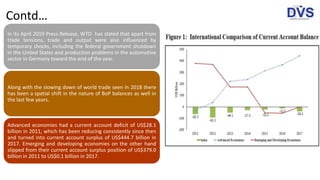

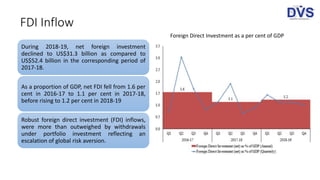

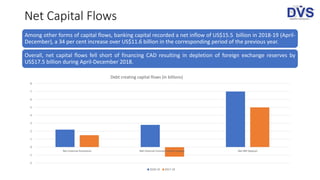

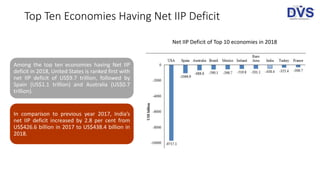

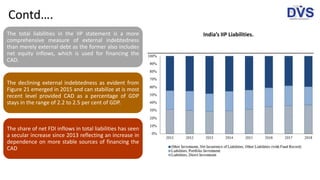

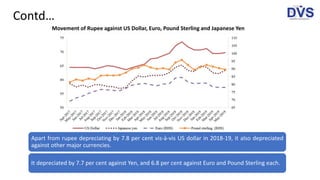

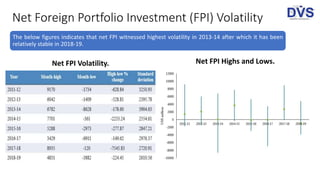

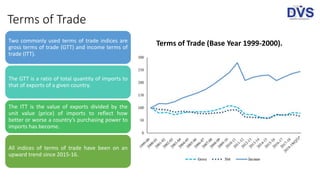

The external sector of India's economy remains stable, though the current account deficit is projected to widen to 2.4% of GDP in 2018-19 due to a deterioration in the trade deficit. Rising crude oil prices and a decline in export growth have contributed to the worsening trade deficit. The income terms of trade, a measure of import purchasing power, has been rising, possibly because export price growth has exceeded crude price growth. Foreign exchange reserves declined by $17.5 billion during April-December 2018 due to a shortfall in capital inflows relative to the current account deficit.