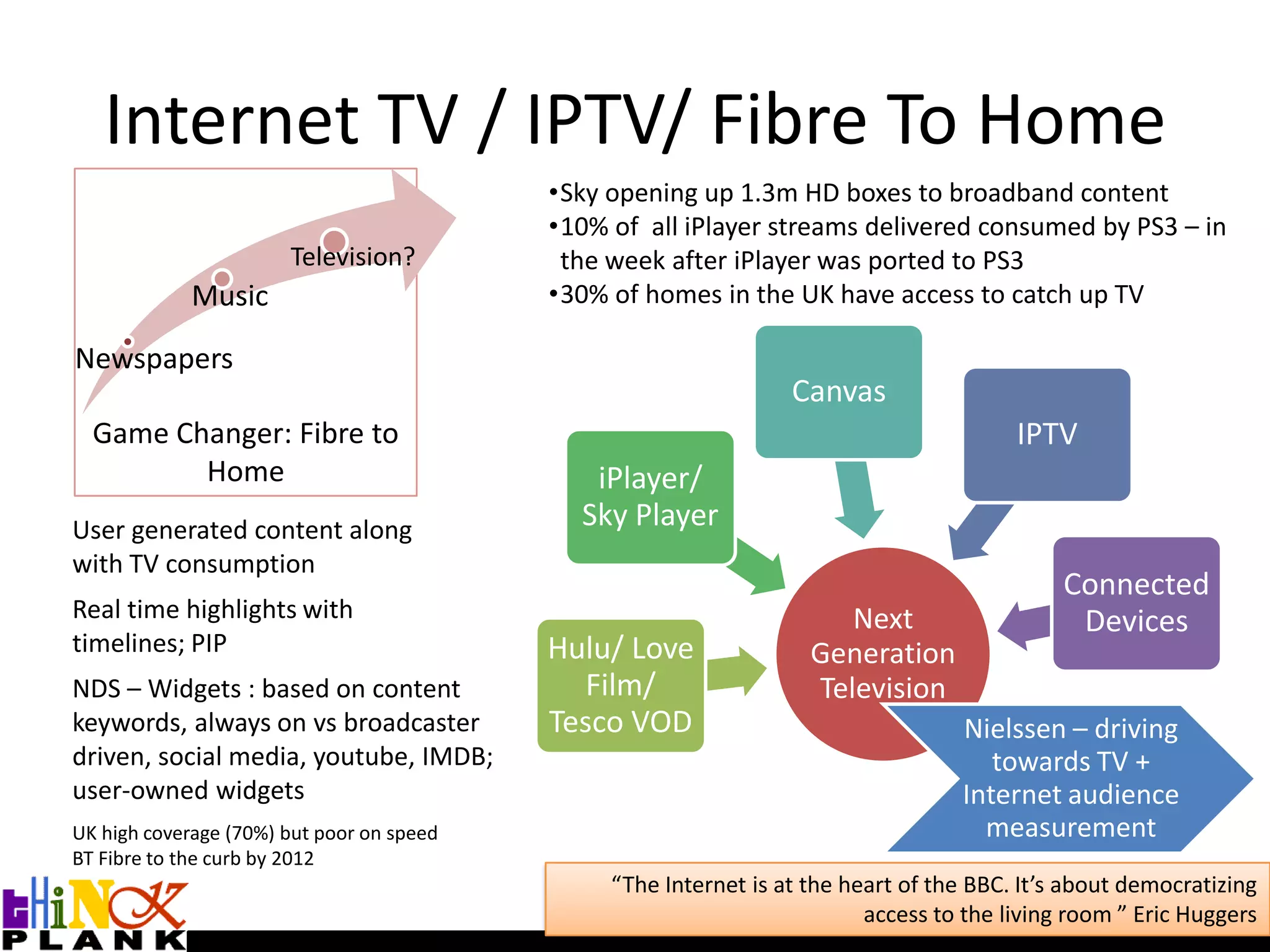

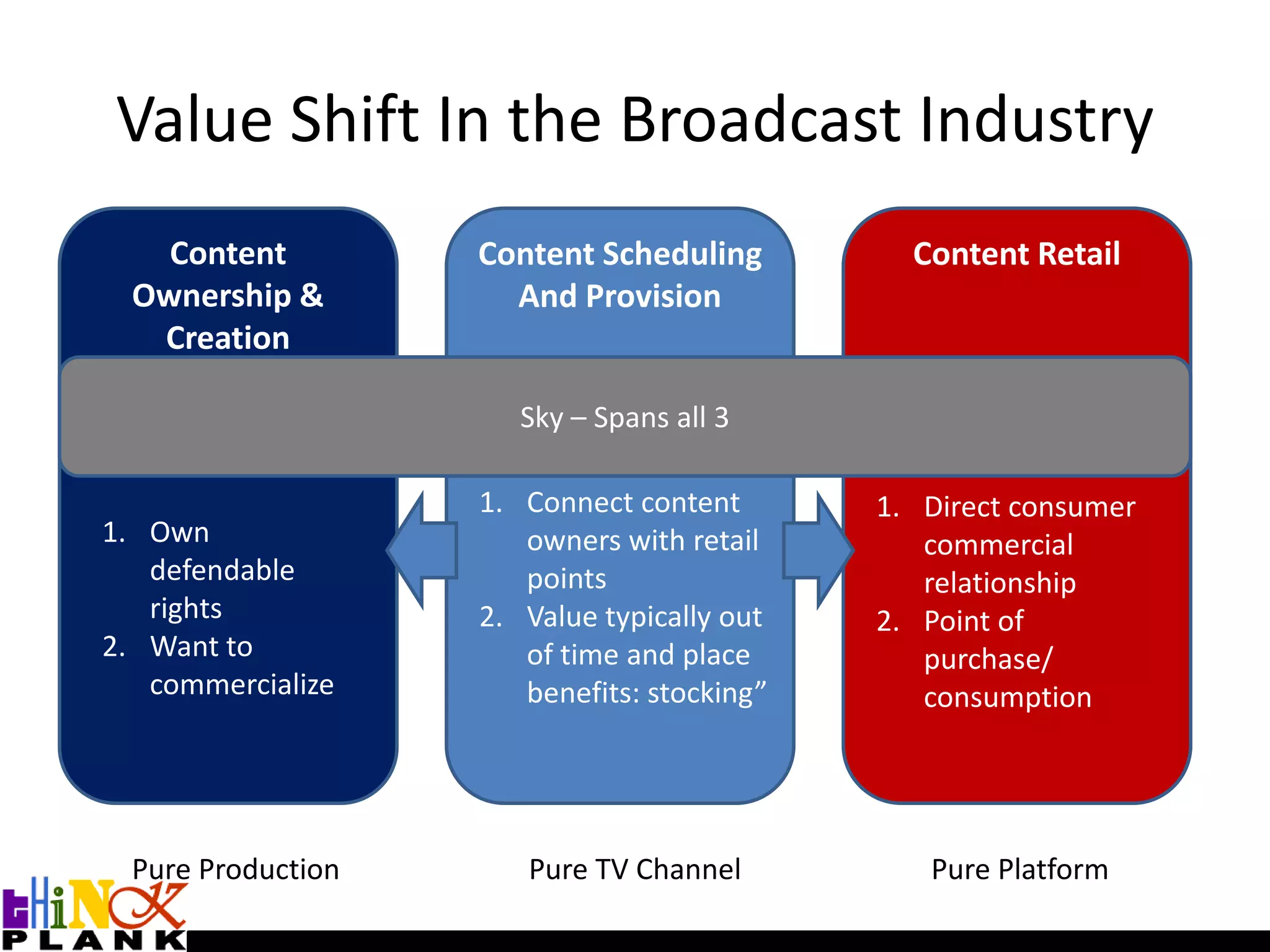

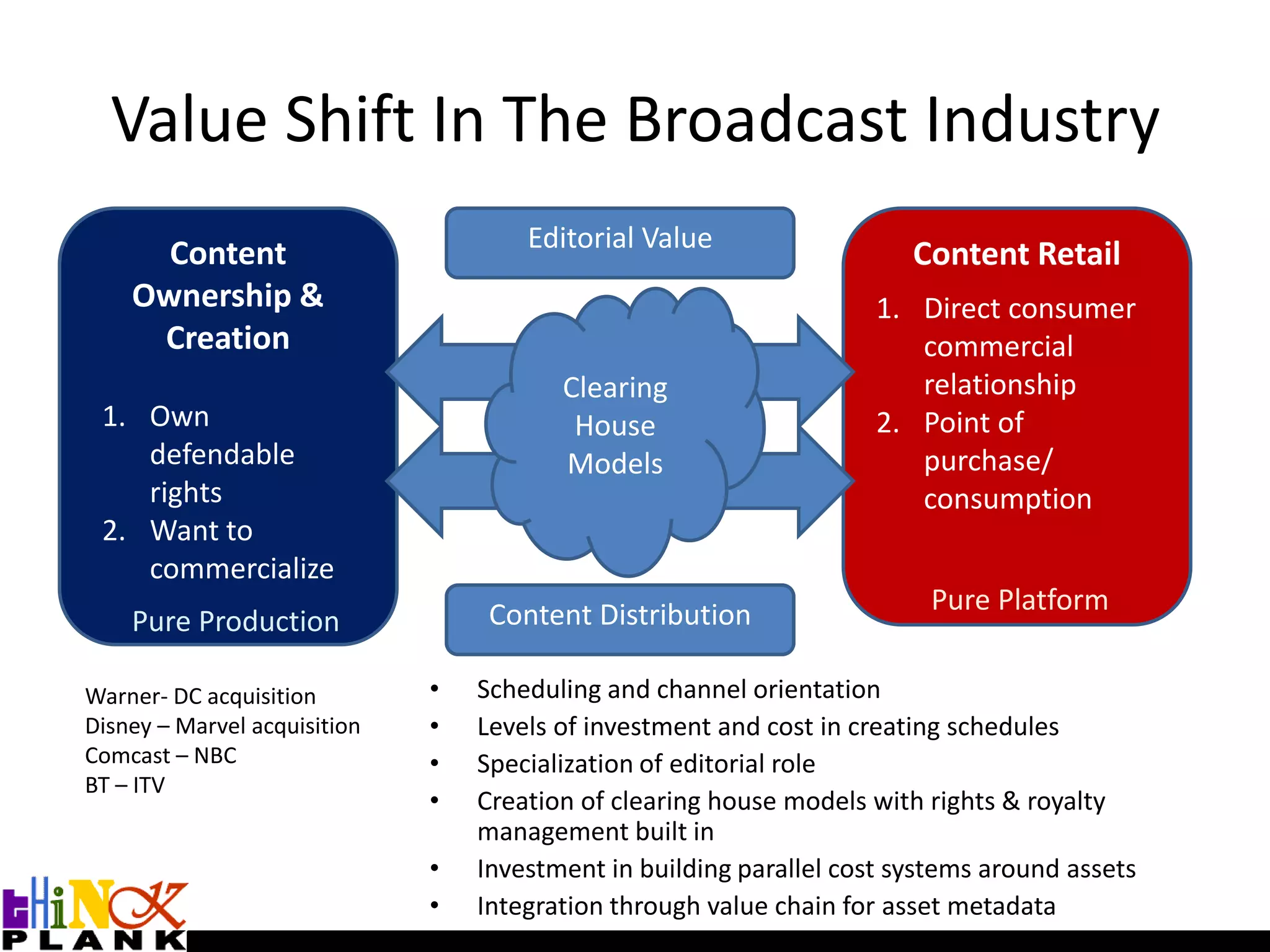

