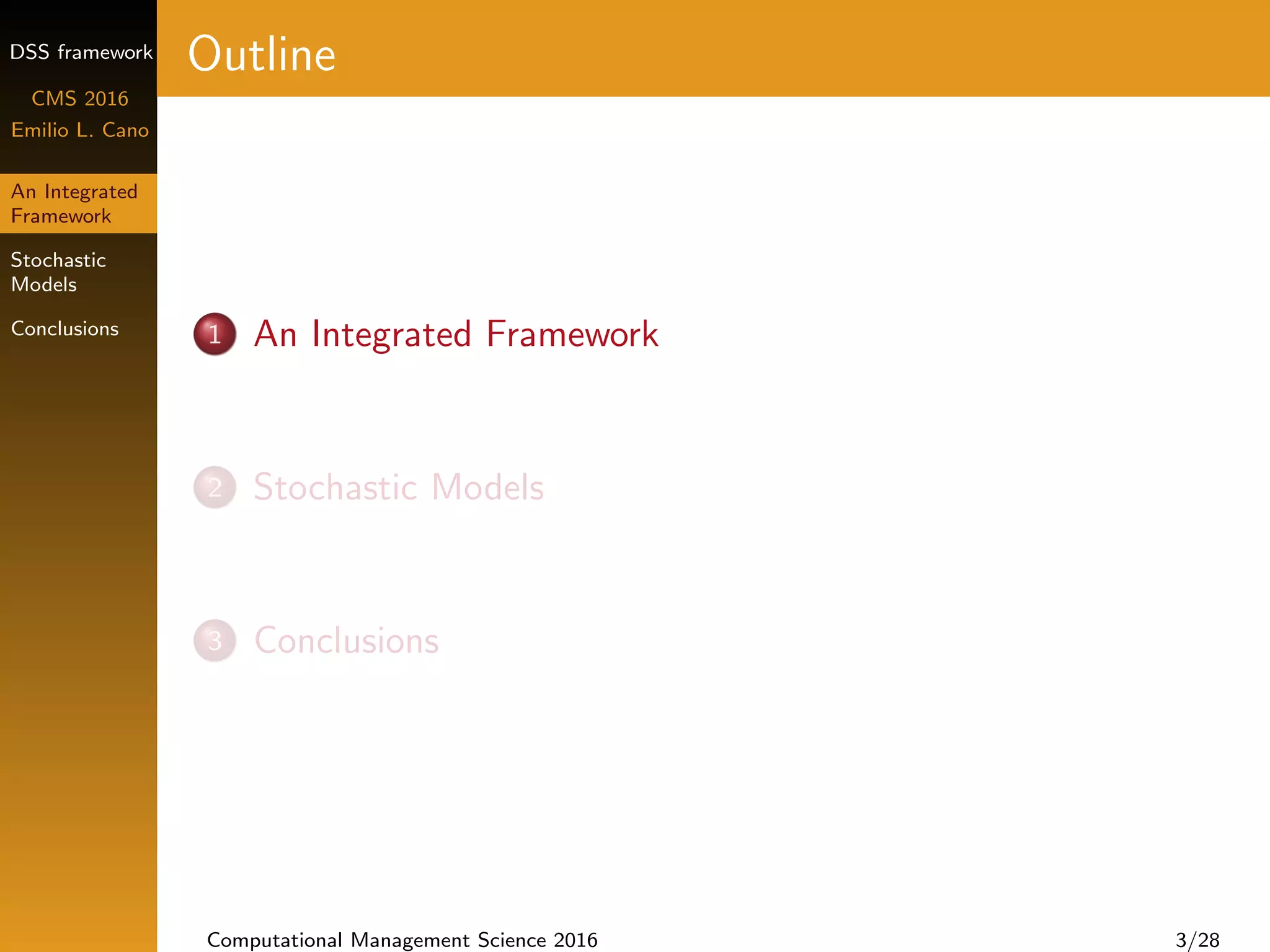

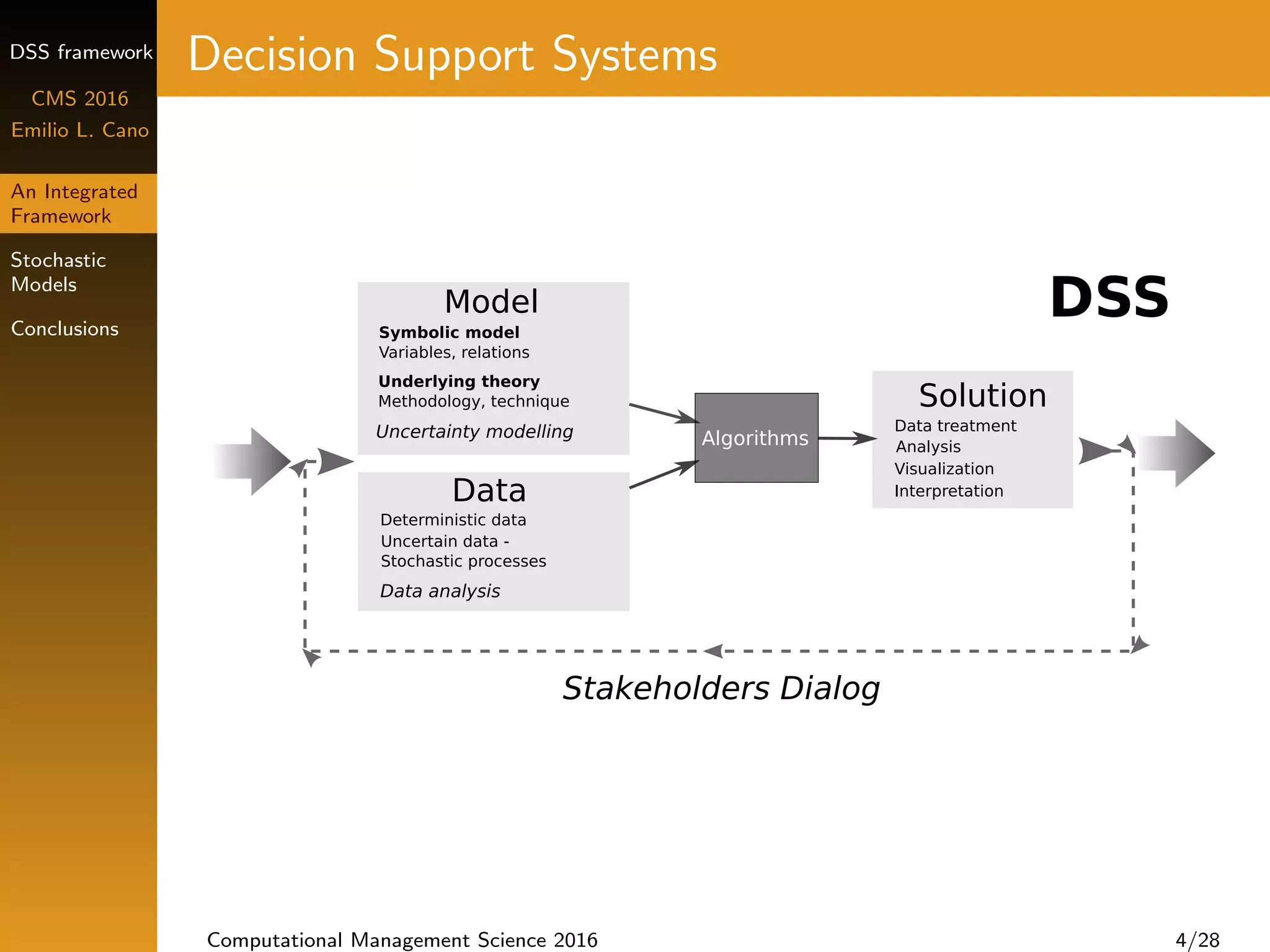

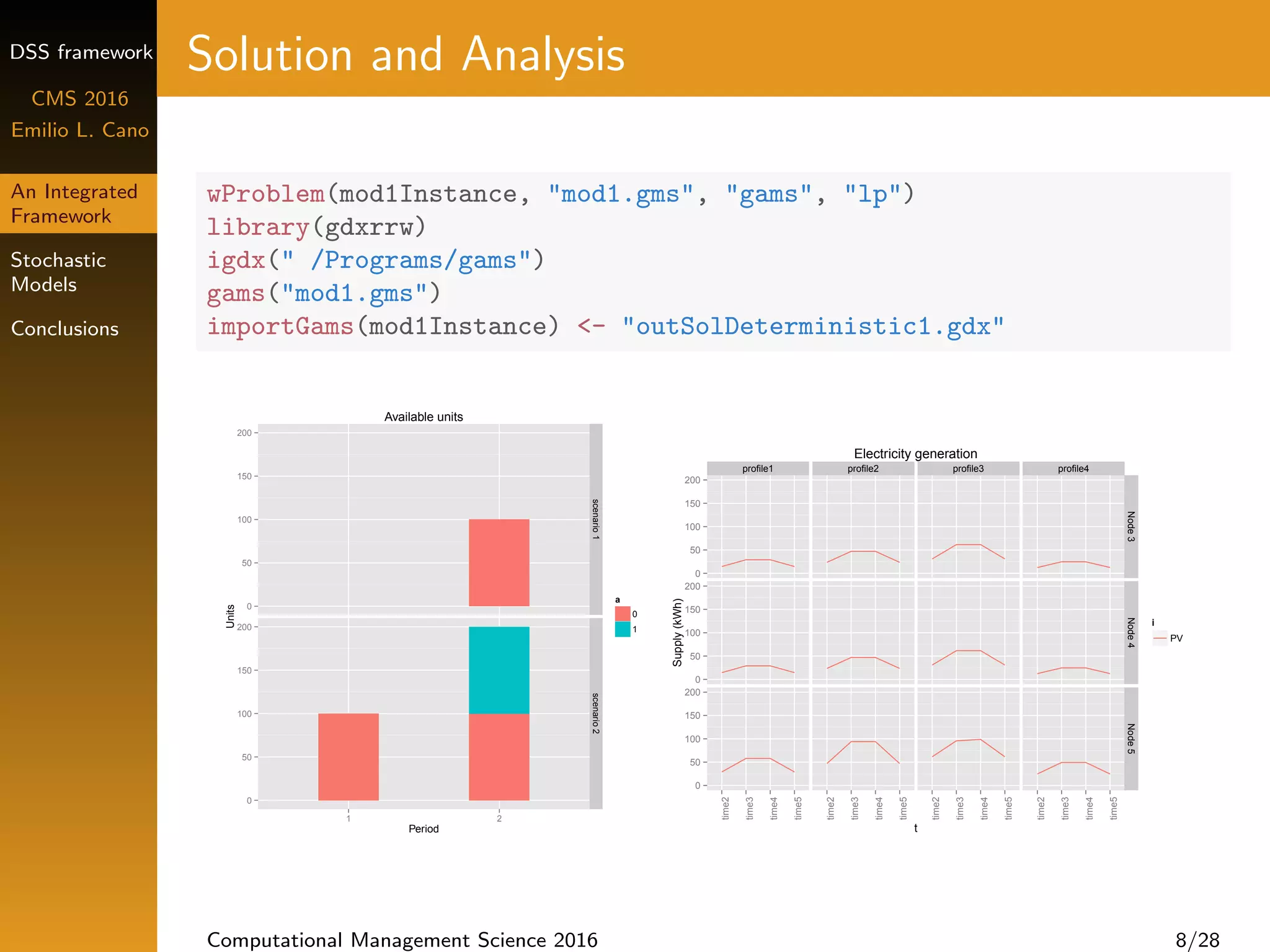

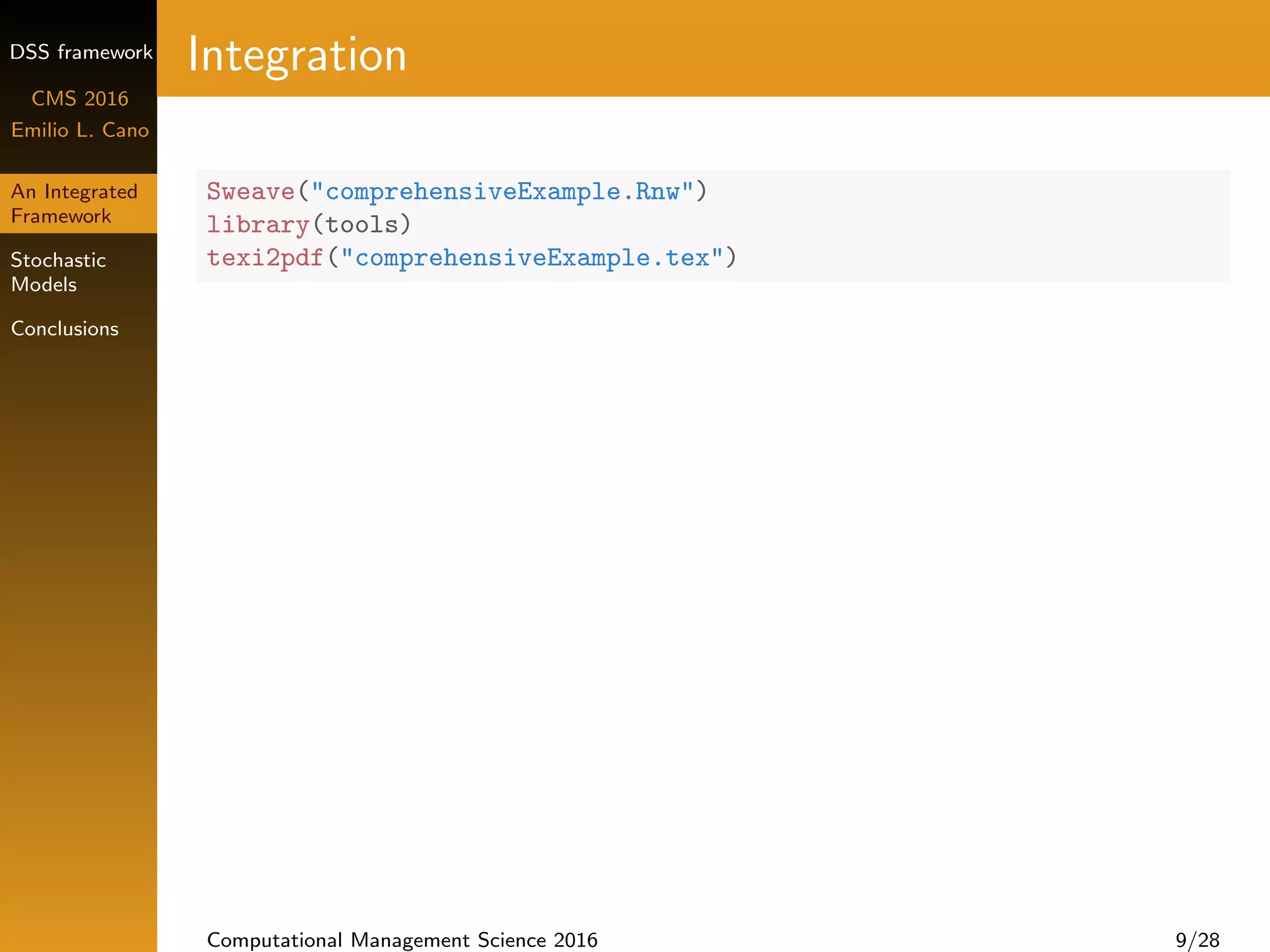

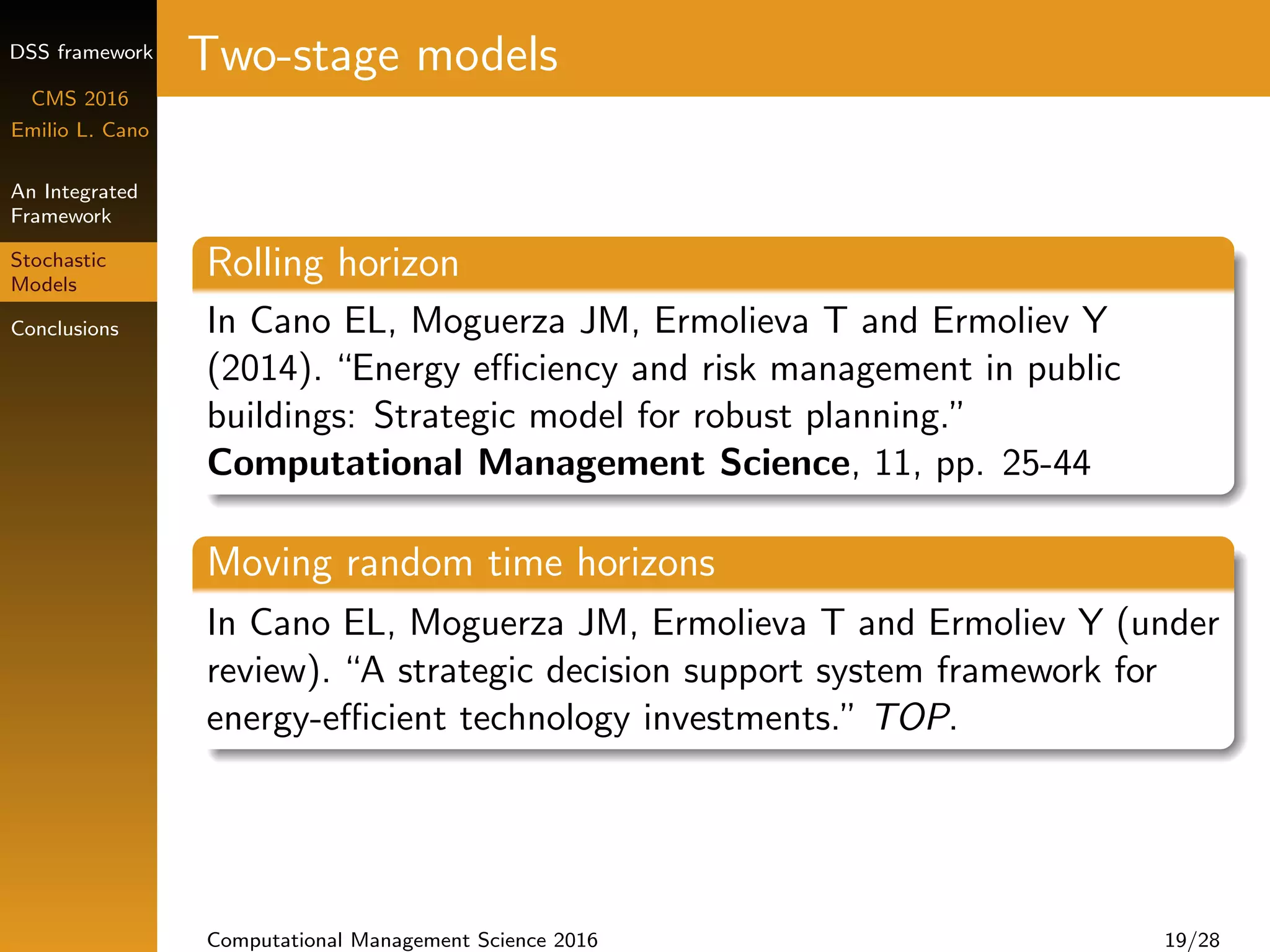

This document presents an integrated framework for decision support systems using R. It describes using R and related packages to represent stochastic energy optimization problems, generate input files for solvers, analyze results, and produce reproducible reports. Stochastic models are developed and solved within this framework. The framework allows statistical analysis, graphical output, model equations, solver inputs/outputs, and comprehensive reports to be combined for modeling, analysis, and stakeholder communication.

