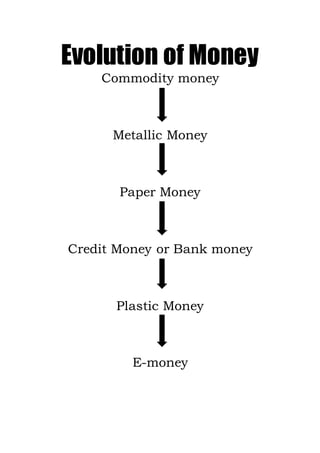

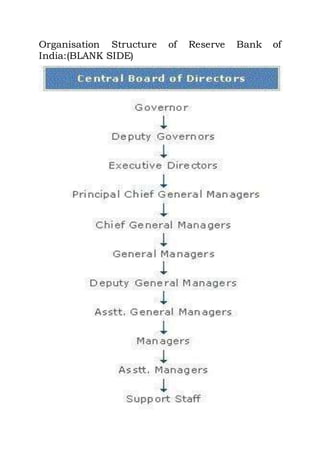

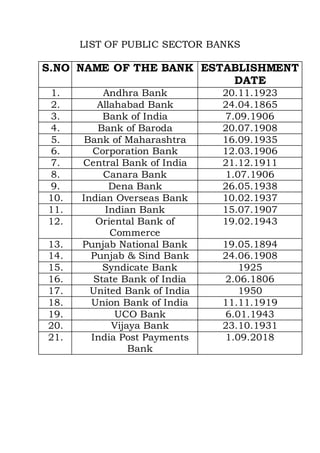

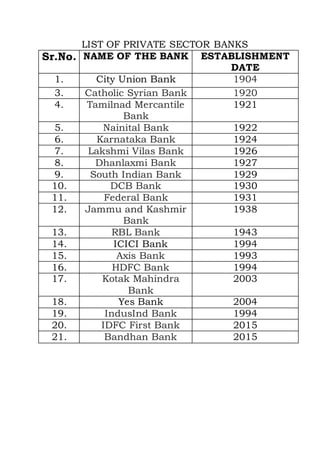

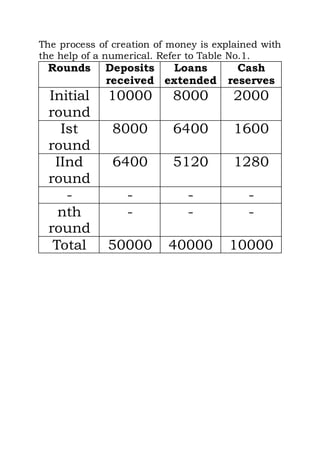

This document is an economics project by Akshita Grover on 'Money and Banking', acknowledging the guidance of her teacher Mr. Bhavin Oza and support from family and friends. It covers the evolution, types, and functions of money, the banking system's role in the economy, and details about India's central bank and commercial banks. Key concepts include the barter system, the progression of money forms, and the money creation process by commercial banks.