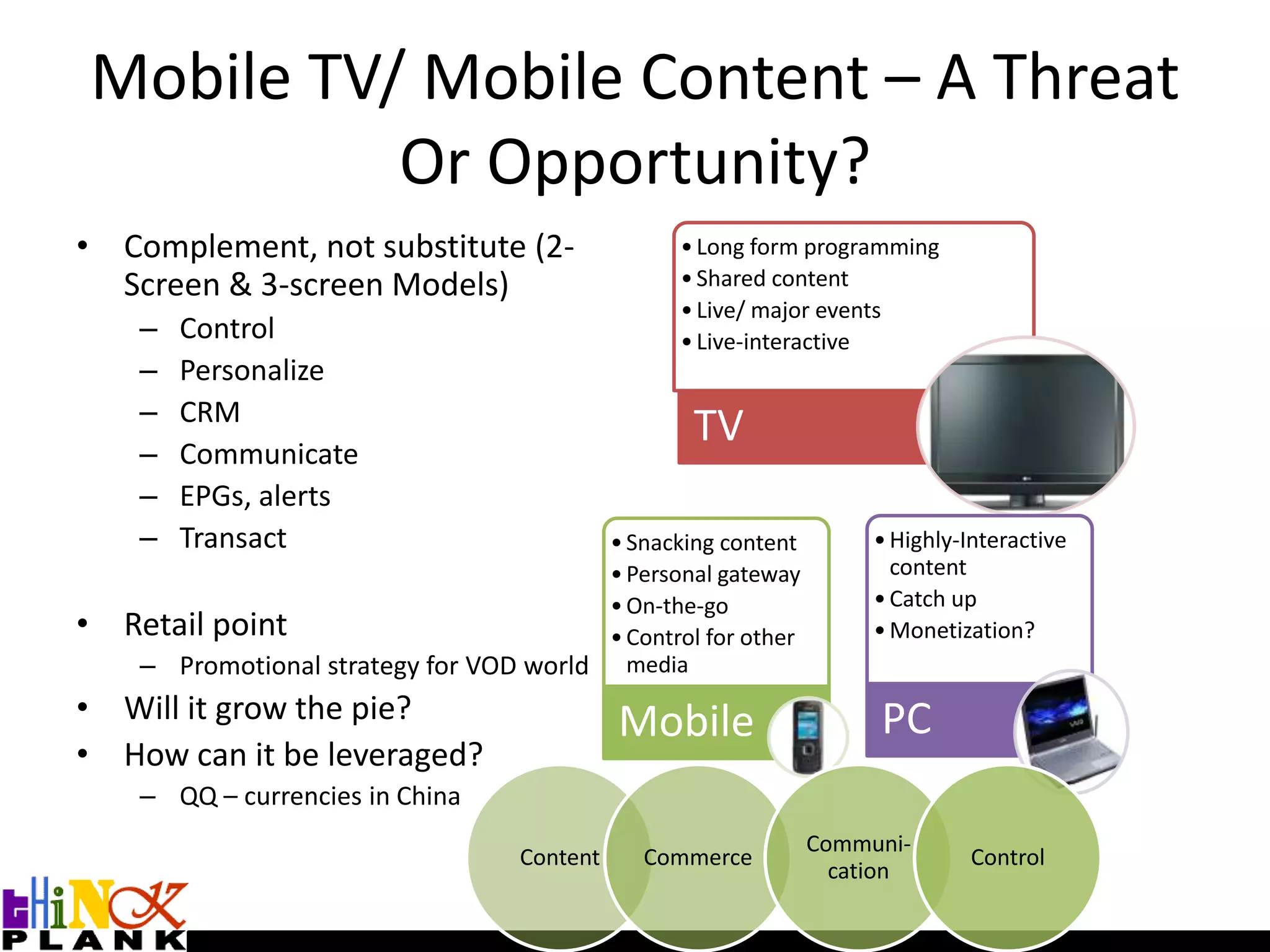

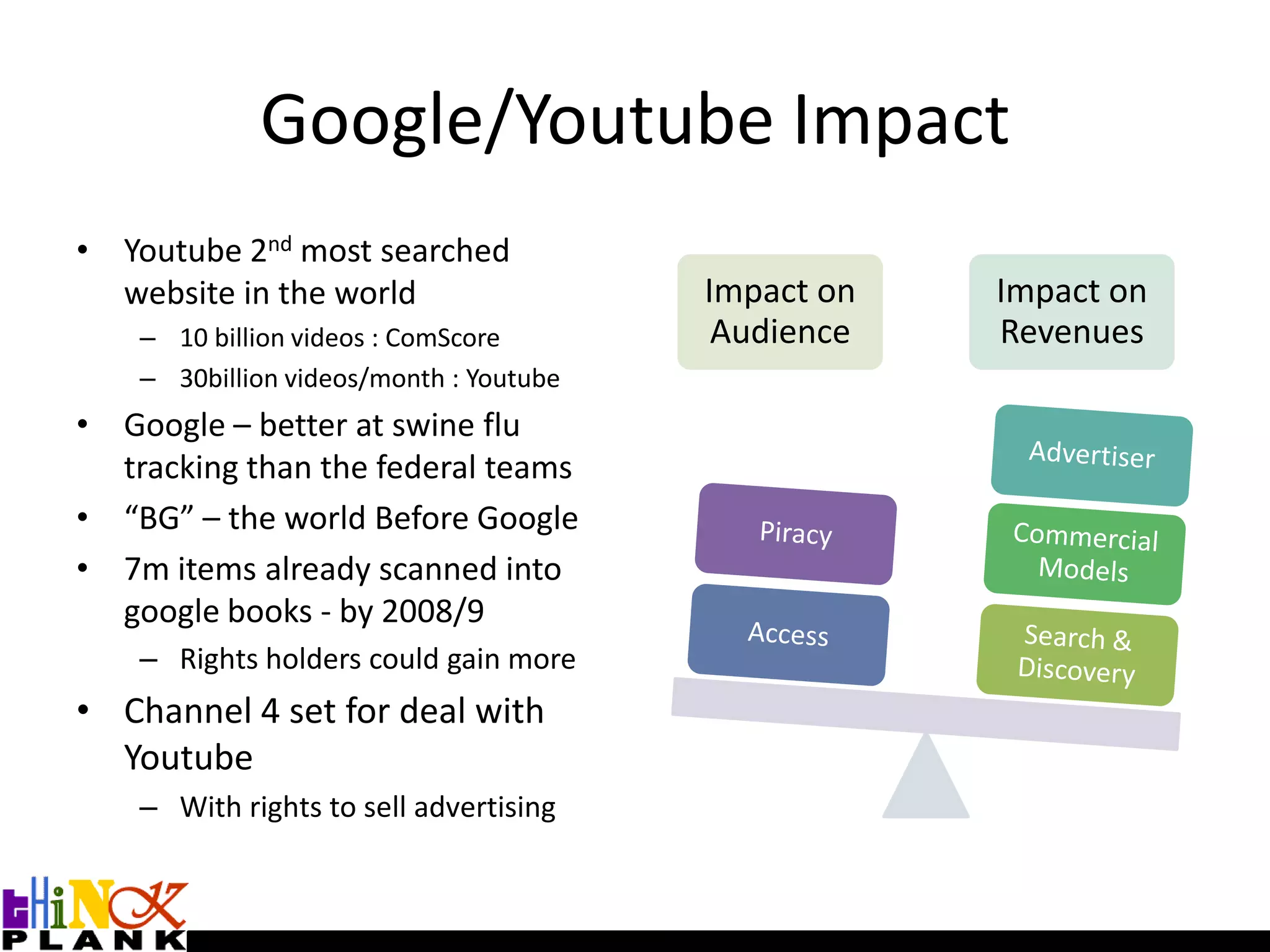

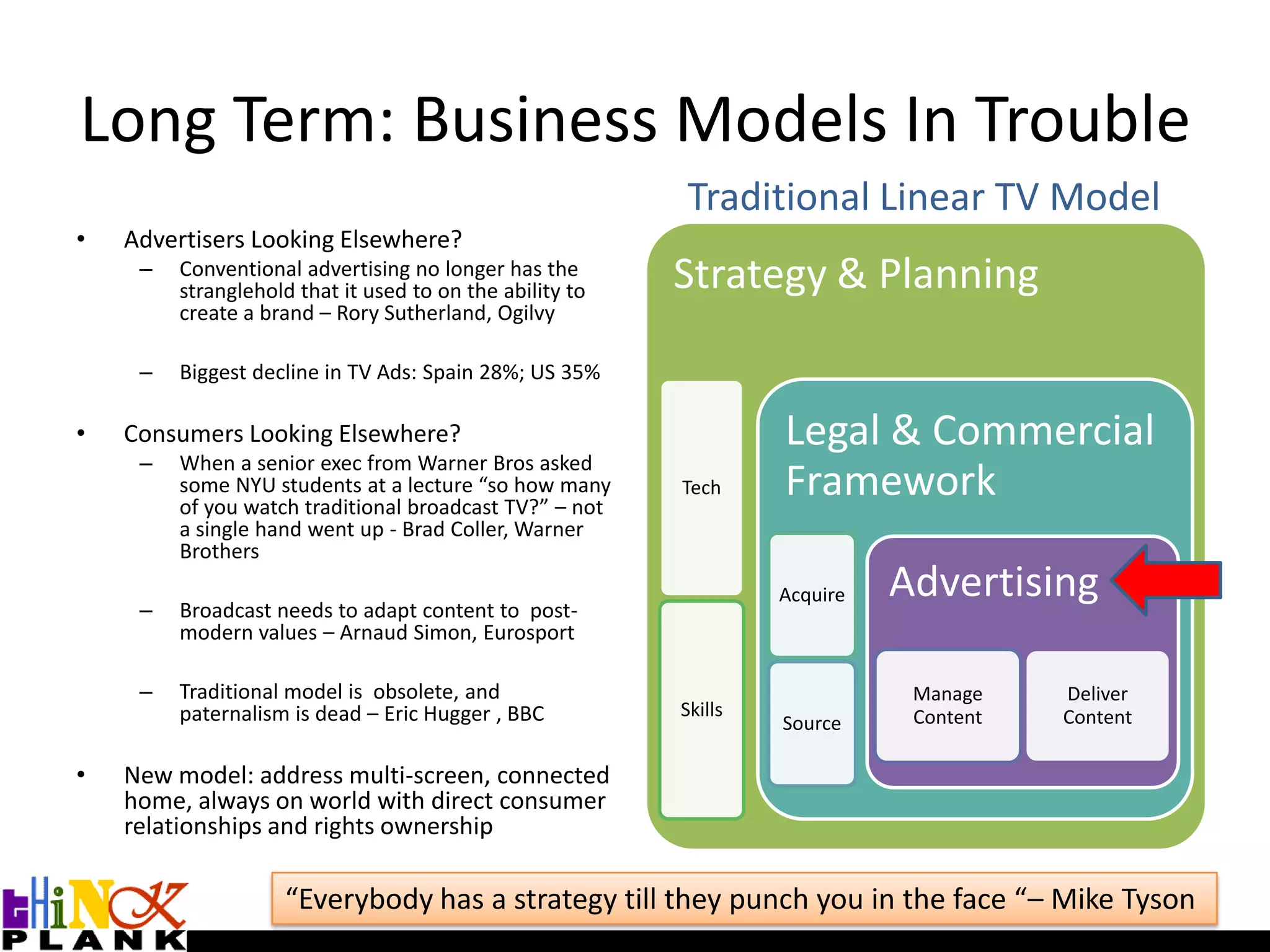

