The document summarizes the key aspects of the Employees' State Insurance Act of 1948 in India. It discusses who the act applies to, how it is administered, and what benefits it provides. Specifically, it covers that the act: 1) Applies to factories employing 10 or more power-using employees or 20 or more non-power using employees; 2) Is administered by the Employees' State Insurance Corporation; and 3) Provides sickness, maternity, disability, dependents, medical, and funeral benefits for covered employees and their families.

![:- Definitions

Employee : refers to any person employed on wages in, or in

connection with, the work of a factory or establishment to which

this Act applies.

It has a wide connotation and includes clerical, manual, technical,

and supervisory functions. Persons whose monthly salary

[excluding overtime] does not exceed RS. 10,000/- are included

under the Act.

Wages : means all remuneration paid in cash when the terms of

the contract are fulfilled. Wages paid for leave period are included

but

Contribution paid to PF or Pension Fund

Sum paid top defray expenses

Gratuity paid on discharge](https://image.slidesharecdn.com/a-181212150413/85/ESI-1948-8-320.jpg)

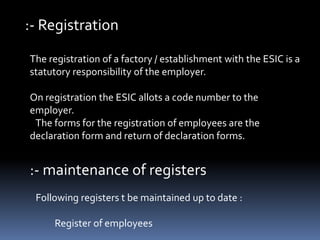

![Accident book to record each employment accident

Inspection Book

Certain forms have been prescribed under the Act and these are to

be filled up as &when required.

:- Administration

The scheme is administered by Employees State Insurance

Corporation [ESIC] a corporation formed under the Act with

membership from employees, employers, the parliament, the

state and central government and medical profession.

ESIC is responding for policy planning, decision making and

overseas the functioning of the scheme through a standing

committee drawn from the main corporation body.

Central Minster of Labor is ESIC chairman.](https://image.slidesharecdn.com/a-181212150413/85/ESI-1948-11-320.jpg)

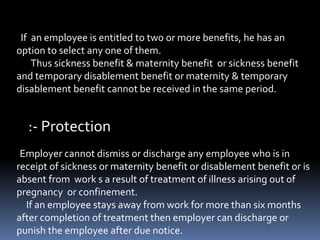

![:- Benefits

[a] Sickness and Extended Sickness Benefit

[b] Maternity Benefit

[c] Disablement Benefit

[d] Dependents’ Benefit

[e] Funeral Benefit

[f] Medical Benefit – Restricted, Extended and Full

Medical care

:- Restrictions

When a person is entitled to avail of one benefit, he shall not

be entitled to other benefits.](https://image.slidesharecdn.com/a-181212150413/85/ESI-1948-12-320.jpg)

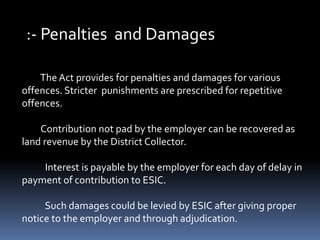

![:- Summary

The ESI Act applies to all power using factories employing

10 or more persons and to all non- power using factories

employing 20 or more persons.

Persons whose remuneration [including overtime] per

Month does not exceed RS. 10,000/- are covered under the

Act.

The scheme provides for sickness and extended sickness

benefit, maternity benefit, disablement, dependents’ benefit

, medical benefit, funeral benefit and s on.](https://image.slidesharecdn.com/a-181212150413/85/ESI-1948-18-320.jpg)