Enron rose rapidly in the 1980s and 1990s through aggressive accounting practices and trading of energy contracts. However, by 2001 it began collapsing under the weight of hidden debts and losses, revealed through the use of special purpose entities and misleading financial reports approved by its auditor, Arthur Andersen. The bankruptcy of Enron in late 2001 resulted in billions lost for investors and employees and led to reforms through the Sarbanes-Oxley Act to increase transparency in corporate accounting.

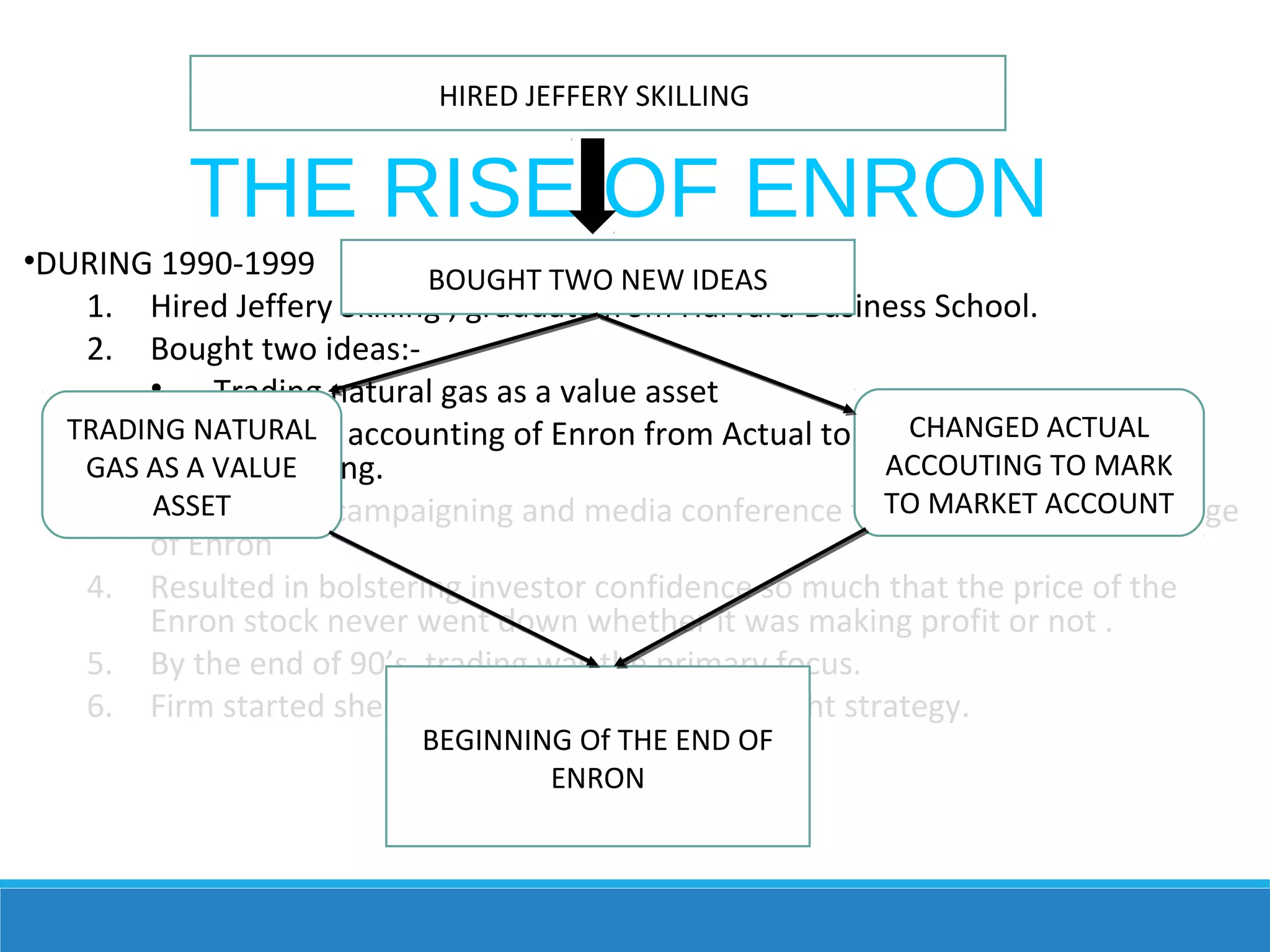

![ARTHUR ANDERSON AND

ENRON

[RISKY BUSINESS]

Arthur Andersn LLP and David B. Ducan , who

oversaw Enron’s account were the major players in

the scandal.

Arthur Anderson was one the largest accounting

firm in the US during that time.

Ignoring Enron’s malpractices, it offered its stamp of

approval, which was enough for investors and

regulators alike for a while.