![DSS framework

CMS 2016

Emilio L. Cano

An Integrated

Framework

Stochastic

Models

Conclusions

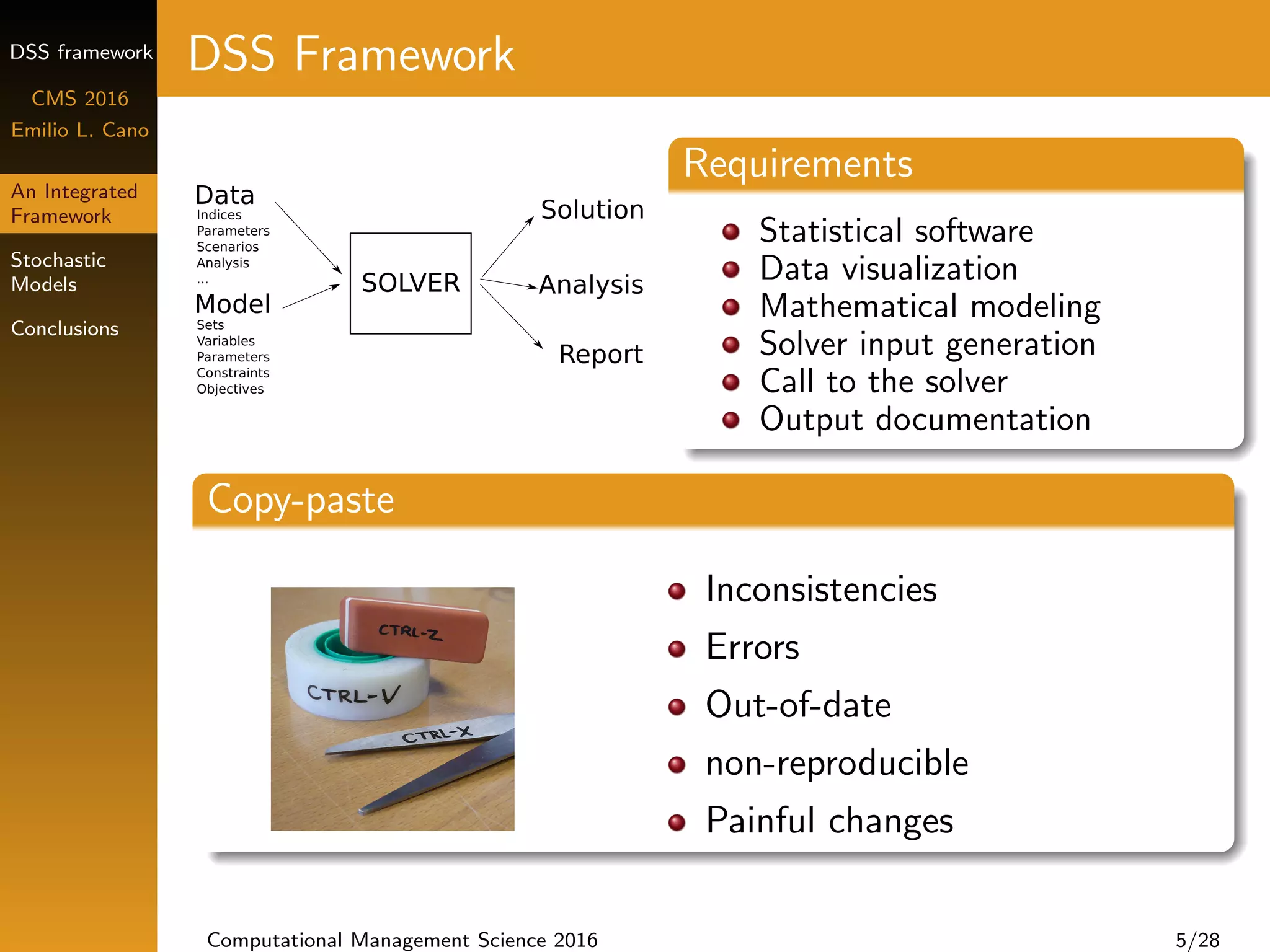

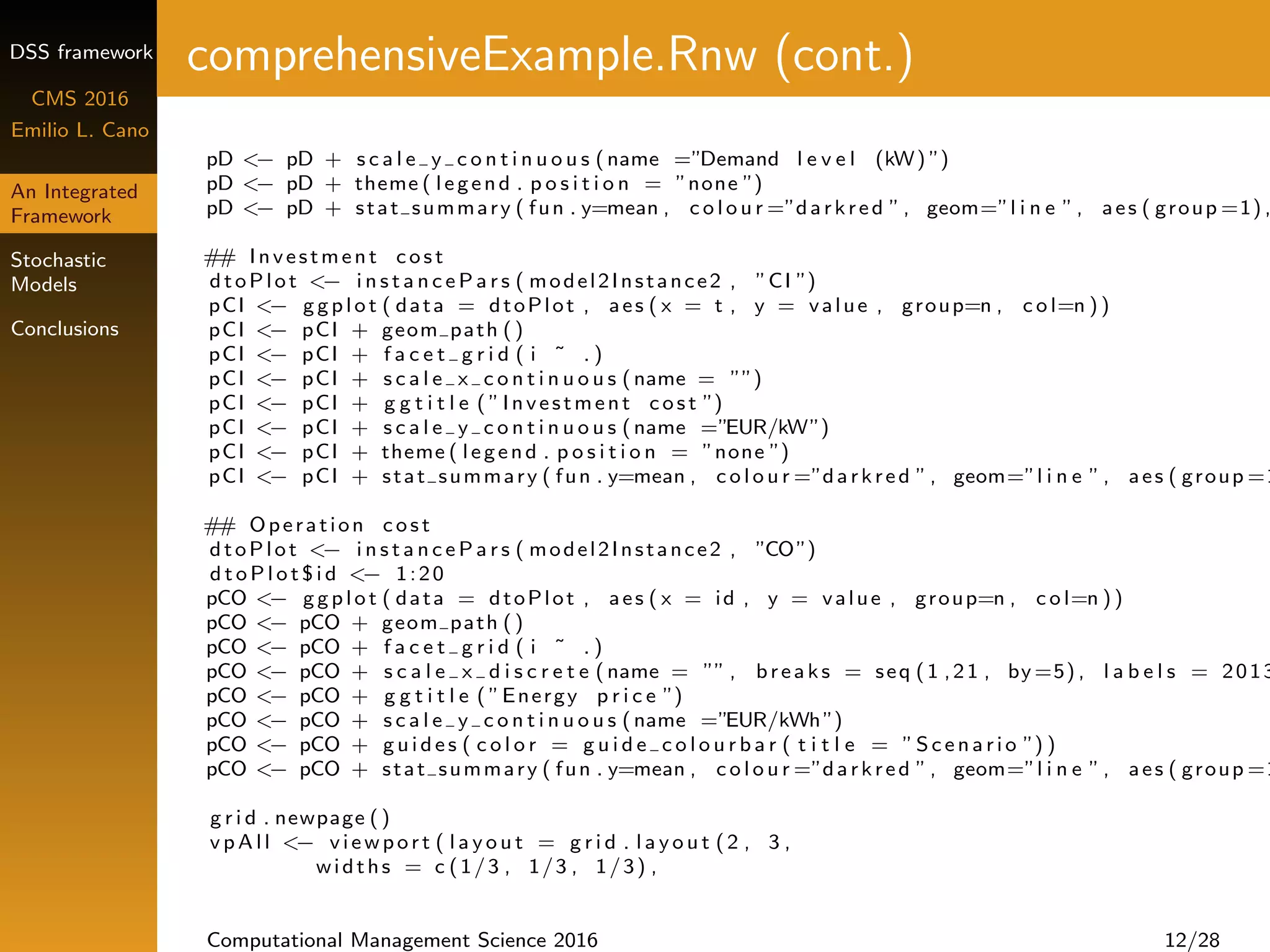

DSS Framework

Requirements

Statistical software

Data visualization

Mathematical modeling

Solver input generation

Call to the solver

Output documentation

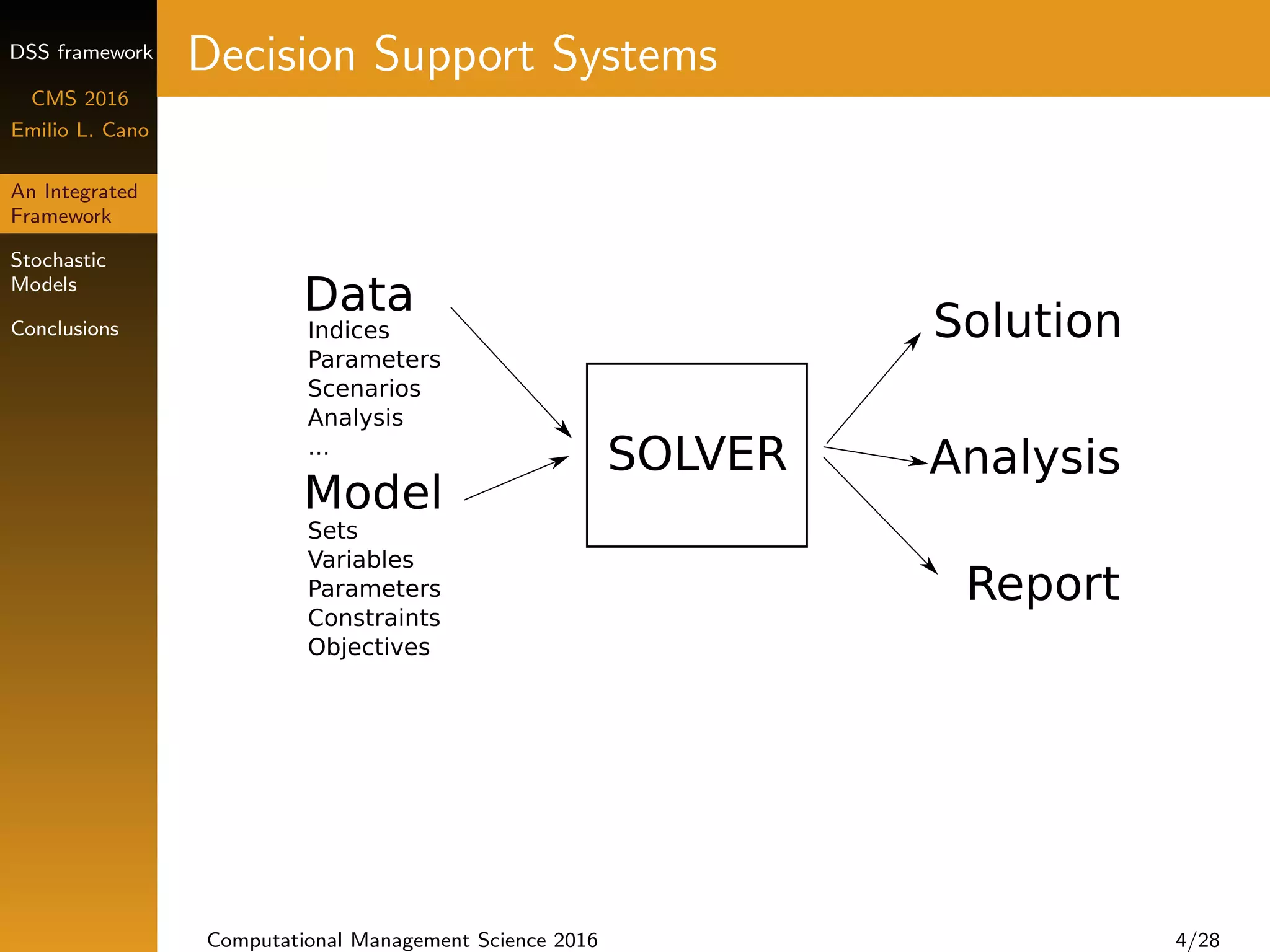

Framework

Reproducible Research & Literate Programming

omptimr R package & Algebraic Modeling Languages (AMLs)

“The goal of RR is to tie specific instructions to data analysis and

experimental data [and modeling] so that results can be recreated,

better understood and verified”

“LP: a document that is a combination of content and data analysis

code [and models]”

Computational Management Science 2016 5/28](https://image.slidesharecdn.com/elcanocms2016slides-160805093244/75/Energy-efficient-technology-investments-using-a-decision-support-system-framework-11-2048.jpg)

