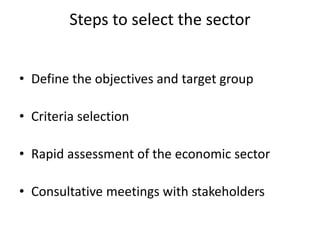

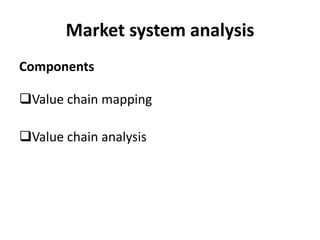

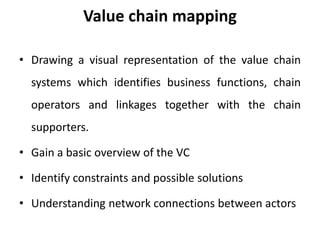

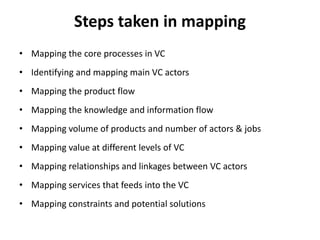

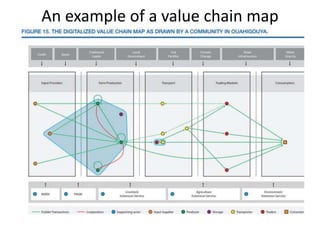

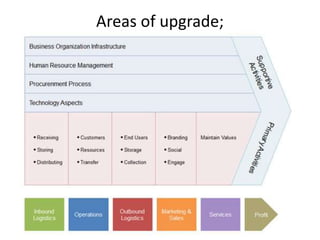

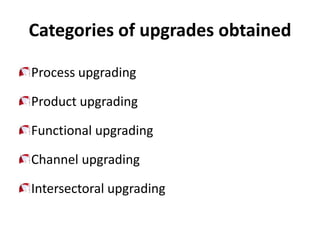

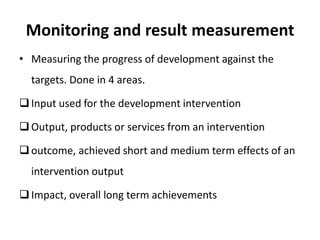

The document discusses value chain development processes. It defines a value chain as the range of activities involved in producing, marketing, and consuming a specific product. Value chain development aims to improve these activities through upgrades. The key steps are selecting a sector, mapping and analyzing the value chain, designing interventions, implementing upgrades, and monitoring results. Upgrades can include improvements to production processes, products, functions within the chain, marketing channels, or moving to new sectors. The document also discusses approaches and constraints to value chain development.