Which included approval for many subsidiaries like

raptor and condor.

Received $52 million in 2001, mainly for non audit

related consulting services.](https://image.slidesharecdn.com/auditingpresentation-170404043518/75/ENRON-SCANDAL-11-2048.jpg)

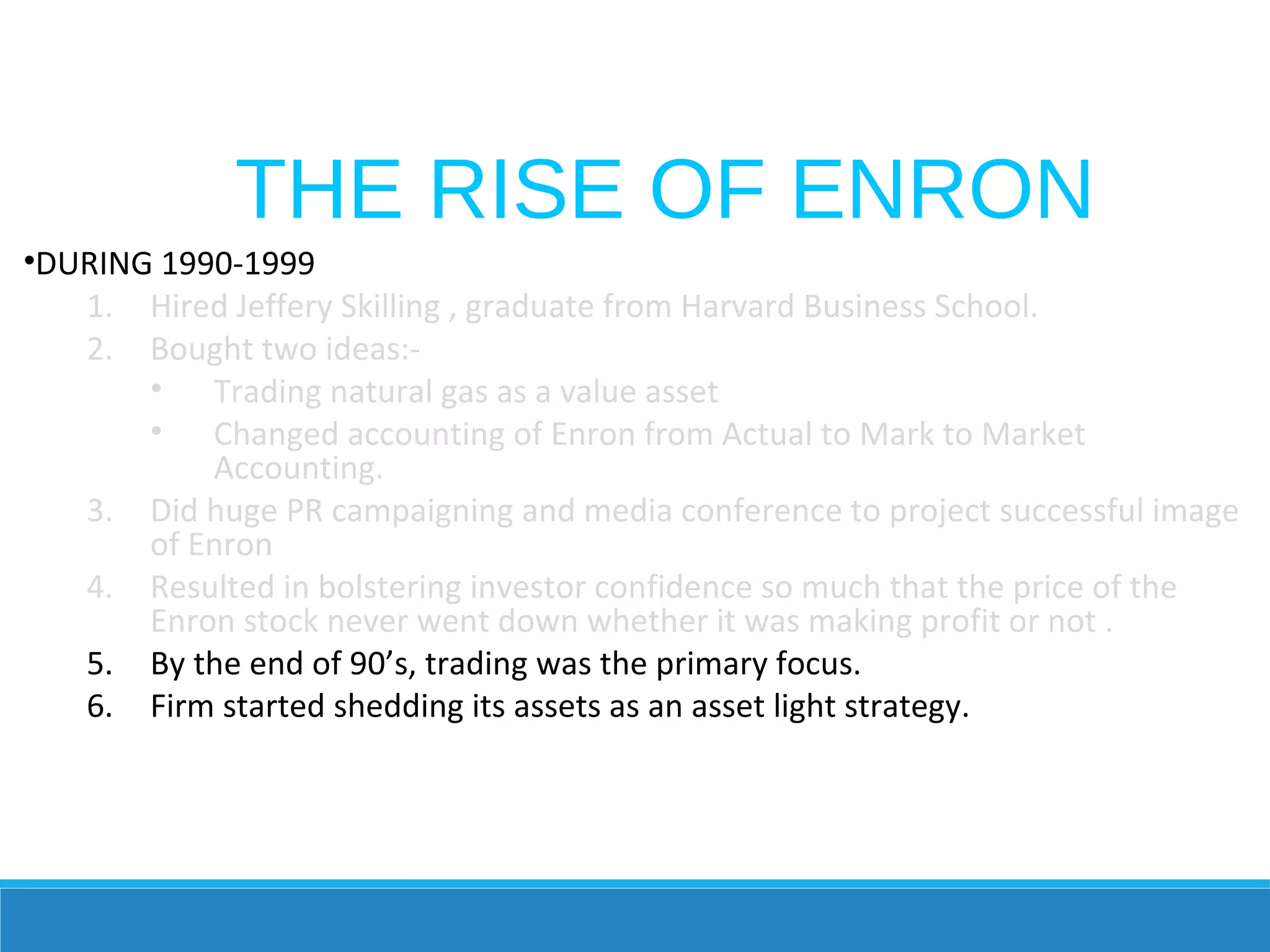

![Stock heading South

•Oct 22 – Enron announces , its facing SEC [Security and

Exchange Commission] probe. Shares fall further to around

$20.75 that day.

•8th

Nov, 2001 – Told investors that they were restating

earnings for past 4 and ¾ years and admits its inflated its

income by around $586 million since 1997.

•By end of Nov, 2001 stock reached $0.3 falling from its peak

price $90 in just 8 months.

•2nd

Dec, 2001 – Filed Bankruptcy.](https://image.slidesharecdn.com/auditingpresentation-170404043518/75/ENRON-SCANDAL-13-2048.jpg)