![DSS framework

CMS 2016

Emilio L. Cano

An Integrated

Framework

Stochastic

Models

Conclusions

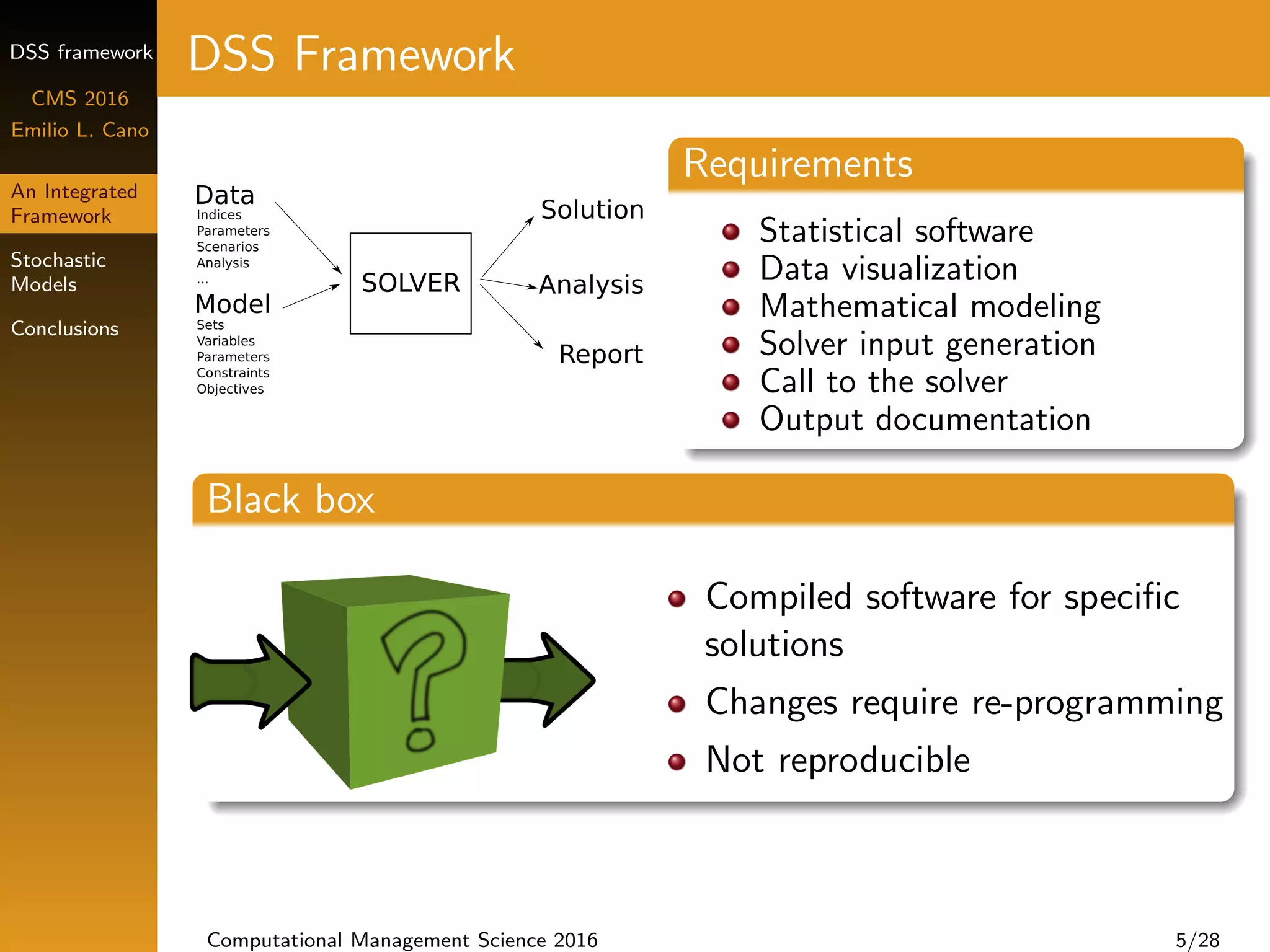

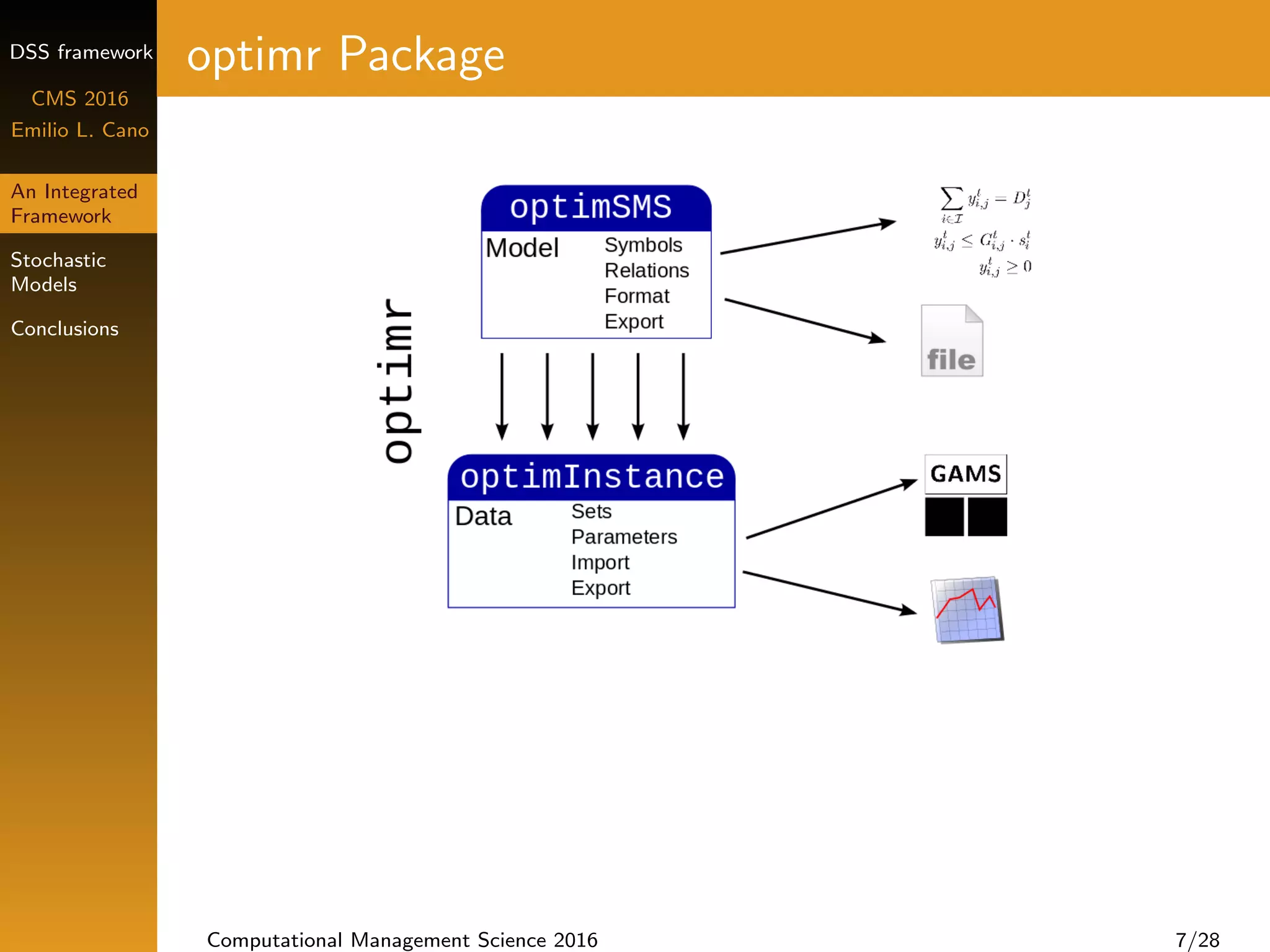

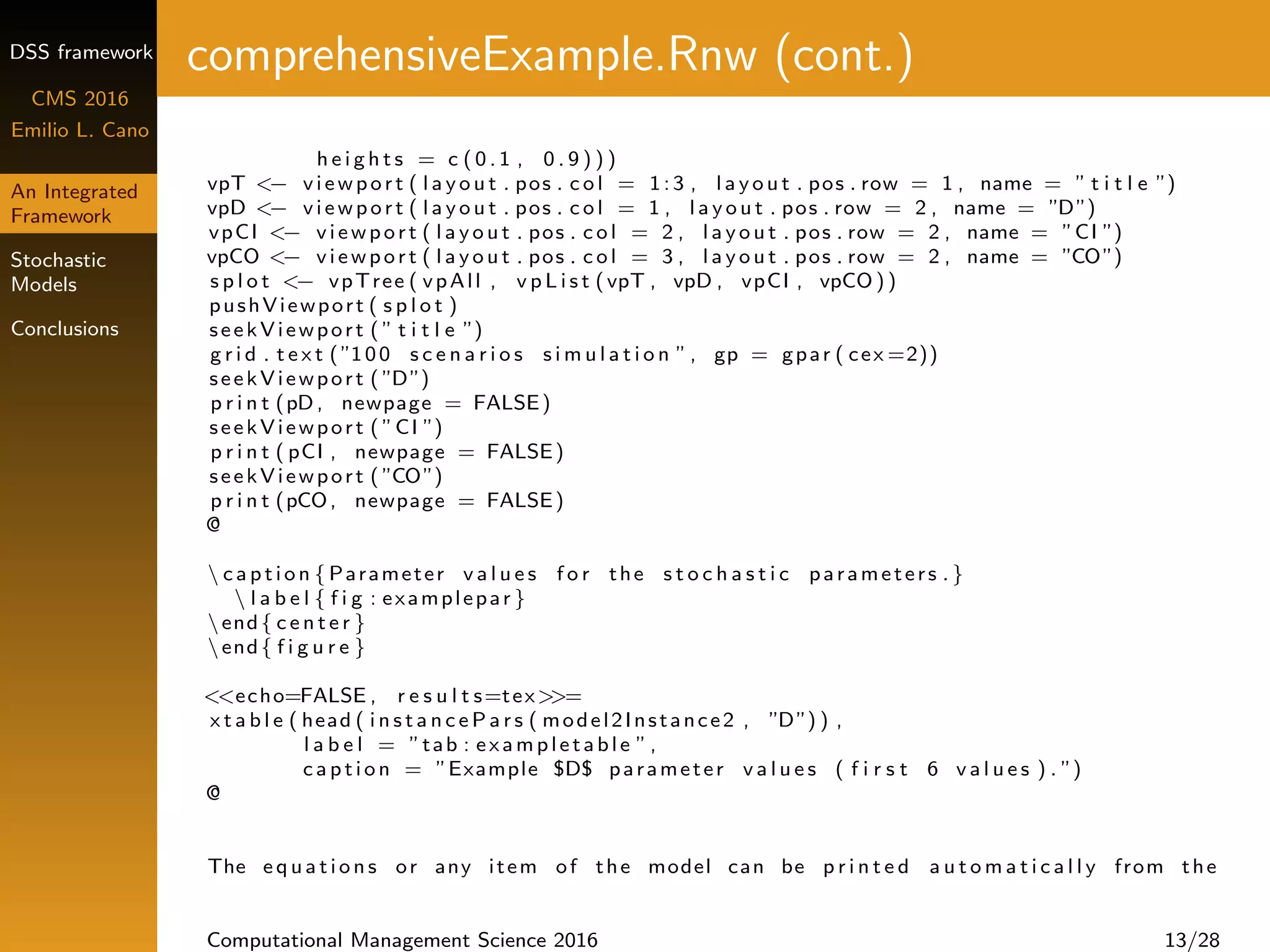

optimr Package

getEq(model1SMS, 4, format = "gams")

## [1] "eqDemand(j,t) ..nt Sum((i), y(i,j,t)) =e= D(j,t) n;n"

Computational Management Science 2016 7/28](https://image.slidesharecdn.com/elcanocms2016slides-160805093244/75/Energy-efficient-technology-investments-using-a-decision-support-system-framework-15-2048.jpg)

