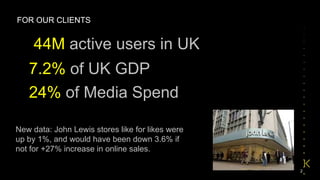

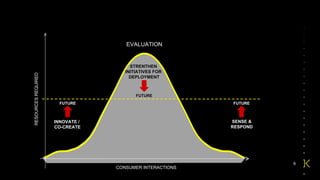

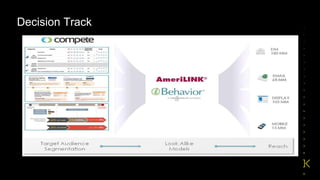

This document discusses digital connections and consumer insights. It notes that 44 million people in the UK are active online users, accounting for 7.2% of GDP and 24% of media spending. It also mentions that John Lewis stores saw a 1% increase in like-for-like sales but would have seen a 3.6% decrease without a 27% rise in online sales. The document lists various online video sources and platforms for collecting consumer data. It provides an overview of Kantar's approach to collect, connect, and speed insights and some examples of its RapidView panels around the world to study consumer behavior.