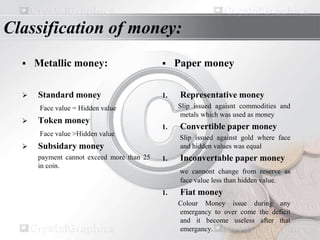

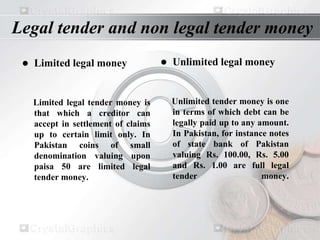

The document outlines the evolution and functions of money, detailing its progression from barter systems to commodity money, paper money, demand deposits, and e-money. It classifies money into various categories, such as metallic and paper money, and discusses legal tender versus non-legal tender. Furthermore, it highlights the primary and secondary functions of money, including its role as a medium of exchange and a store of value.