![DSS framework

CMS 2016

Emilio L. Cano

An Integrated

Framework

Stochastic

Models

Conclusions

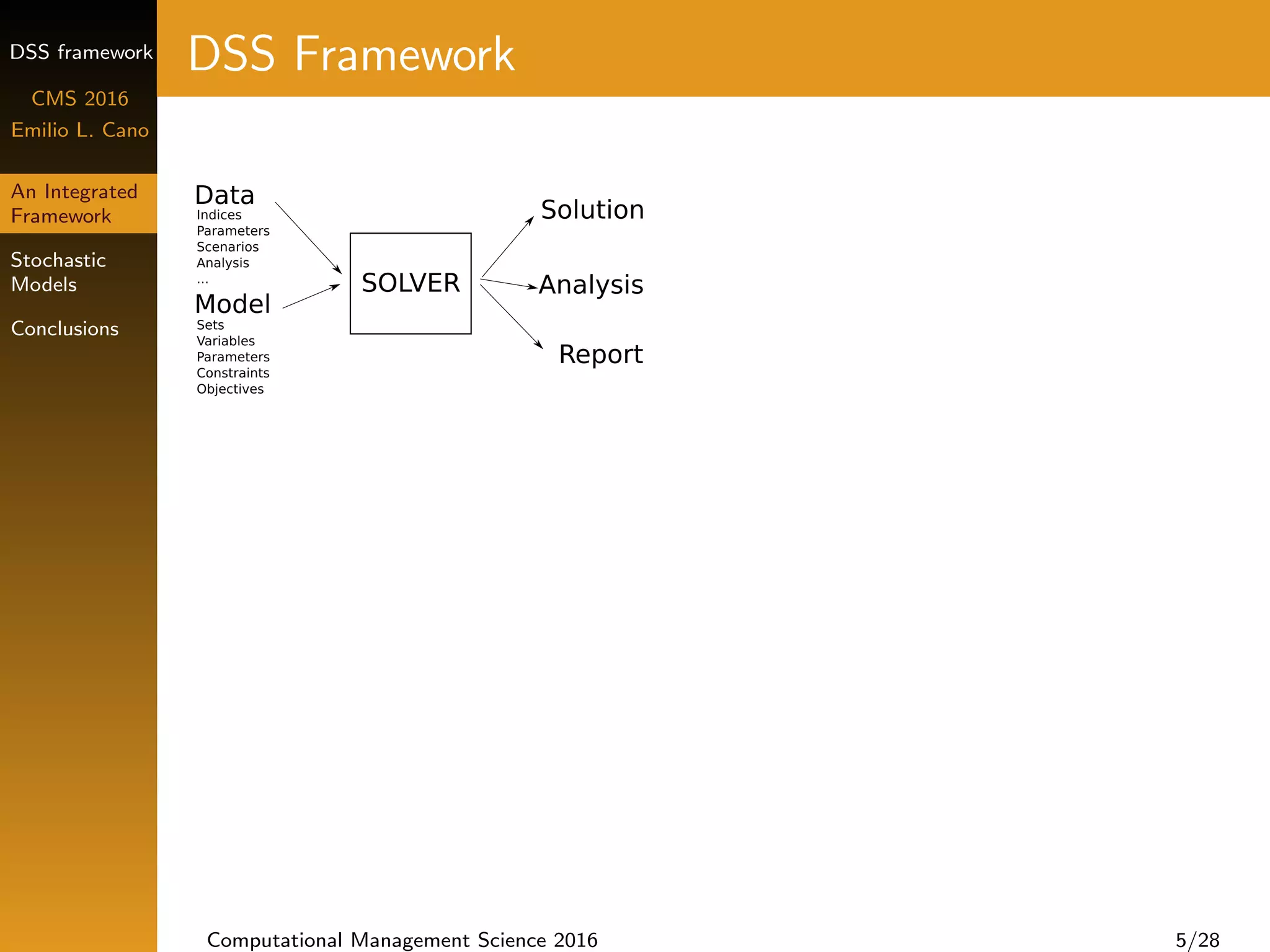

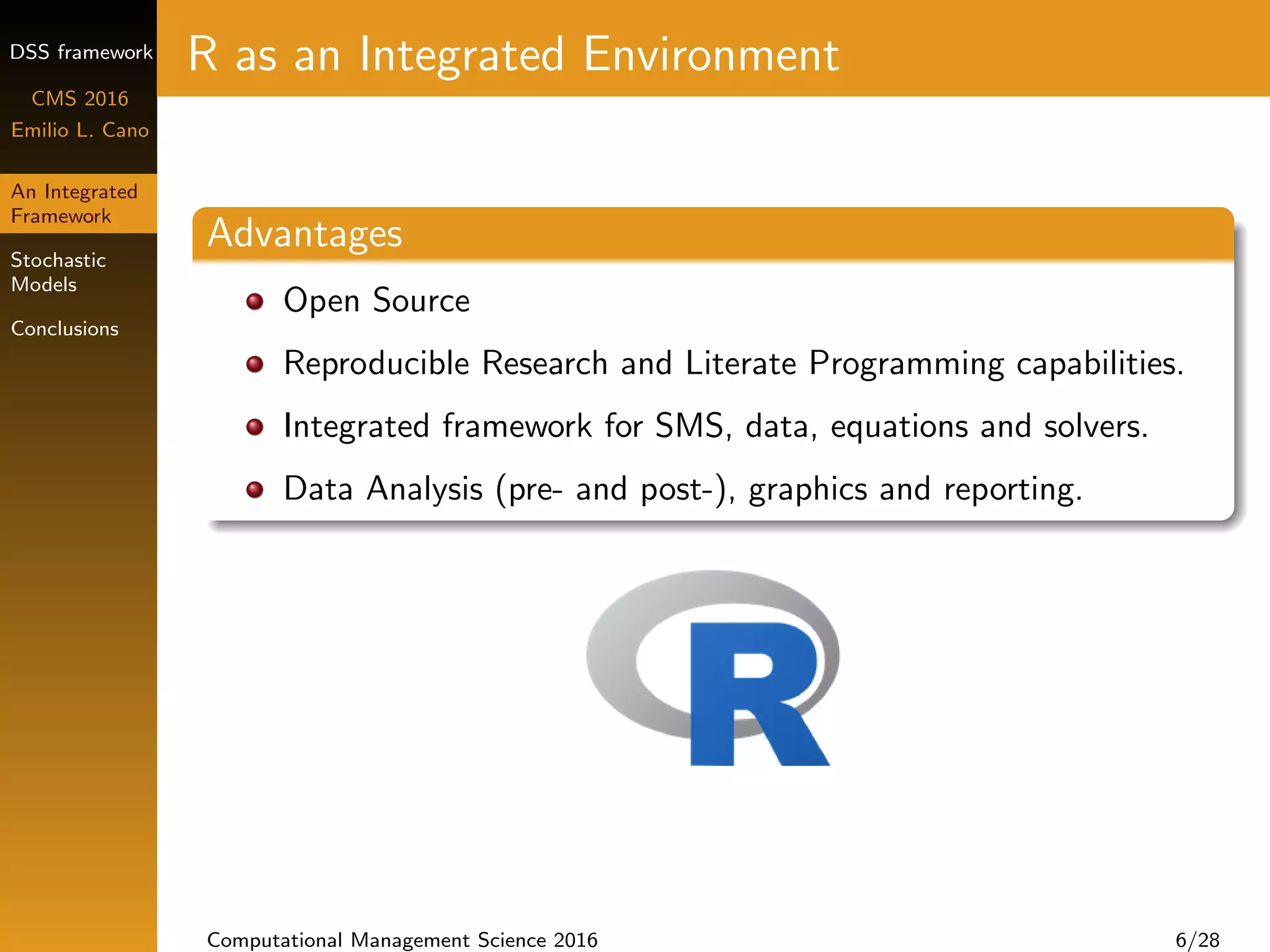

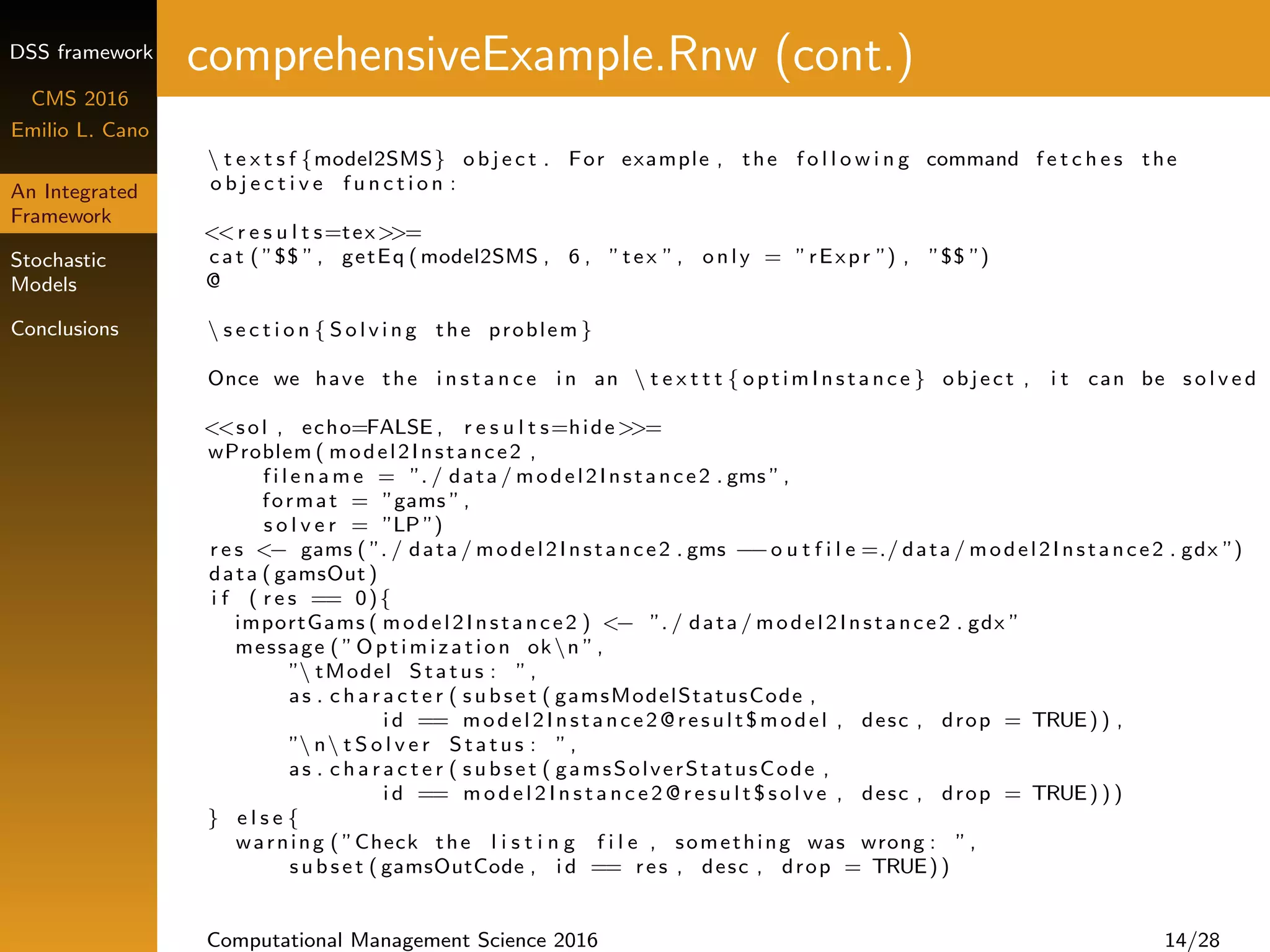

comprehensiveExample.Rnw

documentclass [ a4paper ]{ a r t i c l e }

usepackage {Sweave}

t i t l e { Comprehensive Example f o r

``An I n t e g r a t e d Framework f o r the

R e p r e s e n t a t i o n and S o l u t i o n of S t o c h a s t i c

Energy Optimization Problems ' '}

author { Emilio L . Cano}

<<i n t r o , echo=FALSE , r e s u l t s=hide>>=

## System r e q u i r e m e n t s

## − The R s o f t w a r e and the packages loaded below

## − A l i c e n c e d GAMS i n s t a l l a t i o n . I f GAMS d i r e c t o r y

## i s other than ”˜/ app/gams23 . 9 ” , change the l i n e

## ' igdx (”˜/ app/gams23 . 9 ”) '

## − A LaTeX d i s t r i b u t i o n f o r the c u r r e n t system

## Load needed packages

l i b r a r y ( k n i t r )

l i b r a r y ( optimr )

l i b r a r y ( gdxrrw )

l i b r a r y ( x t a b l e )

l i b r a r y ( ggplot2 )

l i b r a r y ( g r i d )

## T e l l gdxrrw where GAMS i s i n s t a l l e d

igdx (”˜/ app/gams23 . 9 ”)

## Run s c r i p t s with data

## D e t e r m i n i s t i c model

Computational Management Science 2016 10/28](https://image.slidesharecdn.com/elcanocms2016slides-160805093244/75/Energy-efficient-technology-investments-using-a-decision-support-system-framework-19-2048.jpg)

