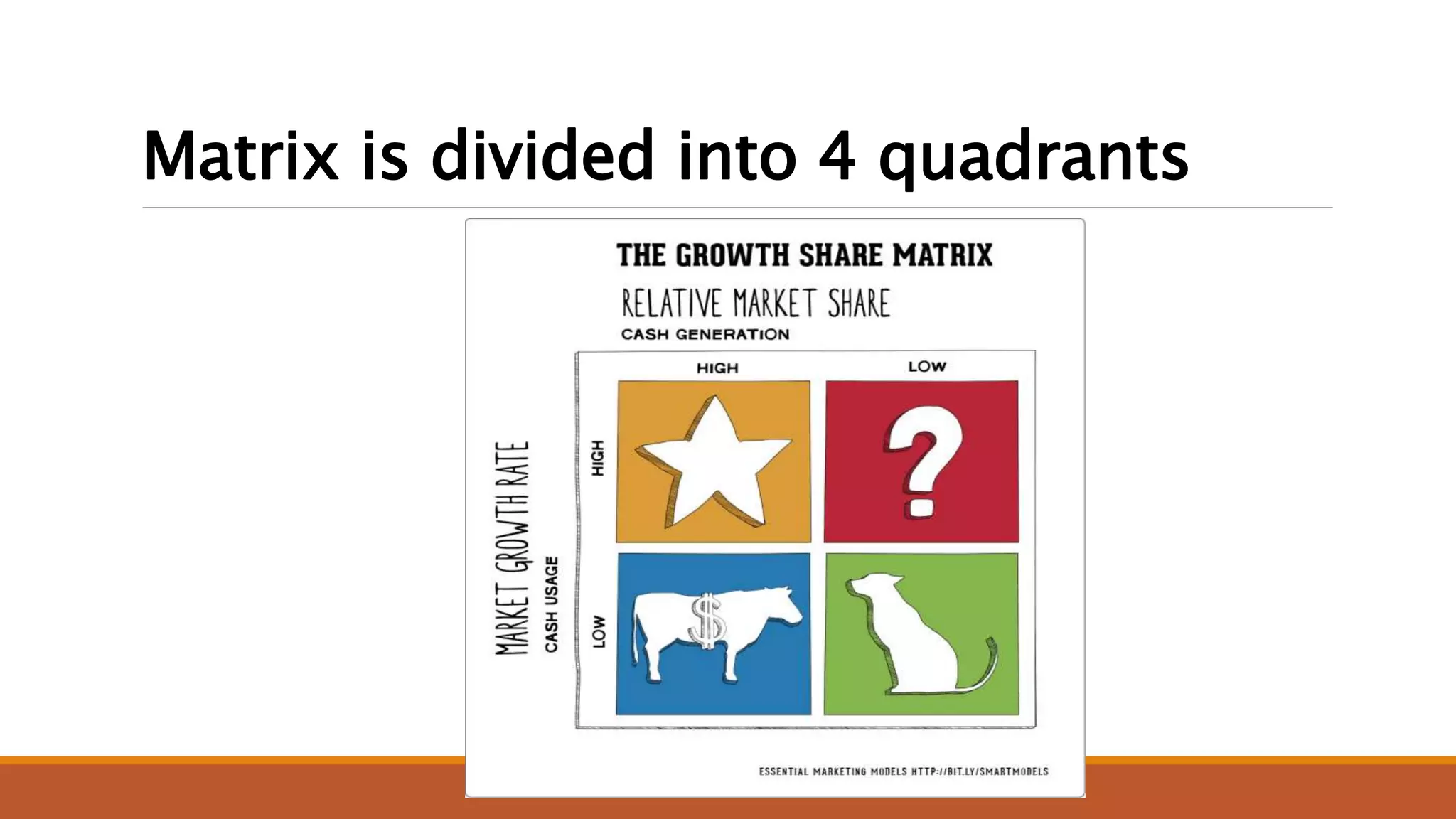

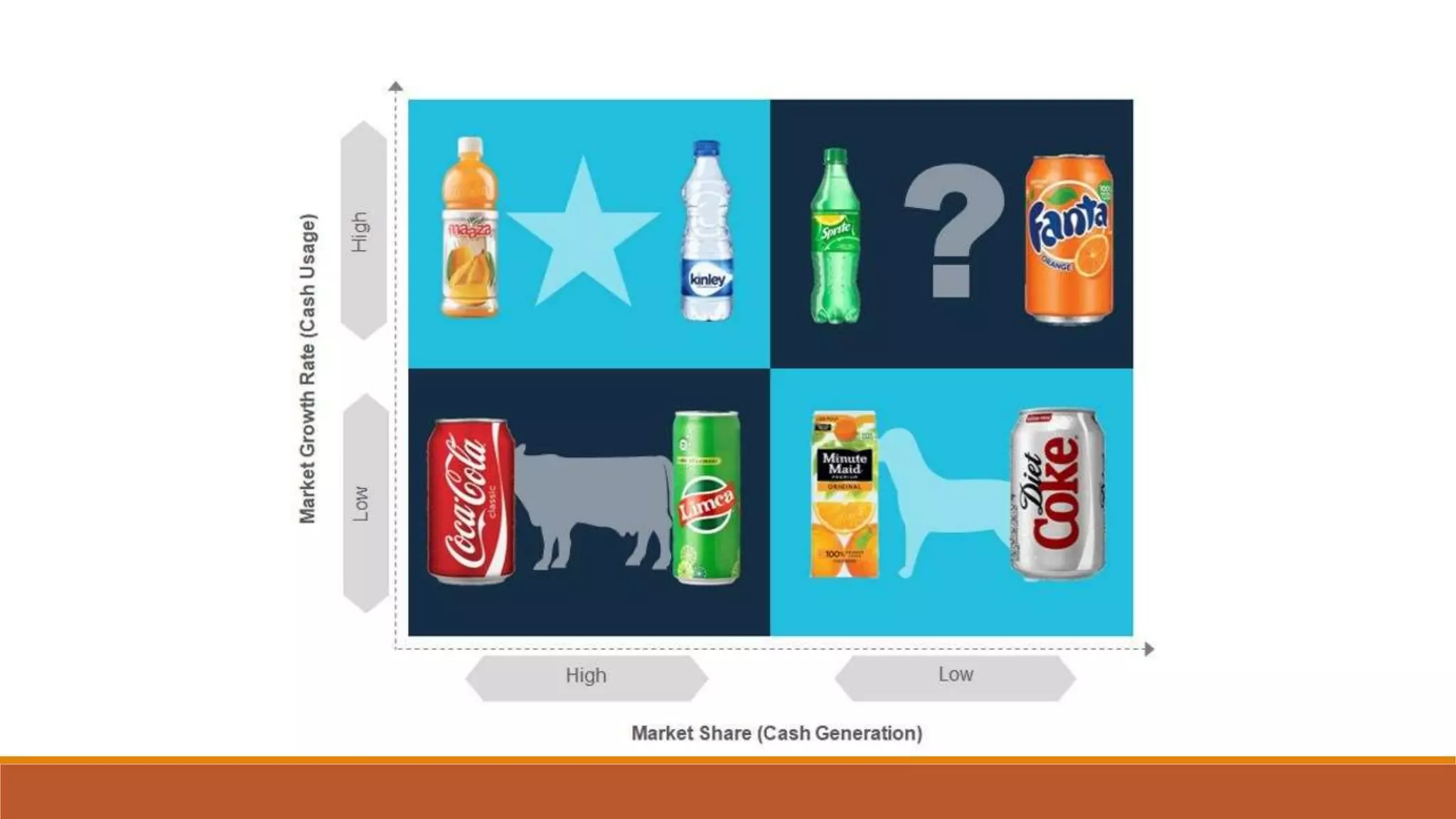

The BCG matrix, developed in the early 1970s by Bruce Henderson, is a strategic tool for businesses to analyze their product portfolios by categorizing them into four quadrants: Stars, Question Marks, Cash Cows, and Dogs, based on market growth and market share. Each quadrant represents different resource allocation needs and growth potential, with Stars requiring investment for growth, Cash Cows generating cash with minimal investment, Question Marks needing significant resources to increase market share, and Dogs generally being inefficient or losing value. However, the model has limitations, as it oversimplifies business valuations and does not consider other factors influencing profitability.