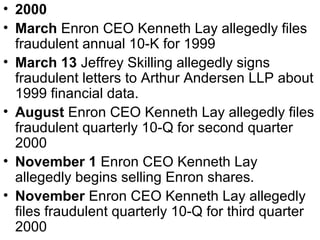

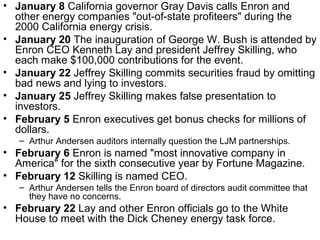

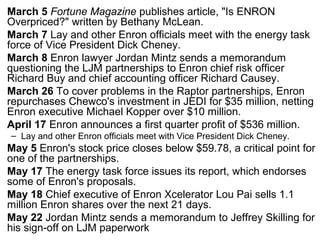

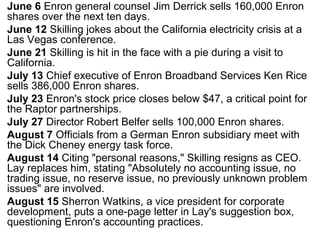

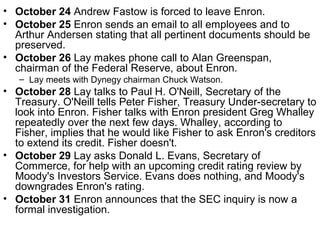

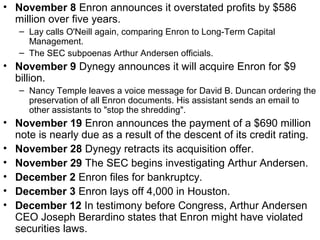

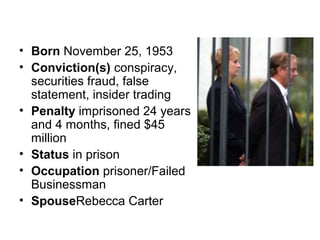

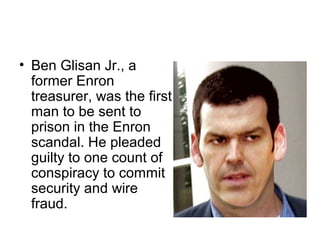

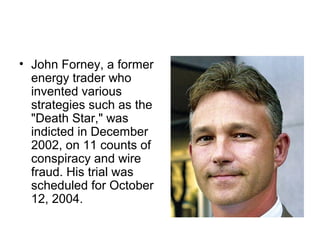

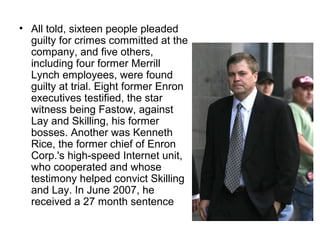

The document provides details on the Enron scandal, including profiles of key individuals involved and a timeline of events. It describes how Andrew Fastow committed fraud starting in 1996 through creating off-book entities at Enron. The scandal unraveled in 2001 with Enron having to restate earnings and eventually declaring bankruptcy in November 2001. Many individuals were later charged and convicted for their roles in the fraudulent accounting practices. Arthur Andersen was also convicted for shredding Enron documents.

![• 1996

• CFO Andrew Fastow begins committing crimes by creating off-

book entities for personal enrichment. [1]

• 1997

• Andrew Fastow creates Chewco in an effort to hide debt and

inflate profits but Chewco doesn't meet requirements to keep it

off Enron's balance sheet.

• 1998

• Enron enters into several capital intensive ventures that turn

into financial disasters including a water distribution scheme

and power plants in Brazil.

• 1999

• Enron board of directors waive conflict of interest rules in order

to allow Andrew Fastow to run private companies that do

business with Enron. He creates LJM that buys poorly

performing Enron assets. In reality, LJM is used to hide debt

and inflate profits for Enron in order to prop up its stock price. It

is believed that this is the beginning of the complex and

questionable accounting practices that lead to Enron's demise](https://image.slidesharecdn.com/enron2-160420164730/85/Enron-2-12-320.jpg)