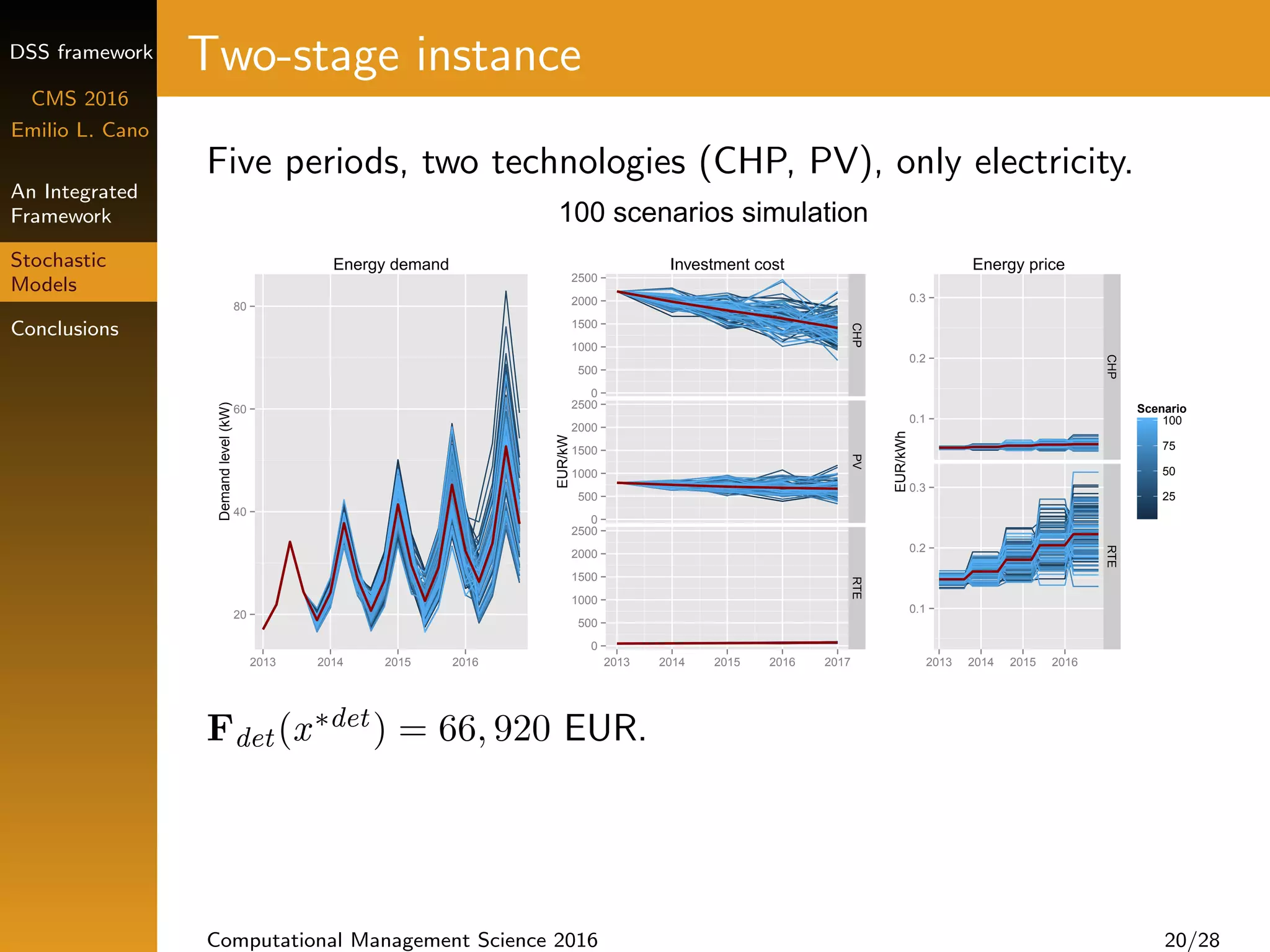

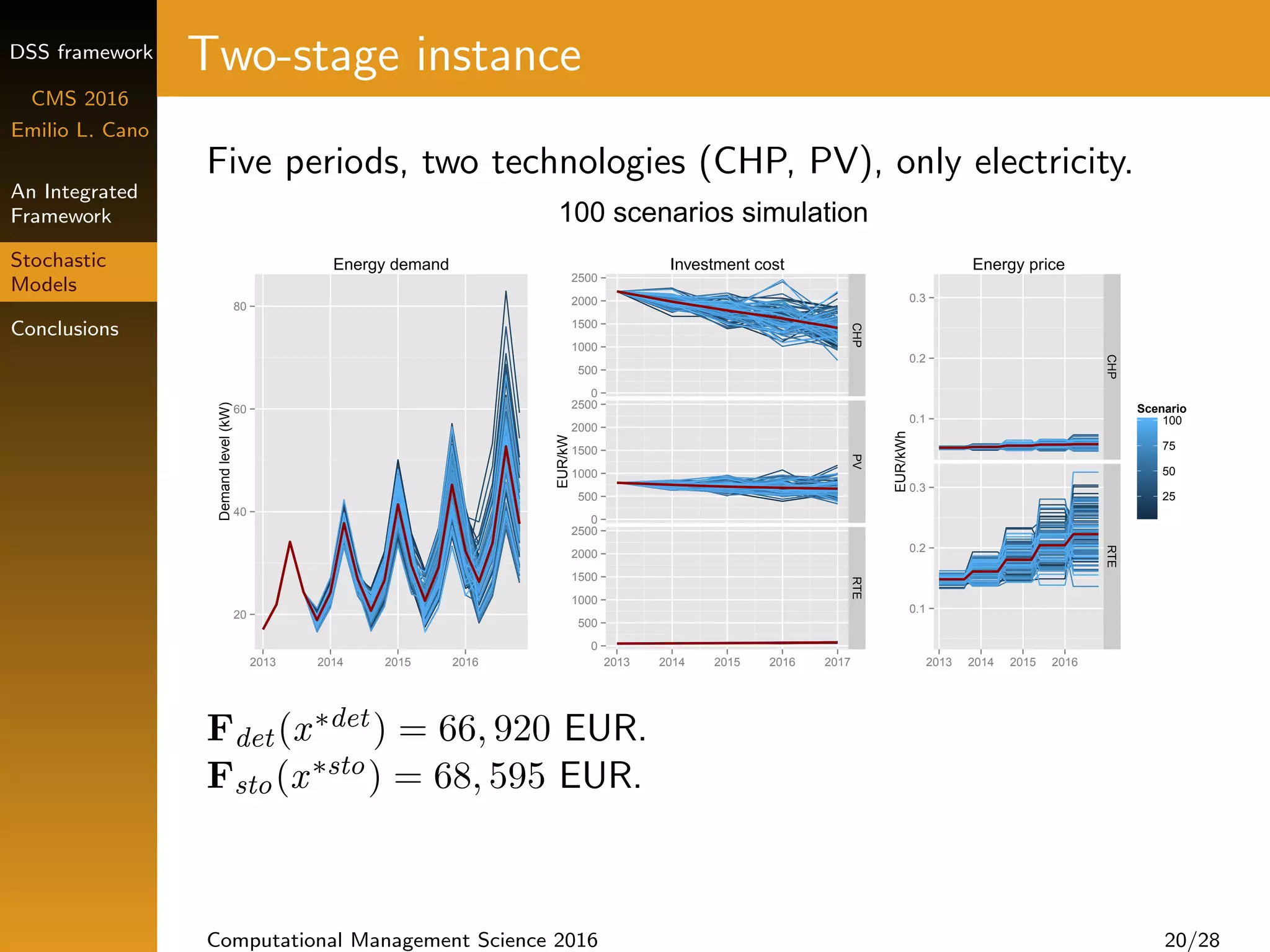

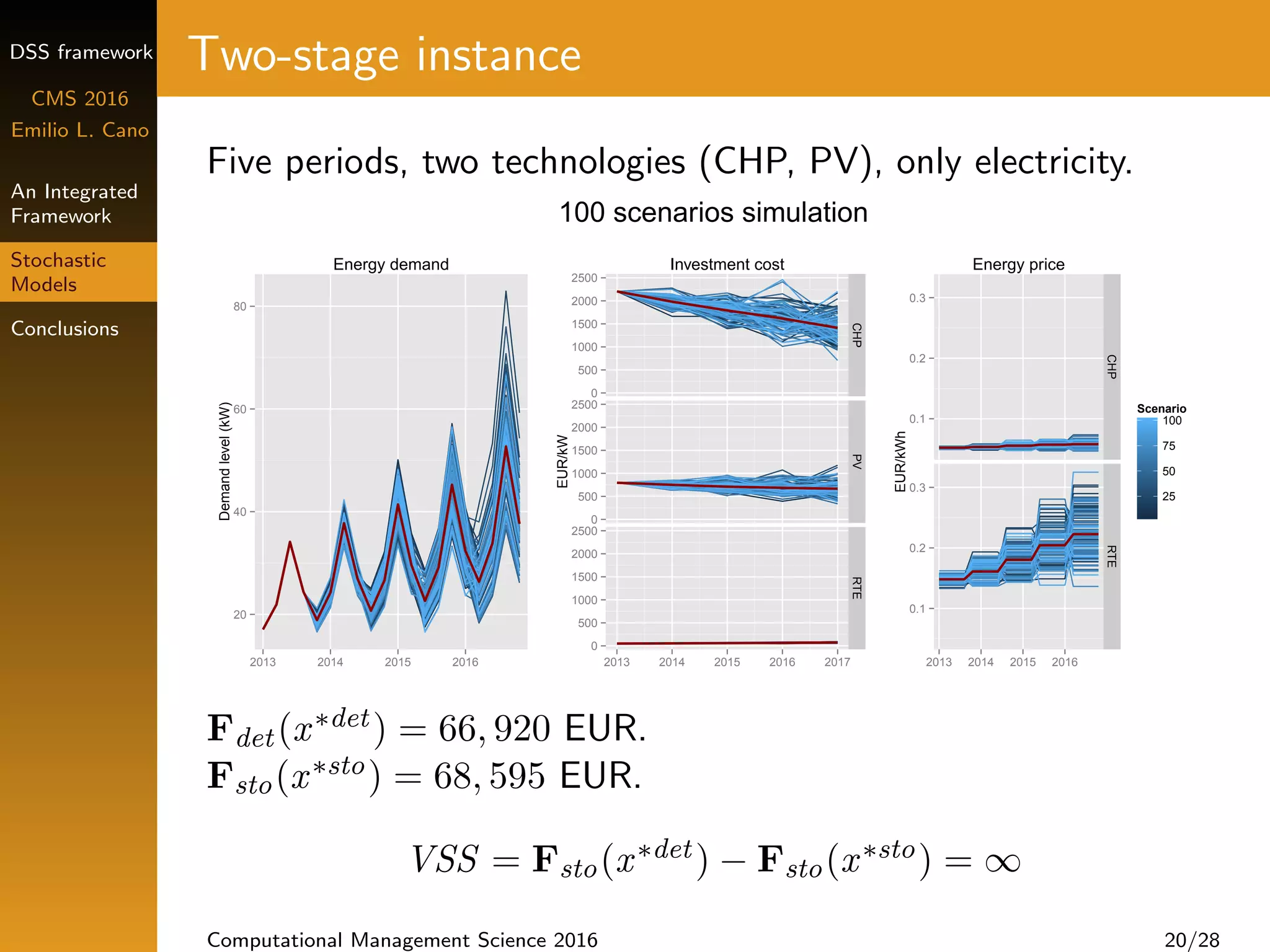

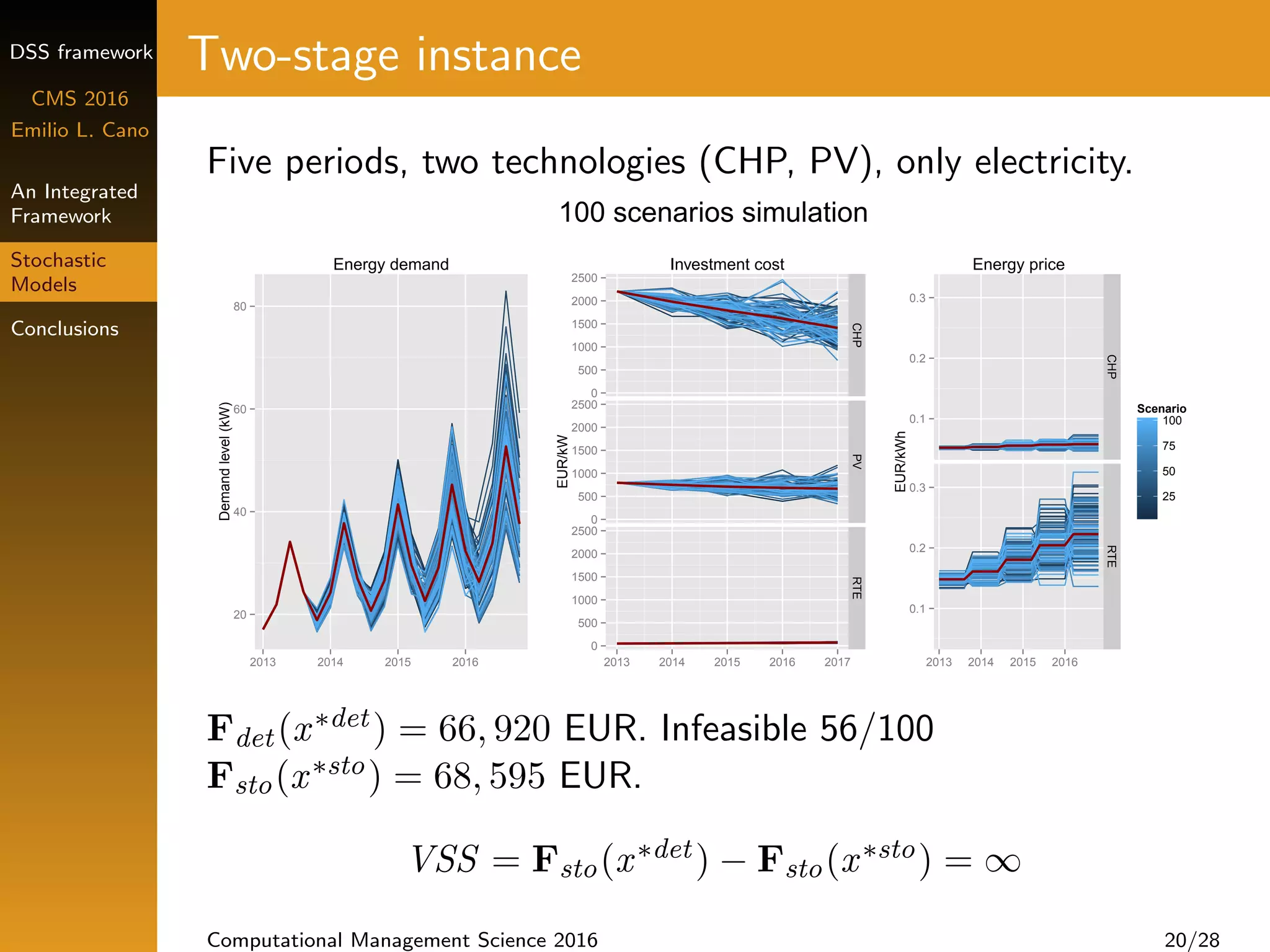

![DSS framework

CMS 2016

Emilio L. Cano

An Integrated

Framework

Stochastic

Models

Conclusions

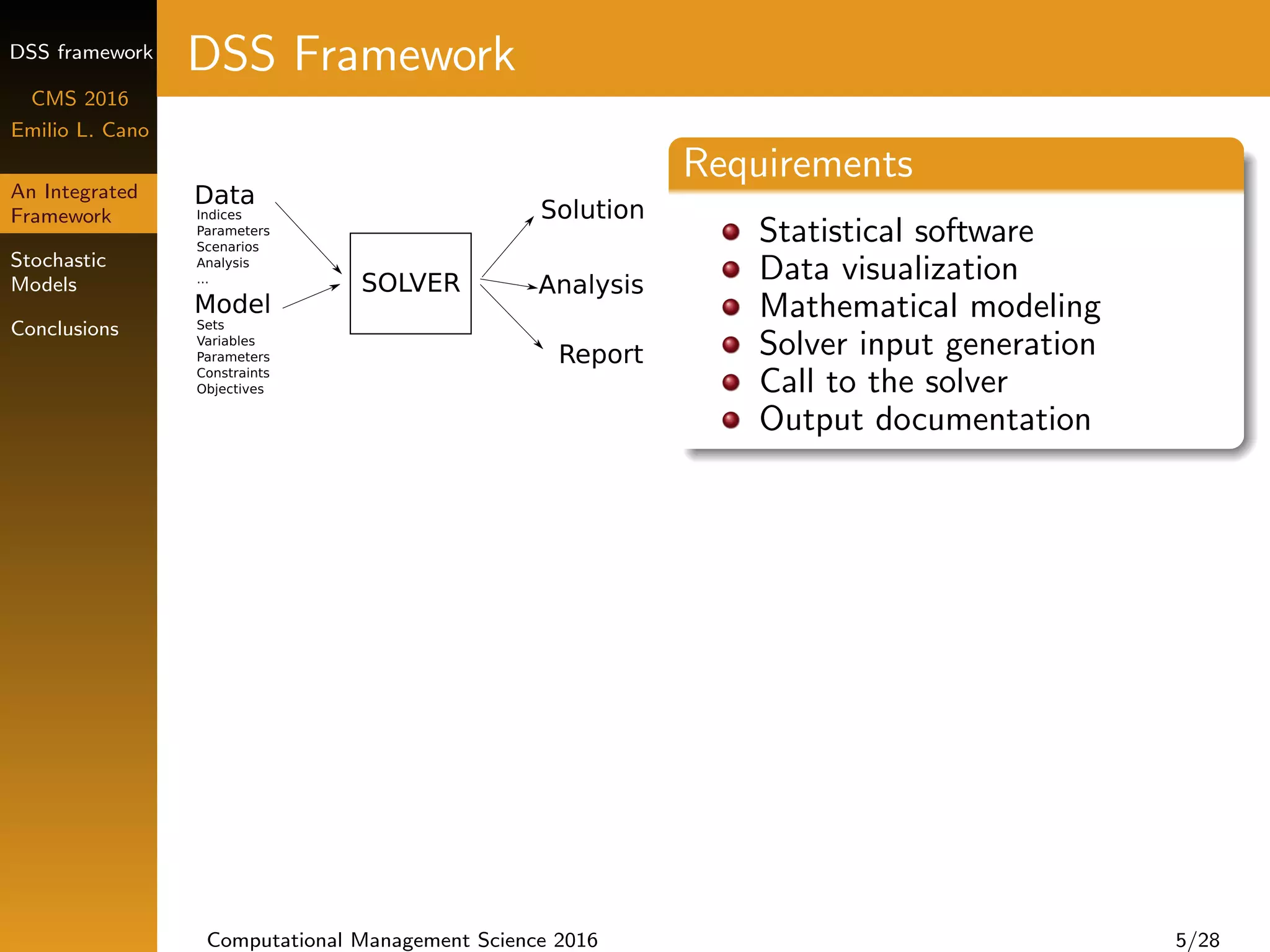

