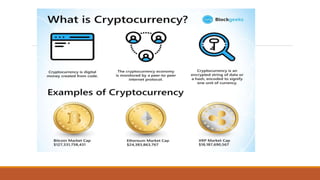

The document outlines the evolution of money from commodity money, such as salt and wheat, to metallic coins, paper money, and eventually to plastic and electronic forms of currency, including cryptocurrencies. It discusses the essential characteristics and functions of money, emphasizing its role as a medium of exchange, unit of value, and store of value, among other functions. Additionally, it highlights the theories of demand for money based on its various functions within trade and economics.