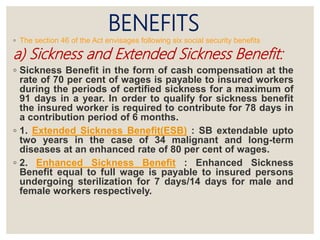

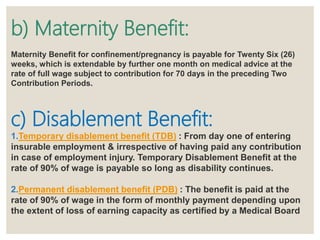

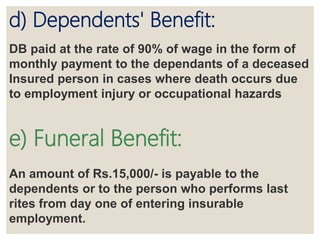

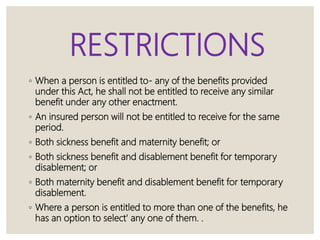

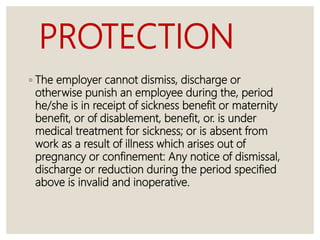

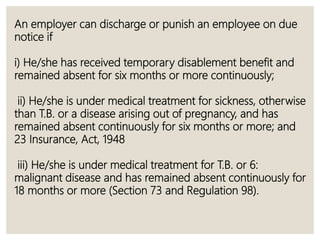

The Employees' State Insurance Act provides social security benefits like sickness, maternity, disability and medical benefits to employees in factories and other establishments. The scheme is administered by the Employees' State Insurance Corporation through regional and branch offices. Employers must register eligible factories and employees under the scheme and contribute funds along with deductions from employee wages. Benefits include cash payments for sickness, maternity leave and disabilities from work-related injuries. Medical care is also provided to insured employees and dependents.

![REGISTRATION

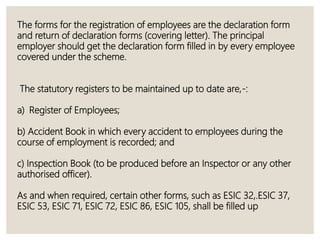

◦ The registration of a factory/establishment with the

Employees' State Insurance Corporation is a statutory

responsibility of the employer under Section 2-A of the

Act, read with Regulation10-B.

◦ The owner of a factory/establishment to which the Act

applies for the first time is liable to furnish to the

appropriate regional office, within 15 days after the Act

becomes applicable, a declaration of registration in Form

01.. On receipt of the 01 Form] the regional office will

examine the coverage; and after it is satisfied that the Act

applies-to the factory/establishment, will allot a code

number to the employer.](https://image.slidesharecdn.com/esiact1948-211118062831/85/Esi-act-1948-10-320.jpg)