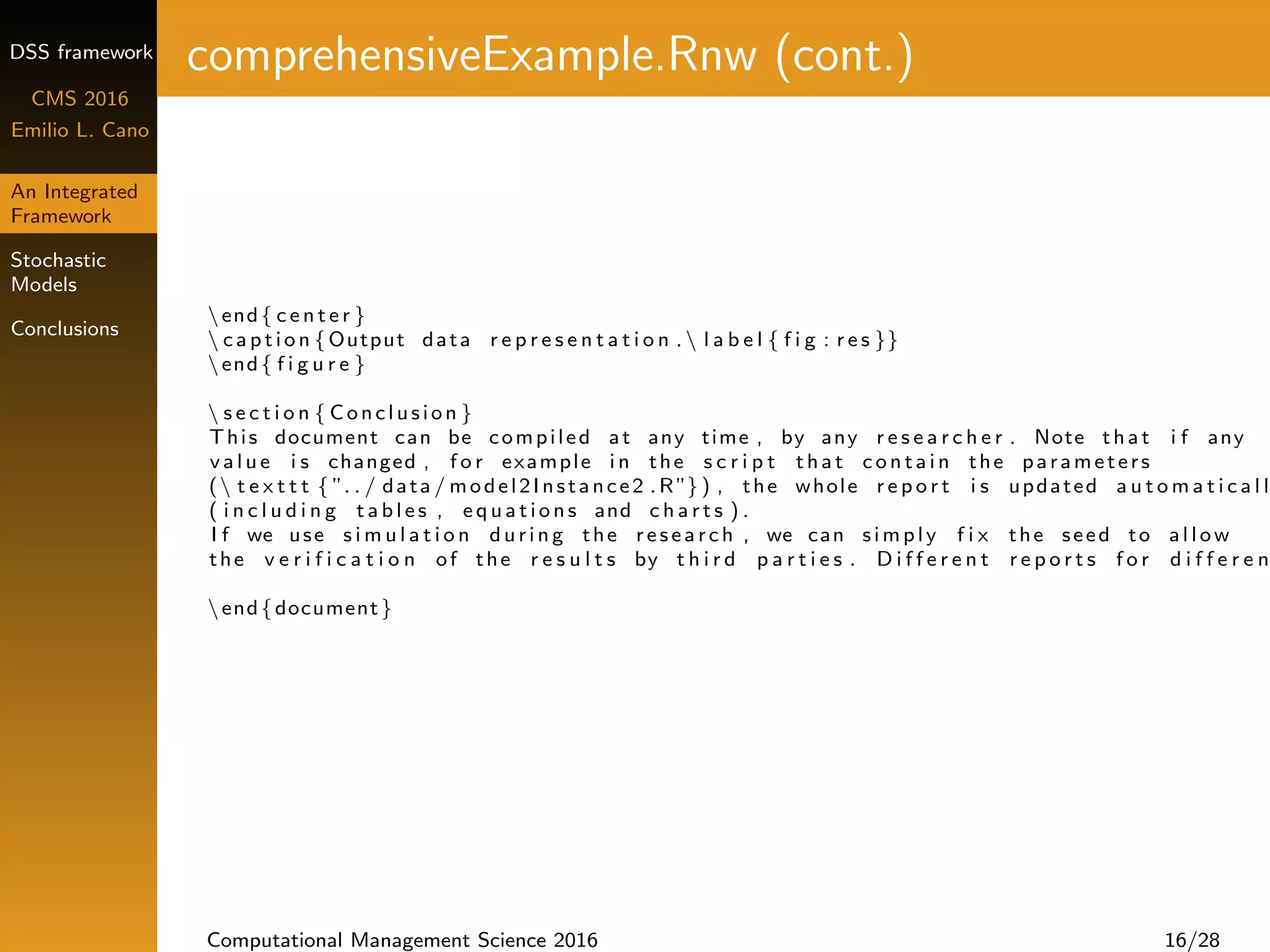

comprehensiveExample.Rnw (cont.)

source ( ”. / data /model1SMS .R ”)

## S t o c h a s t i c e x t e n s i o n

source ( ”. / data /model2SMS .R ”)

## I n s t a n c e with 100 s c e n a r i o s

source ( ”. / data / model2Instance2 .R ”)

