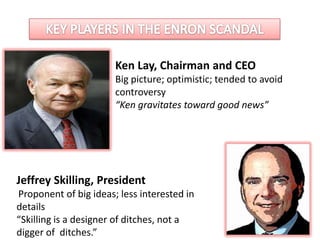

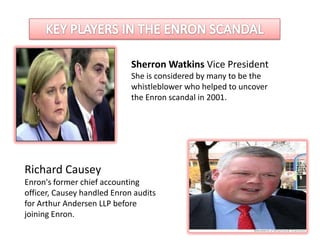

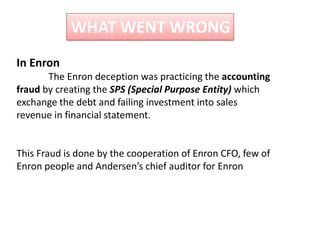

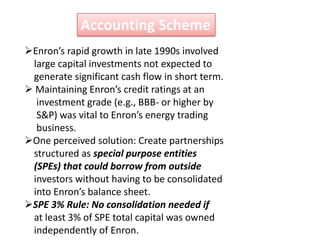

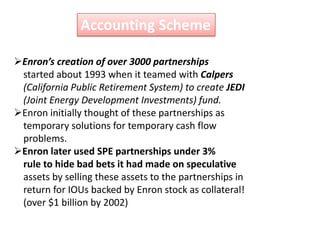

This document outlines key people involved in the Enron scandal and what went wrong. It describes Ken Lay as the optimistic CEO who avoided controversy, and Jeffrey Skilling as a proponent of big ideas less interested in details. It notes Arthur Andersen violated public accounting practices by auditing Enron internally and externally. The main causes of Enron's collapse are described as deception through off-balance sheet entities used to hide debts and losses, and a complex accounting scheme involving thousands of partnerships to inflate profits and hide risks.