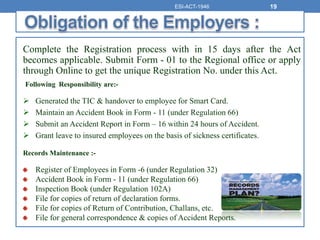

The document provides an overview of the Employees' State Insurance Act of 1948 in India. Some key points:

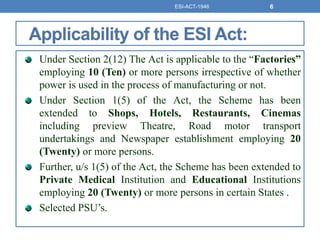

- The ESI Act established a social insurance program to provide sickness, maternity, disability and death benefits to employees in India.

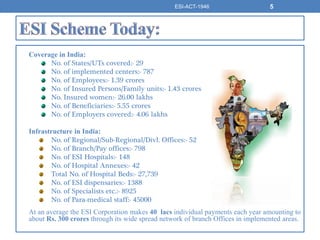

- It covers over 1.39 crore employees across 29 states/UTs and provides benefits through a network of hospitals, dispensaries and other facilities.

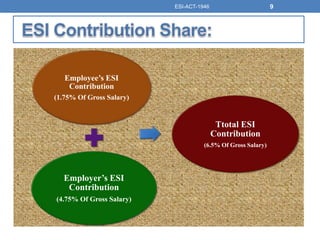

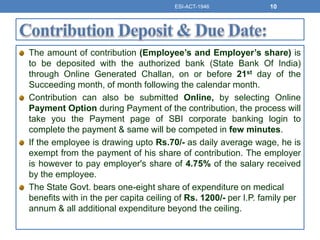

- The program is funded through mandatory contributions of 1.75% of wages by employees and 4.75% by employers.

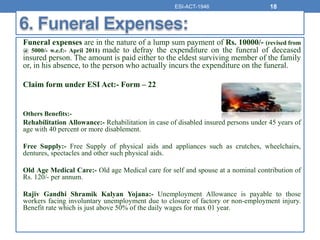

- It provides medical benefits, cash benefits for sickness, maternity and disability, dependents benefits for family, and funeral expenses.