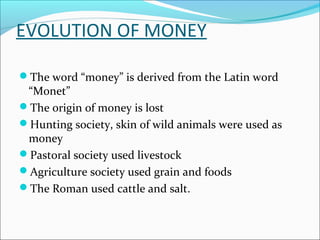

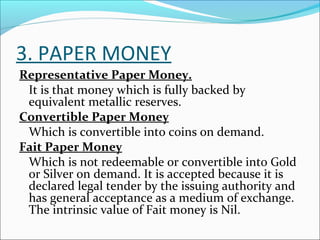

The document discusses the evolution of money, beginning with its origins in early societies and the transition from barter systems to various forms of currency. It outlines the progression from commodity money to metallic, paper, credit, and finally electronic money, highlighting the advantages and challenges of each stage. Essential characteristics of money, such as general acceptability, stability of value, and divisibility, are also mentioned.