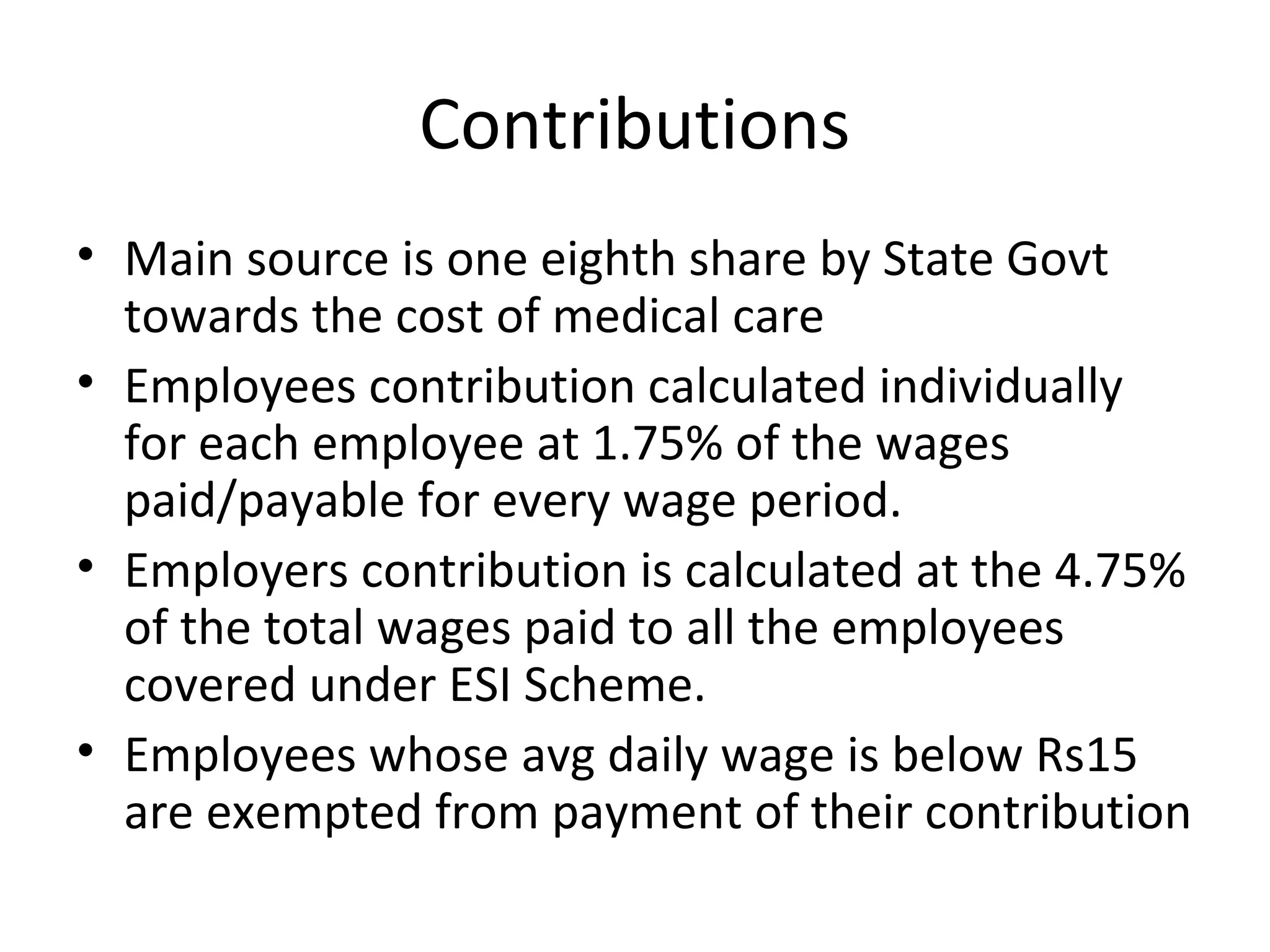

The Employees State Insurance Act of 1948 aims to provide social security benefits such as sickness, maternity, and disablement benefits to employees covered under the scheme. The act applies to various establishments employing a specified minimum number of persons and includes extensive provisions for registration, contributions, and administration by the Employees State Insurance Corporation. Key benefits include medical treatment, funeral expenses, and protective measures against employer retaliation during periods of benefit receipt.