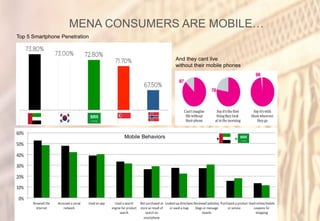

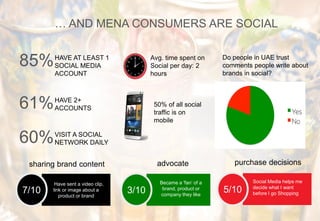

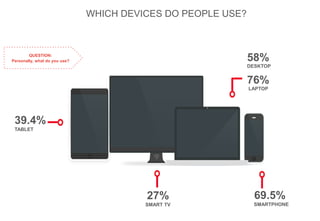

1) MENA consumers, especially in the UAE, are among the most connected globally, spending significant time daily on social media and using multiple devices.

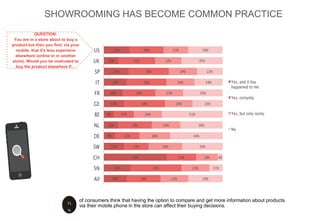

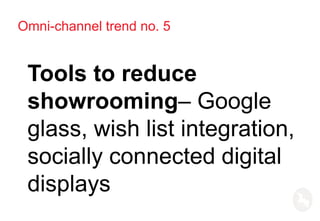

2) Researching products online and purchasing offline is common, and showrooming has become a widespread practice.

3) Consumers heavily rely on peer reviews and opinions when making purchase decisions, more so than expert opinions.

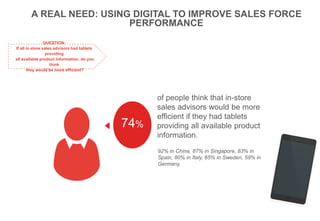

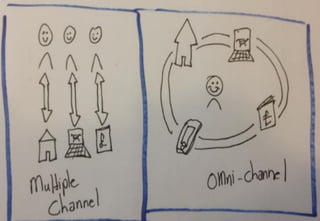

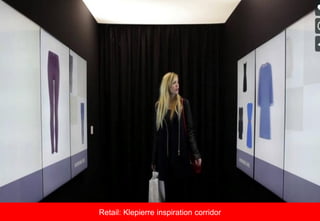

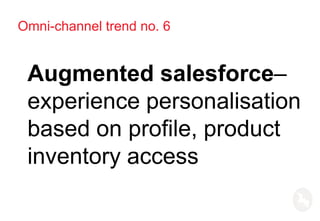

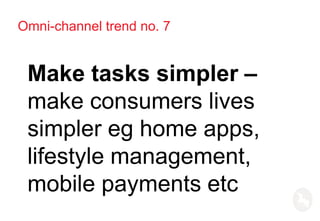

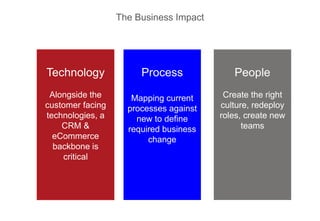

4) To better serve digitally savvy customers, businesses need to create seamless omni-channel experiences, equip salespeople with digital tools, and customize experiences based on consumer profiles and behaviors.