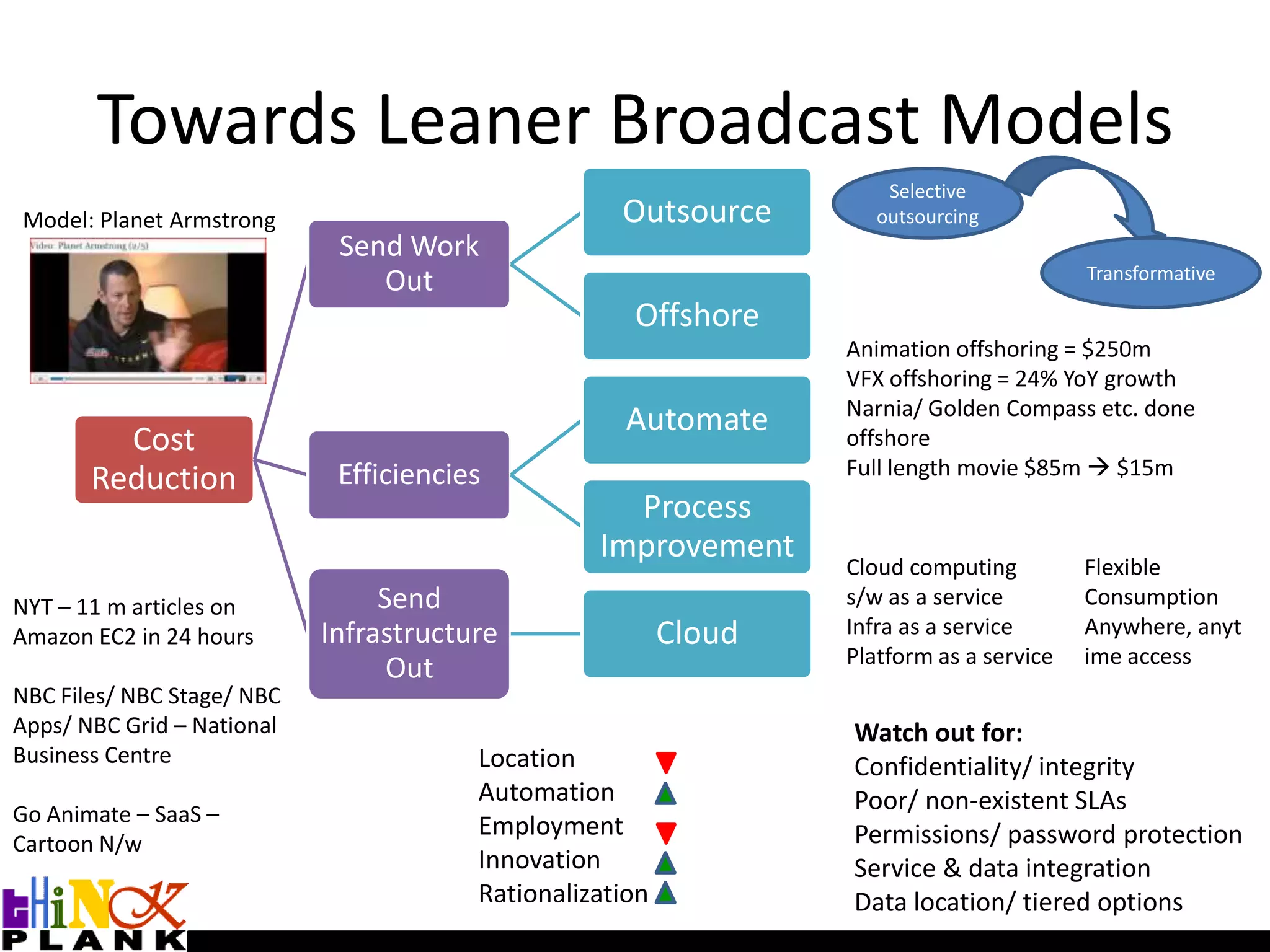

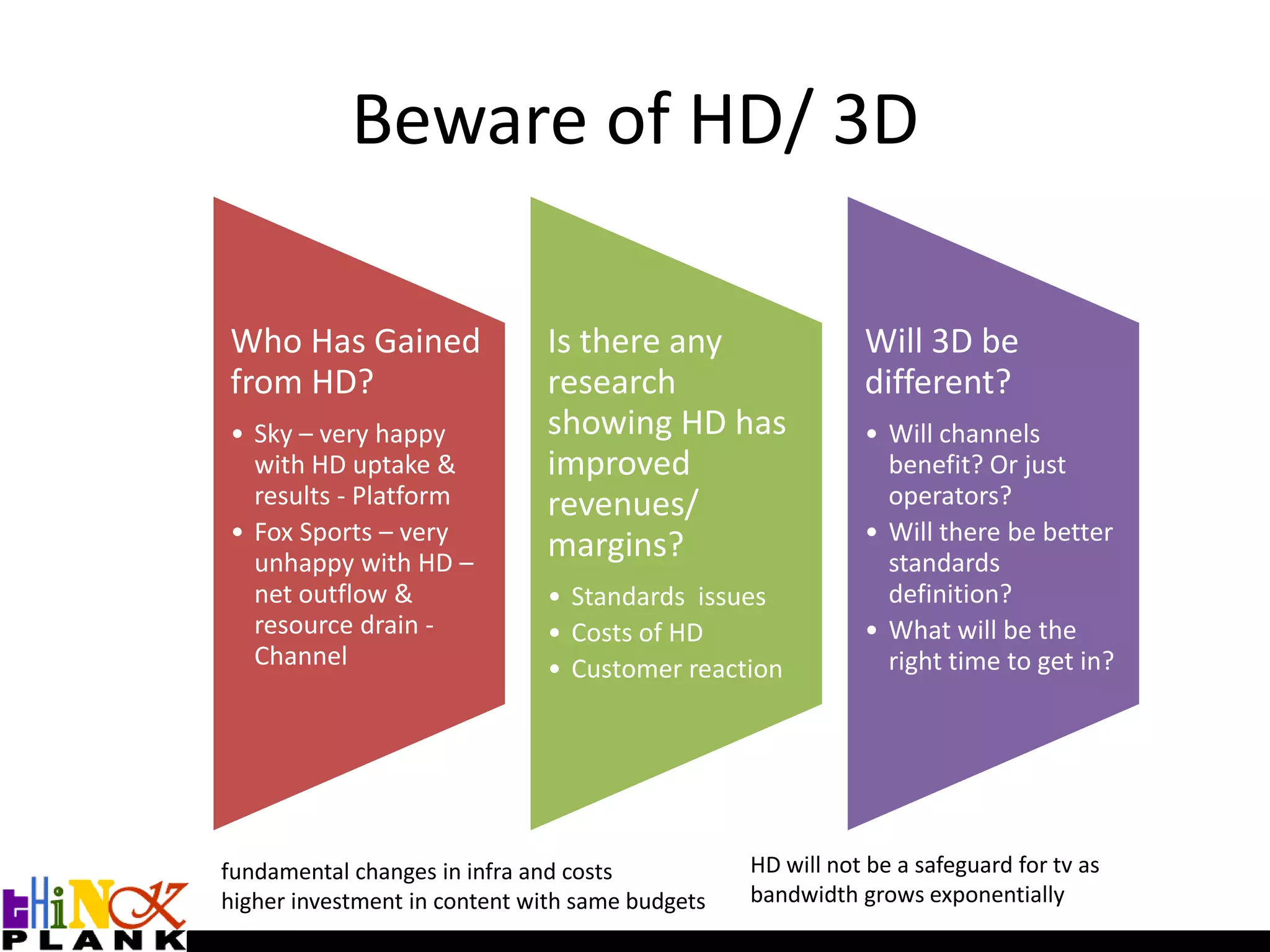

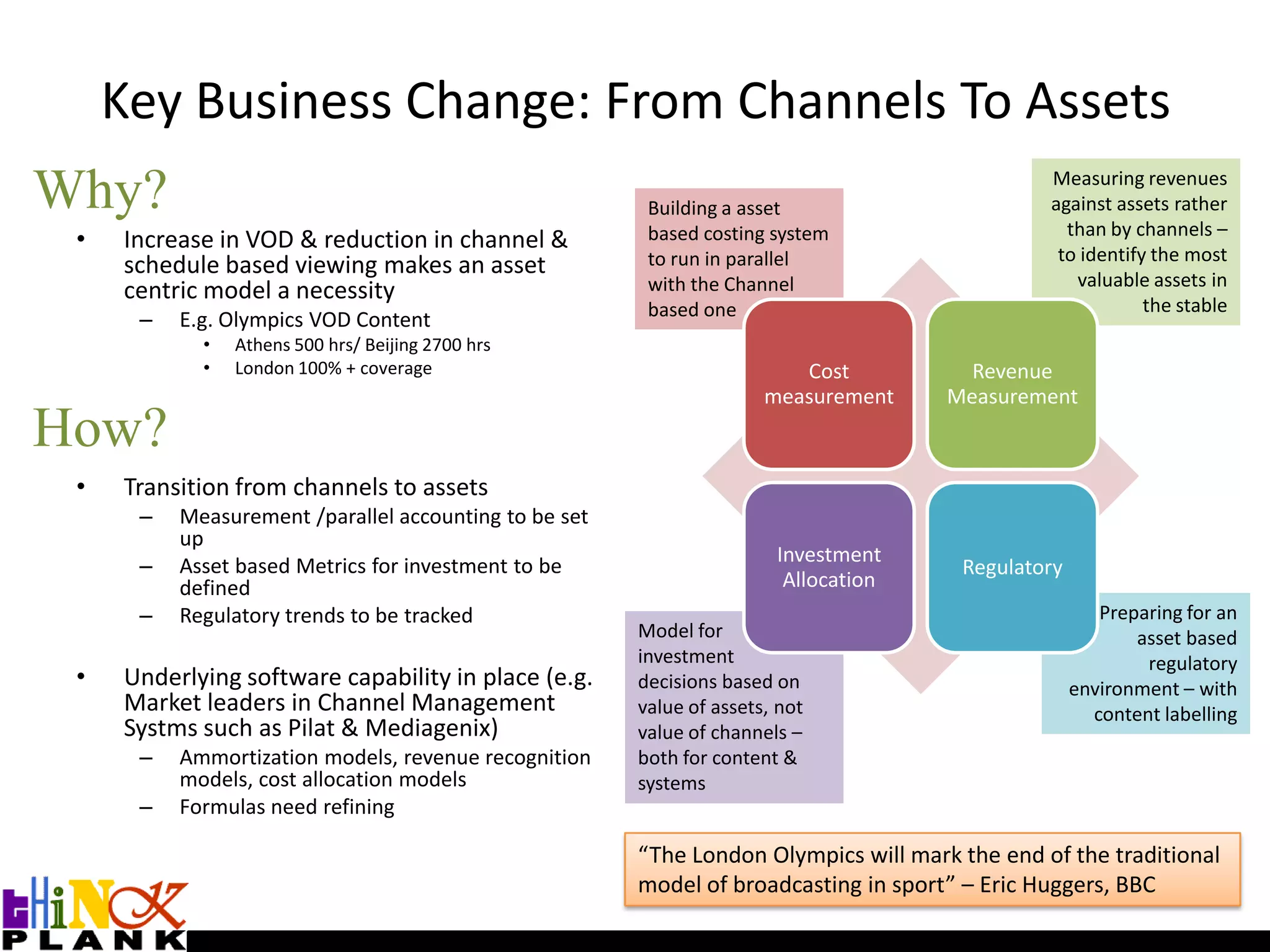