@

begin {document}

SweaveOpts{ concordance=TRUE}

m a k e t i t l e

s e c t i o n { I n t r o d u c t i o n }

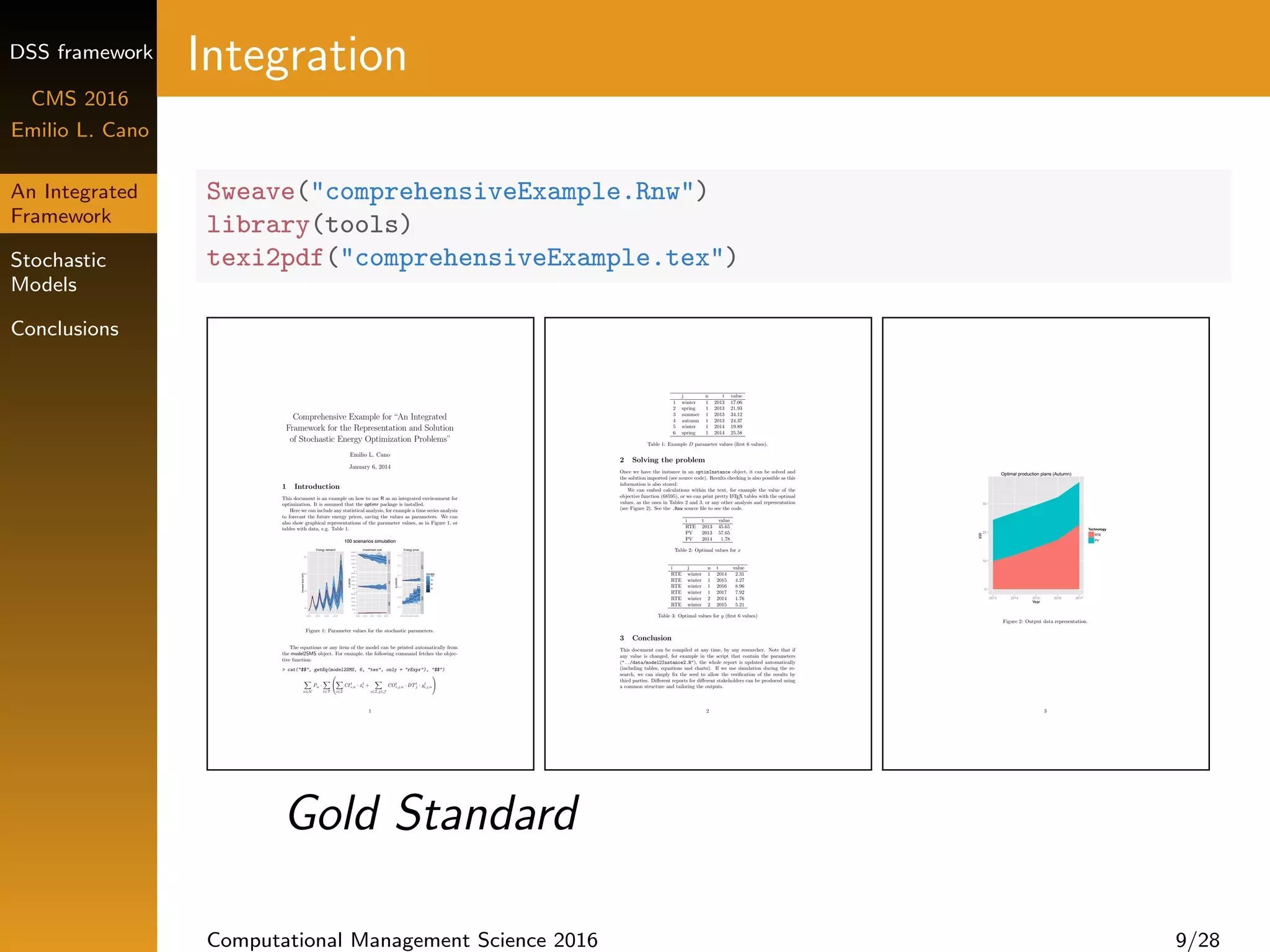

This document i s an example on how to use t e x t s f {R} as an i n t e g r a t e d

environment f o r o p t i m i z a t i o n . I t i s assumed that the t e x t s f { optimr } package i s

Here we can i n c l u d e any s t a t i s t i c a l a n a l y s i s , f o r example a time s e r i e s a n a l y s i s

to f o r e c a s t the f u t u r e energy p r i c e s , s a v i n g the v a l u e s as parameters . We can

a l s o show g r a p h i c a l r e p r e s e n t a t i o n s of the parameter values , as i n Figure ˜ r e f { f

begin { f i g u r e }[ htp ]

begin { c e n t e r }

<<examplepar , f i g=TRUE, echo=FALSE , width=10>>=

## Demand

dtoPlot <− i n s t a n c e P a r s ( model2Instance2 , ”D”)

d t o P l o t $ i d <− 1:20

pD <− ggplot ( data = dtoPlot , aes ( x = id , y = value , group=n , c o l=n ))

pD <− pD + geom path ()

pD <− pD + s c a l e x d i s c r e t e (name = ”” , breaks = seq (1 ,21 , by =5) , l a b e l s = 2013:2

pD <− pD + g g t i t l e ( ”Energy demand ”)

Computational Management Science 2016 11/28](https://image.slidesharecdn.com/elcanocms2016slides-160805093244/75/Energy-efficient-technology-investments-using-a-decision-support-system-framework-20-2048.jpg)

![DSS framework

CMS 2016

Emilio L. Cano

An Integrated

Framework

Stochastic

Models

Conclusions

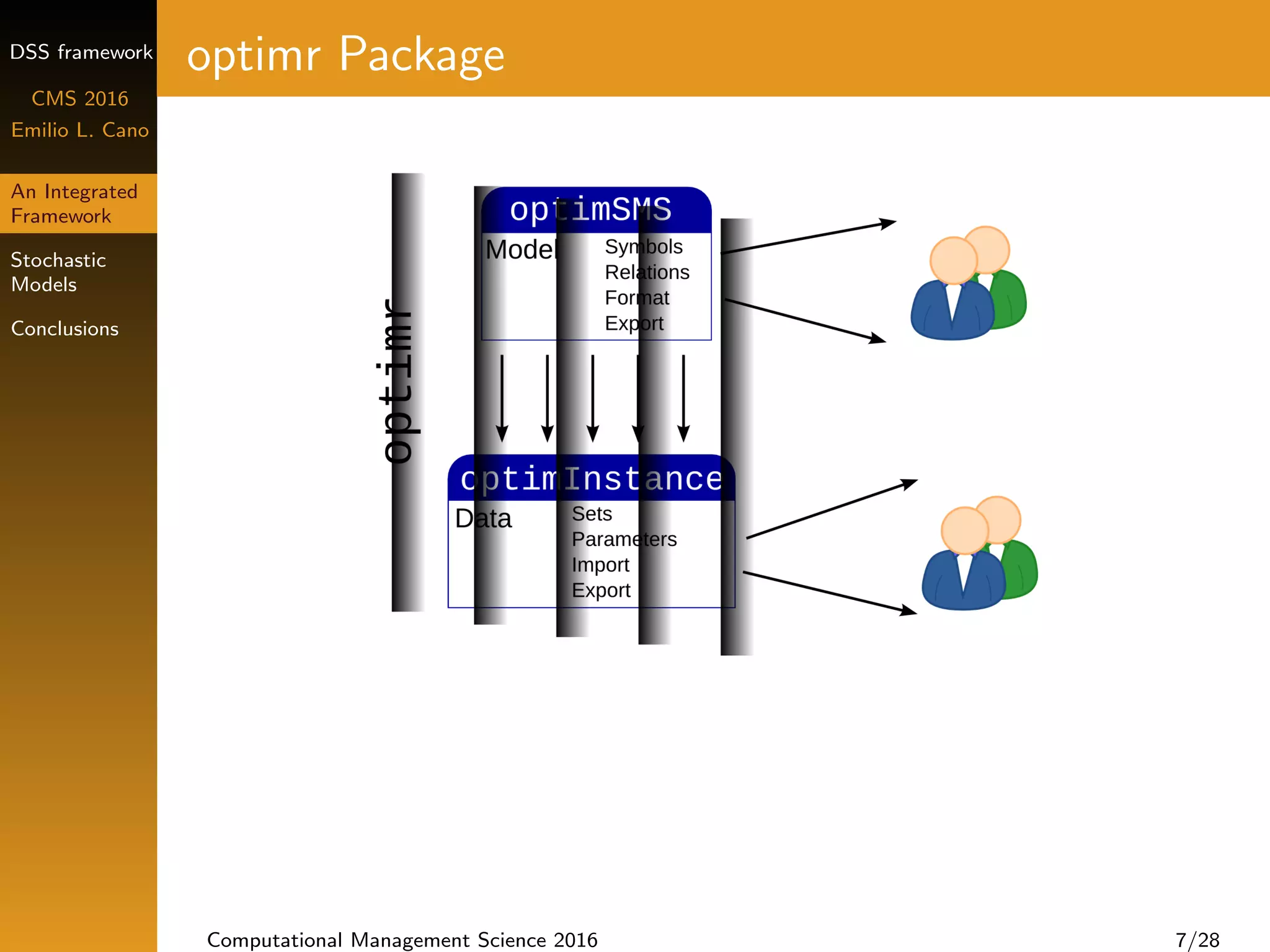

comprehensiveExample.Rnw (cont.)

}

@

We can embed c a l c u l a t i o n s w i t h i n the text , f o r example the v a l u e of the

o b j e c t i v e f u n c t i o n ( Sexpr { round ( m o d e l 2 I n s t a n c e 2 @ r e s u l t $ o b j )}) , or we can p r i n t

LaTeX˜ t a b l e s with the optimal values , as the ones i n Tables r e f { tab : x} and r e

other a n a l y s i s and r e p r e s e n t a t i o n ( see Figure ˜ r e f { f i g : r e s } ) . See the t e x t t t {.R

<<r e s u l t s=tex , echo=FALSE>>=

p r i n t ( x t a b l e ( i n s t a n c e V a r s ( model2Instance2 , ”x ”) ,

”Optimal v a l u e s f o r $x$ ”,

”tab : x ”) , i n c l u d e . rownames = FALSE)

p r i n t ( x t a b l e ( head ( i n s t a n c e V a r s ( model2Instance2 , ”y ”) ) ,

”Optimal v a l u e s f o r $y$ ( f i r s t 6 v a l u e s ) ”,

”tab : y ”) , i n c l u d e . rownames = FALSE)

@

begin { f i g u r e }[ htp ]

begin { c e n t e r }

<<bar , echo=FALSE , f i g=TRUE>>=

d f 2 p l o t <− s ub s e t ( i n s t a n c e V a r s ( model2Instance2 , ”y ”) , j == ”autumn ”)

d f 2 p l o t <− aggregate ( v a l u e ˜ i + t , data = df2plot , FUN = mean)

d f 2 p l o t $ t <− as . i n t e g e r ( as . c h a r a c t e r ( d f 2 p l o t $ t ))

p <− ggplot ( df2plot , aes ( x=t ))

p <− p + geom area ( aes ( y=value , f i l l =i ))

p <− p + l a b s ( t i t l e = ”Optimal production p l a n s (Autumn ) ”, x = ”Year ”, y = ”kW”)

p <− p + s c a l e f i l l d i s c r e t e ( ”Technology ”)

p r i n t ( p )

@

Computational Management Science 2016 15/28](https://image.slidesharecdn.com/elcanocms2016slides-160805093244/75/Energy-efficient-technology-investments-using-a-decision-support-system-framework-24-2048.jpg)

![DSS framework

CMS 2016

Emilio L. Cano

An Integrated

Framework

Stochastic

Models

Conclusions

Multi-stage model with risk management

Different objectives: min cost, emissions, or energy use

Risk measure CVaR [Rockafellar and Uryasev (2000)]

Weighted objective function

Computational Management Science 2016 22/28](https://image.slidesharecdn.com/elcanocms2016slides-160805093244/75/Energy-efficient-technology-investments-using-a-decision-support-system-framework-36-2048.jpg)