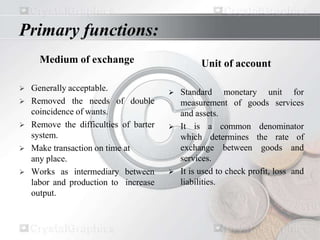

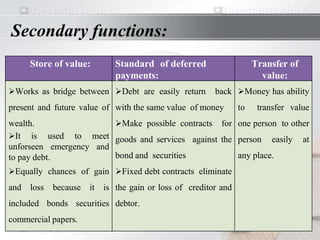

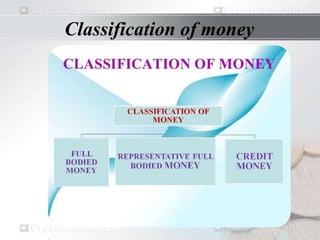

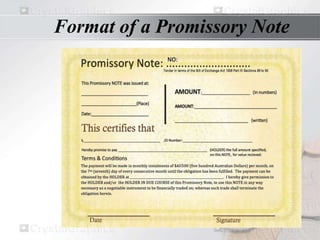

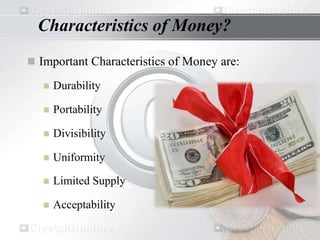

This document provides an overview of money and banking concepts. It defines money's primary functions as a medium of exchange and unit of account, and secondary functions as a store of value, standard for deferred payments, and means to easily transfer value. Money is classified as full-bodied, representative full-bodied, and credit money based on the relationship between its value as money and commodity value. Representative money includes convertible and inconvertible paper money. Credit money encompasses token coins, representative token money, circulating promissory notes, and demand deposits in banks. Key terms and characteristics of money are also introduced. The next session will cover characteristics of money in more detail.