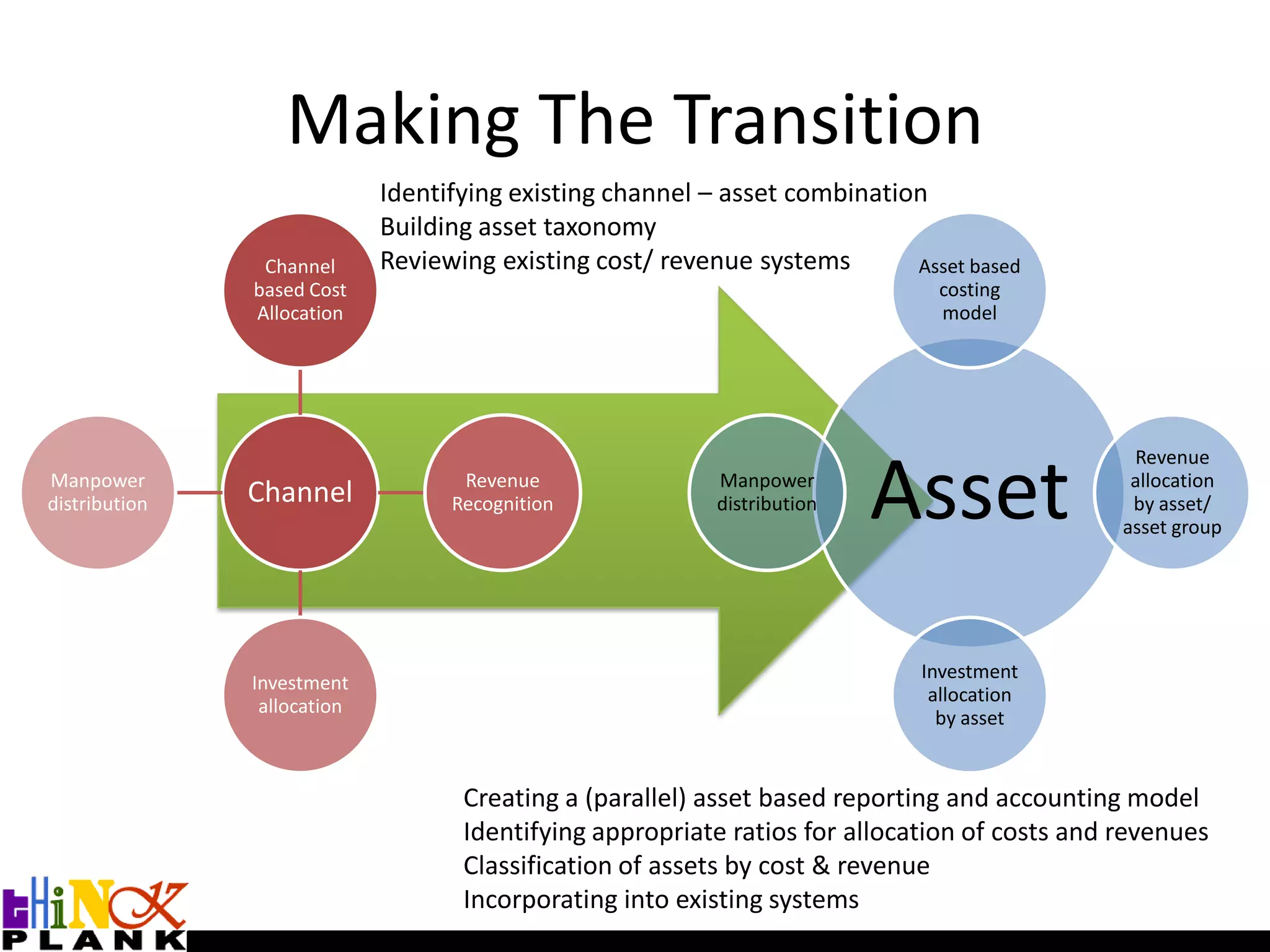

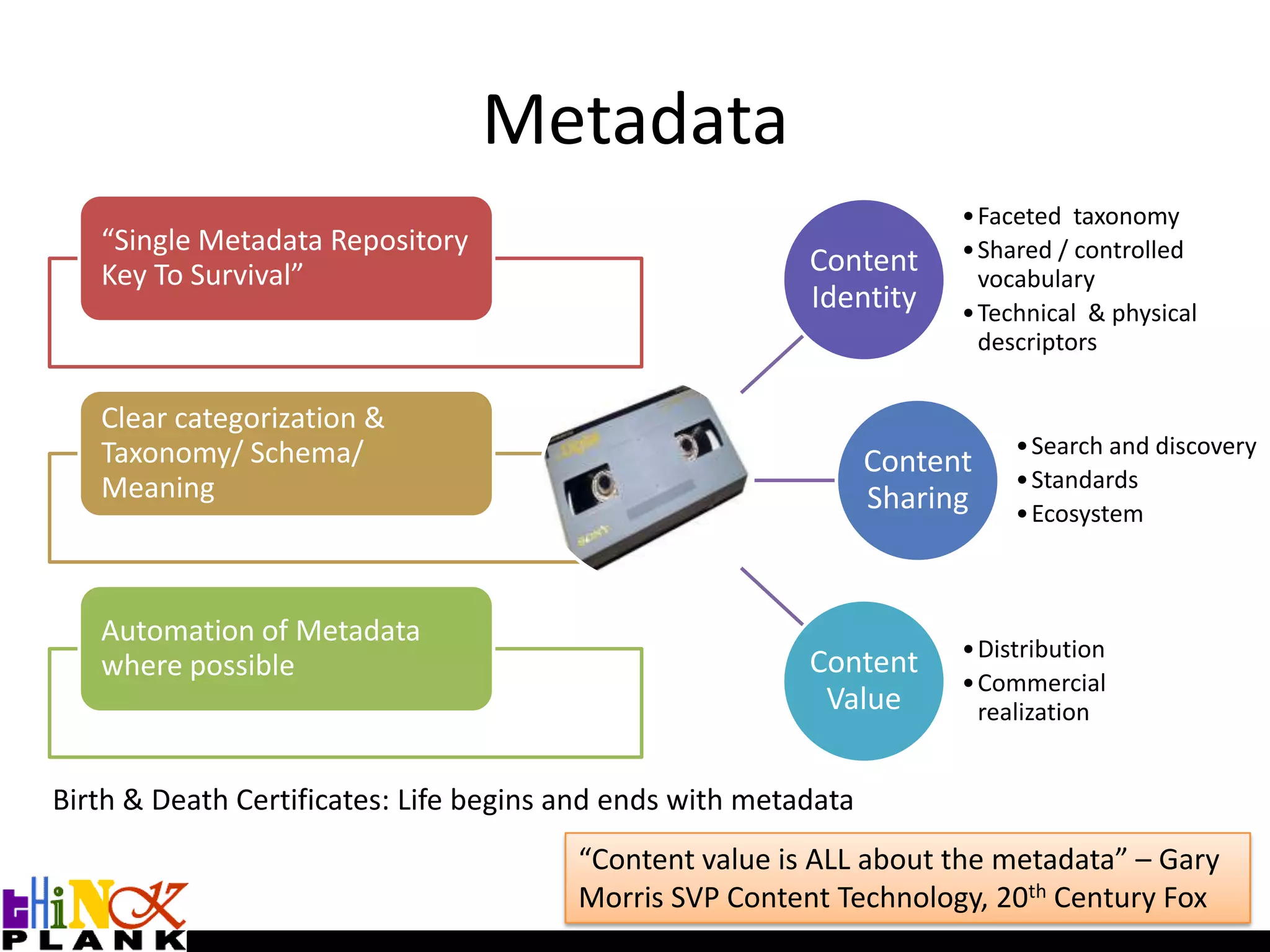

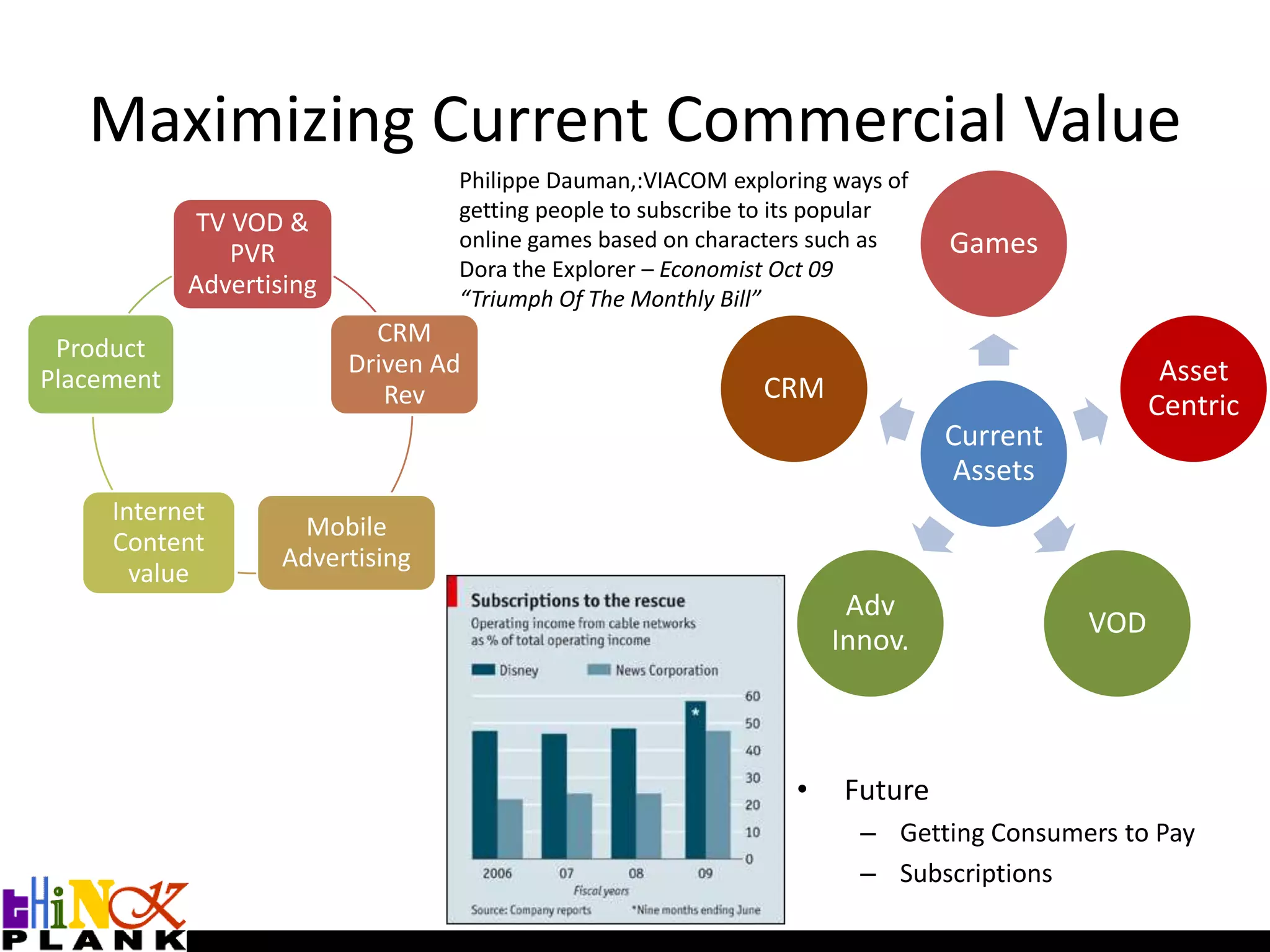

The document discusses the transformative changes in the broadcasting industry over the next five years, highlighting the shift from traditional business models to asset-based valuation and the growing influence of digital platforms and consumer behavior. Key challenges include the erosion of advertising revenue and the need for broadcasters to adapt to a multi-screen and connected environment. It calls for a focus on innovative revenue streams, improved content management, and understanding audience engagement to remain competitive.